Brief

}

}

In evidenza

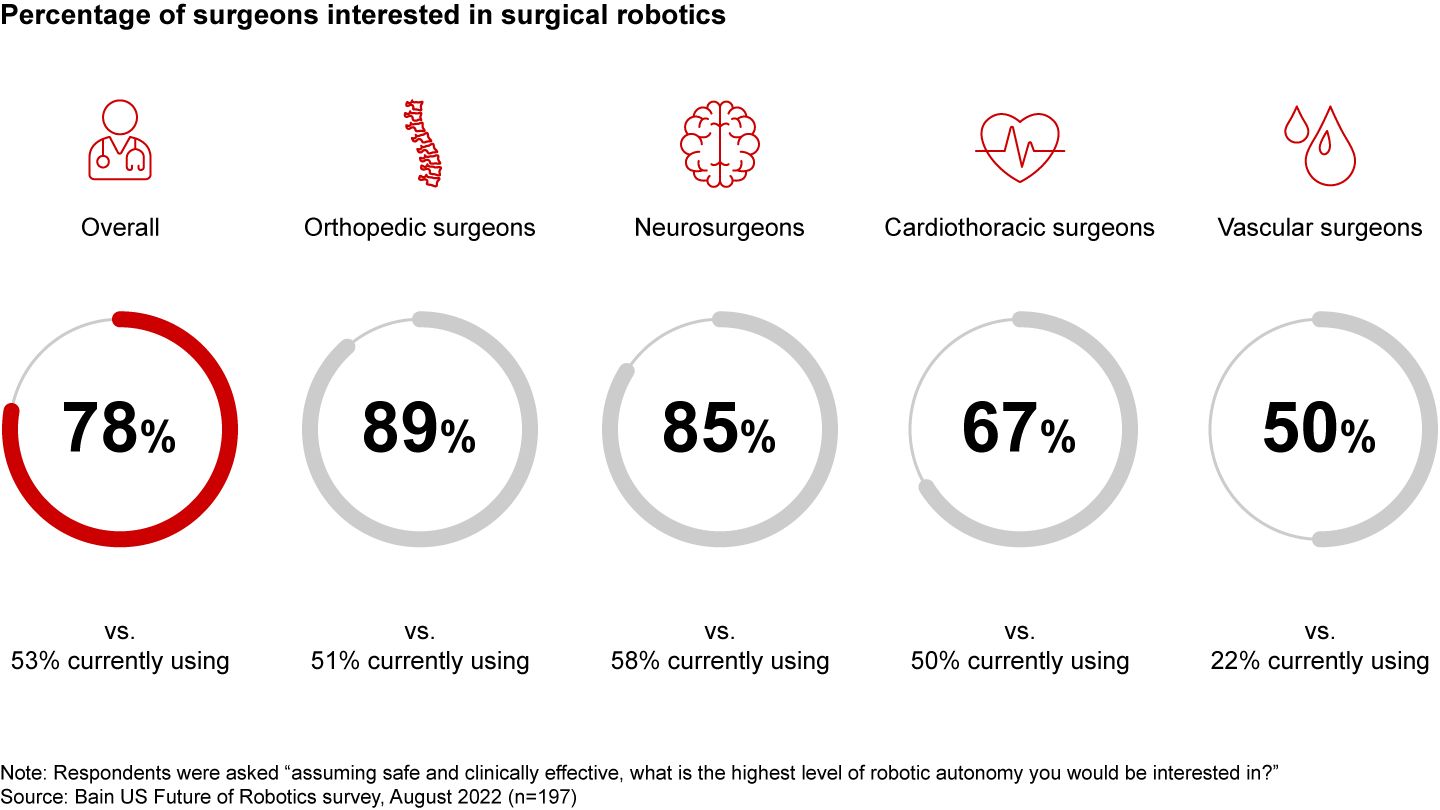

- The more than $3 billion surgical robotics market will continue to balloon over the next decade, with 78% of US surgeons interested in embracing the new technologies.

- While general surgery will remain the most advanced market, several indicators suggest orthopedics and neurosurgery will grow substantially.

- Leading original equipment manufacturers will tailor solutions to address customers’ barriers to adoption and key purchasing criteria.

Promising improved precision and visualization for surgeons, and better experiences and outcomes for patients, investments in surgical robotics have swelled over the past 10 years. It’s now a $3 to $3.5 billion global market, up from around $800 million in 2015.

What does the next decade hold? From artificial intelligence (AI)-assisted to fully autonomous robots, advancements in technology and hardware will revolutionize operating rooms. Leading players, such as Intuitive in general surgery, or Stryker and Zimmer Biomet in orthopedics, are expanding pioneering platforms into new areas. Other large companies, like Johnson & Johnson, are making a play for the burgeoning market through acquisitions, partnerships, and heavy investments in developing their own systems. And start-ups and small to midsize companies are challenging the status quo. Recent breakthroughs are sparking robust M&A activity and a frenzy of VC funding that will fuel the next wave of transformational developments.

In the US, most surgeons are eager to embrace these new technologies. Bain research shows that across specialties that we surveyed, 78% say they are interested in surgical robotics (see Figure 1).

Despite significant advances and rising interest, there’s still plenty of room to grow: Today, around 44% of surgeons say they aren’t using robotics in hip replacement procedures at all. And more than a third of surgeons say they aren’t relying on robots during the majority of a knee replacement procedure.

Several obstacles stand in the way of scaling existing surgical robotic systems. Surgeons at both ambulatory surgery centers (ASCs) and hospitals cite a lack of efficiency, due to longer surgery time, as the largest hurdle. In addition, they say limited clinical evidence and high ongoing and up-front costs hinder their adoption. That’s not to mention many procedures where robots are still in development or face technological obstacles.

