Report

Executive summary

This is the third year Bain & Company has partnered with Kantar Worldpanel to study the shopping behaviors of 40,000 Chinese households. Our unconventional approach equipped research participants with barcode scanners to track what they purchased, as opposed to what they said they had purchased.

Our China Shopper Report 2014, Vol. 2 confirms the findings of prior reports, while shedding new light on key behavior patterns at a time when China’s consumer markets are rapidly changing. We studied 106 fast-moving consumer goods (FMCG) categories and analyzed in more detail the same 26 categories as in previous years spanning the four largest consumer goods sectors—personal care, home care, beverage and packaged food—that account for more than 80% of China’s FMCG market in value.

These 26 categories are:

- Packaged food: Biscuits, chocolate, instant noodles, candy, chewing gum and infant formula

- Beverage: Milk, yogurt, juice, beer, ready-to-drink (RTD) tea, carbonated soft drink (CSD) and bottled water

- Personal care: Skin care, shampoo, personal wash, toothpaste, color cosmetics, hair conditioner, baby diapers and toothbrushes

- Home care: Toilet tissue, fabric detergent, facial tissue, kitchen cleaner and fabric softener

Our approach helped us gain valuable insights into how shoppers make purchases in these 26 important consumer goods categories and develop strategies for marketers to successfully win Chinese shoppers.

To date, and including this report, we have published eight shopper study reports: Four volumes in 2012 (“What Chinese shoppers really do but will never tell you”), two in 2013 (“Growing brands by understanding what Chinese shoppers really do”), and two in 2014 (“Chinese shoppers: Evolving behaviors in a challenging environment”).

Stability in shopper behaviors from 2011 to 2013

For the third year, we carried out identical analysis of the same 26 categories. On balance, shoppers demonstrated the same behaviors across these 26 categories and shopper trends remained consistent over the last three years, even as growth in China’s FMCG market continued to slow, while digital was developing rapidly.