A market this ripe with potential begs many questions: How can OEMs help customers overcome the barriers to adoption? Where are the greatest opportunities for growth? And how can OEMs adapt their portfolio at the pace of change, winning share as competitors and technological developments continuously shake up the landscape?

In a recent survey of 200 surgeons and procurement specialists, we examined the state of robotic surgery across several major specialties that are primed for considerable growth, including general surgery, cardiology, orthopedics, neurosurgery, and vascular surgery. Their responses provide a glimpse into the future of surgery, from where the next wave of disruption will hit to what it will take to boost adoption.

Ready for robots?

With surgeons already utilizing robotics in many procedure types, general surgery will remain the most established market. But robotics is starting to take hold in other specialties. Several indicators suggest orthopedics and neurosurgery will continue to grow substantially in the coming decade (see Figure 2).

Given the advanced technologies available, general, orthopedic, and neurosurgery are primed for greater adoption. Existing platforms, such as hip and knee offerings, will likely see usage accelerate. For some procedure types in these specialties, such as spinal surgery, residents are already training on platforms, indicating growth is ready to ramp up. Here, OEMs have a clear opportunity to connect with customers, increasing training and awareness. In other procedures that lack substantial offerings, OEMs are actively working to leverage existing platforms. For instance, Zimmer Biomet has brought its Rosa technology for knee replacements to spine and brain procedures. And as players like Johnson & Johnson bring new systems to market, increased competition will help lower the barriers to adoption.

On the other hand, some areas, such as vascular surgery and cardiology, will grow at a much slower pace. Technology limitations, coupled with procedural complexity, will make it difficult to deploy viable robotics solutions in the near term. But given the clip of innovation, we expect technological advancements to surmount procedural complexity over time.

For example, soft robotics could eventually solve difficult access and navigation issues in endovascular surgery. For procedures in sports medicine, foot and ankle, and more, the development of smaller, mobile robotic solutions may enable customers to overcome hurdles like high costs and long setup times. And, where robotics aren’t as compelling an option yet in vascular surgery and cardiology procedures, new digital solutions that incorporate intra-operative device guidance, AI-based planning, and other cutting-edge features will fill the gaps in the interim. While there is a longer path of applicability testing, training, and adoption ahead, early movers will focus on near- and long-term strategies today.

Taking a customer-centric approach

Across specialties, leading medtech companies will take a customer-focused lens to how they develop and sell robotic systems. They will not only help customers overcome barriers to adoption, but also build enticing, differentiated offerings that meet customers’ most critical needs.

First and foremost, leading OEMs will address prohibitive costs. According to our survey, surgeons at hospitals and ASCs ranked up-front equipment costs as both the most important consideration when making a purchase and the third largest barrier to adoption. Flexible financing options can help. For instance, according to our survey, hospitals prefer all-cash financing, whereas nearly half of ASCs want capital leases. In addition, future market leaders will simplify their robotics offerings as more options become available, enabling a smaller footprint and lower cost solutions, such as platforms that can perform multiple procedures.

Beyond costs, it will be key to tailor solutions to customer needs. While purchasing criteria and barriers to adoption are relatively consistent across the board, there are subtle but meaningful differences by site of care, decision maker, and specialty.

Site of care. Compared with hospitals, ASCs are particularly interested in the ability to perform procedures with less in-room surgical support. Similarly, ASCs are more likely to be held back by limited interoperability within the existing infrastructure of their facilities. ASCs also express the need for vendor support for routine maintenance, whereas hospitals are more likely to want training for their employees to handle servicing.

Decision maker. Health system executives, hospital and faculty executives, chiefs of surgery, and staff surgeons make more than 60% of all purchasing decisions for surgical robotic systems at hospitals and ASCs. Of course, each has different priorities. Surgeons rank improved precision, visualization, and clinical outcomes as their top three factors when deciding to use surgical robotics. Procurement teams also rank clinical outcomes as a top factor when determining robotics’ return on investment, but many prioritize revenue growth and surgeon recruiting and retention as well.

Specialty. In areas like orthopedics and neurosurgery, where the technology is more advanced and surgeon interest is higher, leading OEMs will invest in the future functionalities that matter most to customers. Orthopedic surgeons, for instance, say they are most interested in performing a greater variety of surgical procedures with one robot. Neurosurgeons, on the other hand, prioritize the ability to operate remotely over greater distances, providing care from miles away. While surgeons across specialties want these features, tapping into nuanced priorities can help OEMs differentiate in an increasingly competitive landscape.

How OEMs can propel the future of surgery

The horizon of possibilities in surgery is seemingly endless. The only certainty is that in 10 years, surgery will look drastically different from how it looks today.

AI, 5G, and augmented reality technologies are already making the previously unthinkable possible, and companies are moving in rapidly to seize their potential. OEMs must be ready to act quickly. They will need to consider competitive moves for the next three to five years, as well as their more aspirational strategic outlook for the next 10.

The next generation of industry leaders will be those that develop a comprehensive “today forward, future back” strategy. They will focus on today’s needs by facing the unvarnished truth about their level of maturity in robotics and considering how to maximize the potential of the current business.

But, at the same time, these companies will keep a close eye on tomorrow’s opportunities and disruptions. They will establish a perspective on the future of the market, determining not only if and how disruption could hit their current market, but also where and how they want to play. They will evaluate customer needs by segment and their portfolio accordingly. With a clear vision, they will decide where to invest internally or partner so they can develop the best-in-class capabilities and technology needed to get to their destination.