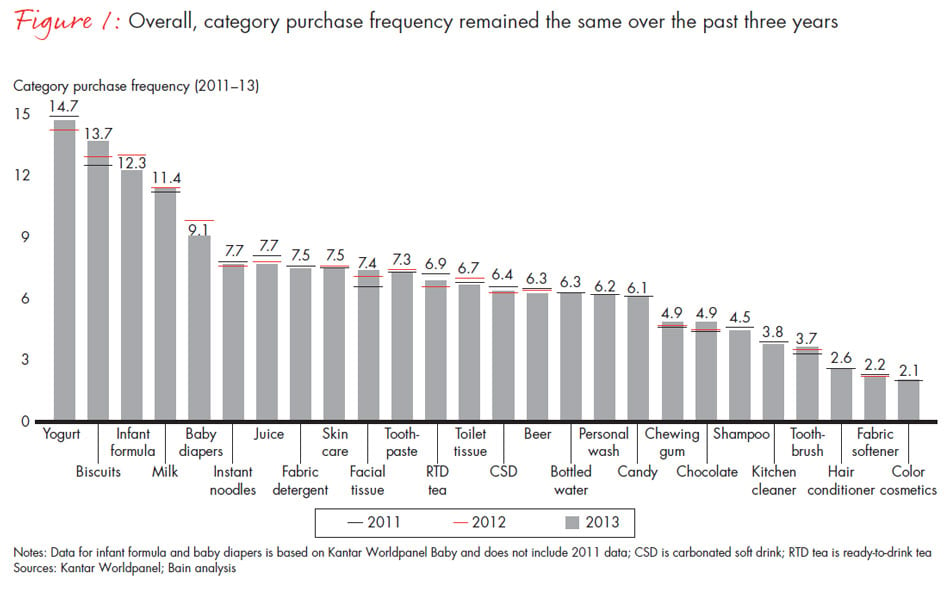

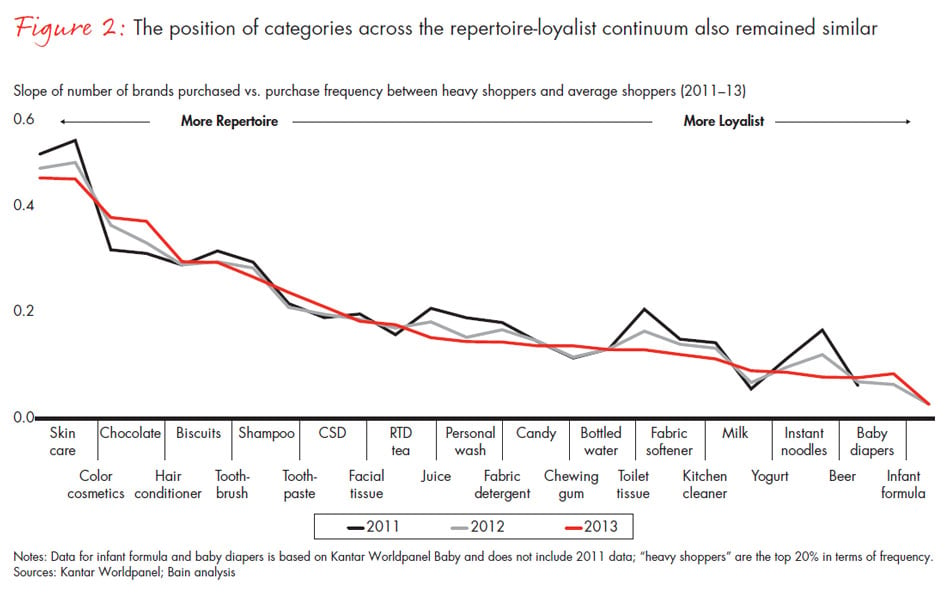

Purchase frequency, the number of purchases per household per year, was similar by category for each of the three years, remaining low overall. The position of categories along the repertoire-loyalist continuum was also similar.

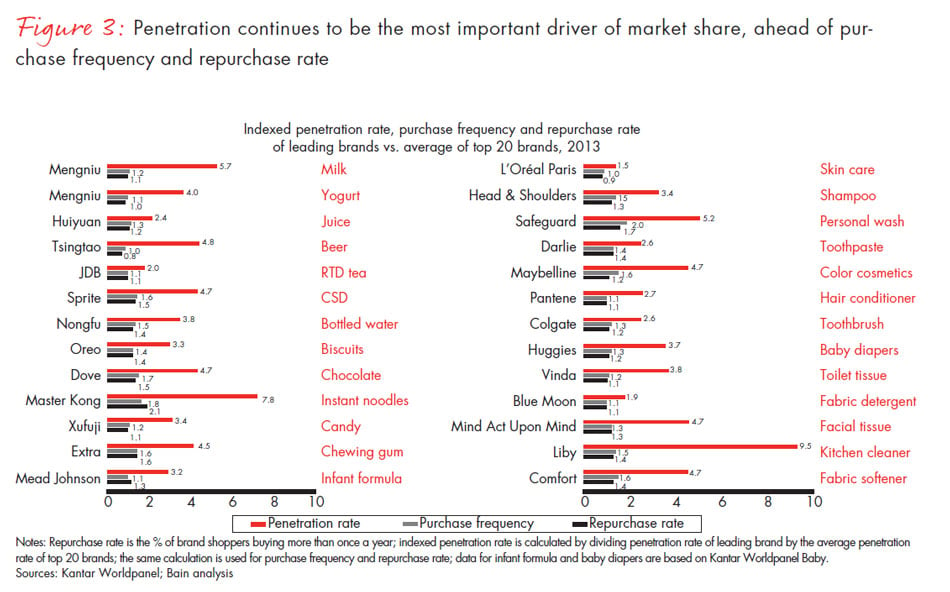

Penetration continued to be the key indicator of market share, ahead of purchase frequency and repurchase rate.

Overall shopper behavior remained stable over the past three years; not surprisingly, however, some category leaders failed to sustain their position and lost it to others.

Generally, brand rankings changed dramatically among the top 10 brands in most categories. There were winners and losers. The winners adapted themselves to actual shopper behaviors, rather than try to change those behaviors.

Three things winners do right

As our 2014, Vol.1 report revealed, the China FMCG market is evolving rapidly. We’ve entered an era in which brand growth will come mainly from share gain. In order to achieve consistent growth, brands need to do three things right:

1. Obsess over actual behaviors. Overall, Chinese shoppers demonstrate very low engagement with brands for most of the categories we studied. The average purchase frequency for the top brands among the 26 categories is less than one purchase every four months—a very low purchase rate. Yet low-frequency shoppers represent a significant percentage of each brand’s shopper base and contribute a significant share of its revenues. The shopper base for all brands remains a “leaky bucket,” as we found that the majority of shoppers left the brands we studied after two years. The percentage of shoppers who leave is lower in loyalty categories, such as milk, but the leaky bucket pattern exists there as well. In order to compensate for losses, brands need to recruit shoppers continuously, which requires a deep understanding of actual behaviors rather than professed behaviors.

2. Clearly define the battlefield. Competition between brands is much broader and more complex than generally thought. To better understand which brands compete most closely with each other, brands need to define their battlefields clearly based on actual purchase overlaps across brands and categories. Narrowly defined segmentations mask the true nature of competitive dynamics among brands.

3. Focus on penetration. Consistent with a key insight from the Ehrenberg-Bass Institute for Marketing Science, summarized by Professor Byron Sharp in his book How Brands Grow, and with our earlier reports, gaining penetration is the key way that brands gain market share. The steady approach for brands to earn penetration requires continuous investment in three key assets: building on existing memory structure to get more shoppers to think about a particular brand as they shop, simplifying and rationalizing product portfolios to focus on critical “hero” SKUs that have the highest potential to win with shoppers, and perfecting in-store activation at the point of sale to ensure superior visibility and distinctiveness and make the shopper’s decision to purchase your brand easy.

Three brand growth success stories

The following stories illustrate the success of brands that build upon the three key brand assets:

Success Story #1: Jia Duo Bao (JDB). JDB, a popular ready-to-drink (RTD) herbal tea brand in China, has enjoyed considerable success by capitalizing on the memory structure consumers have for its red-can package. Prior to 2012, JDB produced and distributed red-can products under the WangLaoJi (WLJ) brand. Following the termination of their agreement, JDB launched its own red-can brand, focusing almost exclusively on the red-can SKUs and advertising heavily with substantial in-store investments.

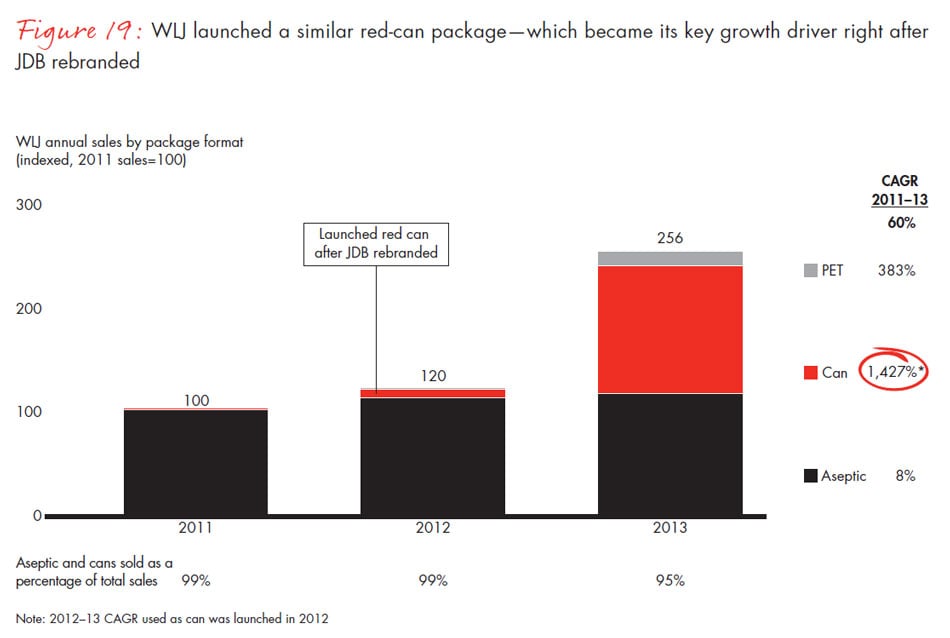

By effectively building on consumers’ red-can memory structure, JDB sales grew 13% per year from 2011 to 2013 and further strengthened its leadership position with 25% market share. Benefiting from the red can memory structure built by JDB’s heavy advertising campaign, WLJ’s annual sales growth reached 60% from 2011 to 2013, mostly driven by its red-can SKUs launched in 2012.

Success Story #2: YunNanBaiYao (YNBY). Chinese brand YNBY used to be a famous traditional medicine brand, established in 1971. It was well-known for its anti-inflammatory benefits and ability to reduce bleeding. Since 2004, it has successfully transferred its established memory structure from traditional medicine to oral care. In doing so, it achieved success with a toothpaste that offered the same benefits as its medicine. Supported by smart investment in advertising and in-store visibility, YNBY gained market share over the last three years to reach 10.9% share value in 2013. Sales have grown 30% per year in the last two years, with a gain in market share of 2.6%.

Success Story #3: Master Kong. Master Kong has built a clear and distinctive logo that exudes reliability and professionalism. The Master Kong logo, which was launched in 1992 when the company first introduced its instant noodles, features the image of a professional chef.

Master Kong has successfully built on the reliable, professional memory structure of its well-known logo to not only increase penetration and market share in instant noodles, but to expand into beverages and biscuits.

The company increased its advertising budget 65% between 2011 and 2013 and invested heavily in in-store assets, reaching a 56% market share in noodles in 2013. Total sales have grown 12% per year in the last two years and the company has gained 3.5% market share.

Full report

Stability in shopper behaviors from 2011 to 2013

Before we get into the main insights of this report, it is critical to remind ourselves of the key takeaways from the 2014, Vol. 1 report, published in July 2014: The FMCG market is evolving quickly; the overall market continues to decelerate across all sectors—packaged food, beverage, personal care and home care—and all city tiers; channel dynamics changed substantially with more challenges in offline channels, while online is booming; fierce competition from Chinese companies is intensifying.

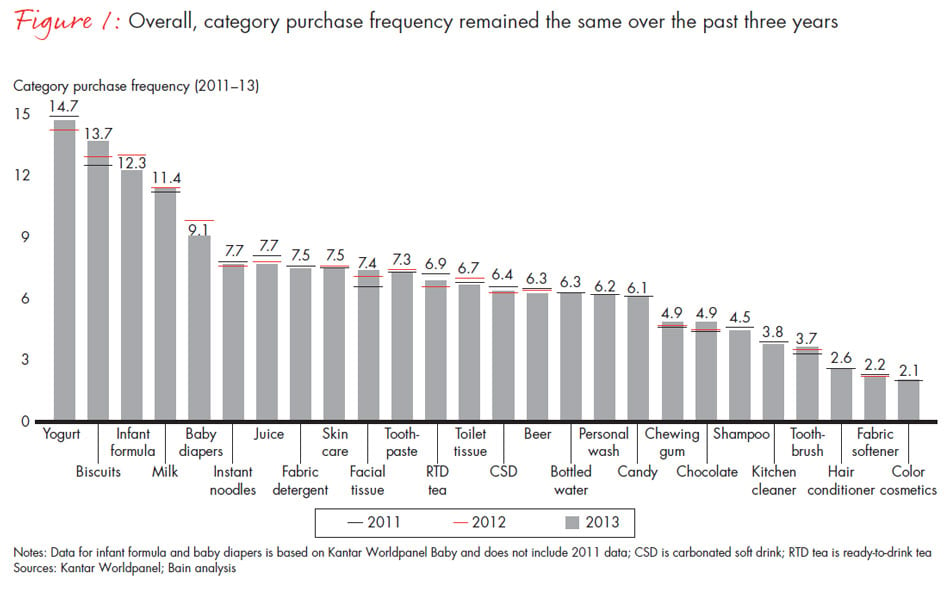

Although the market environment continues to evolve, shopper behaviors from 2011 to 2013 have remained consistent and stable across the board. Overall, purchase frequency remained unchanged and at a low level across all of the 26 categories (see Figure 1). The average purchase frequency rarely exceeded one purchase per month (about once a month for yogurt, biscuits, infant formula and milk; about once every two or three months for personal wash, candy, chewing gum, chocolate, shampoo, etc. Fabric softener and color cosmetics were purchased even less frequently).

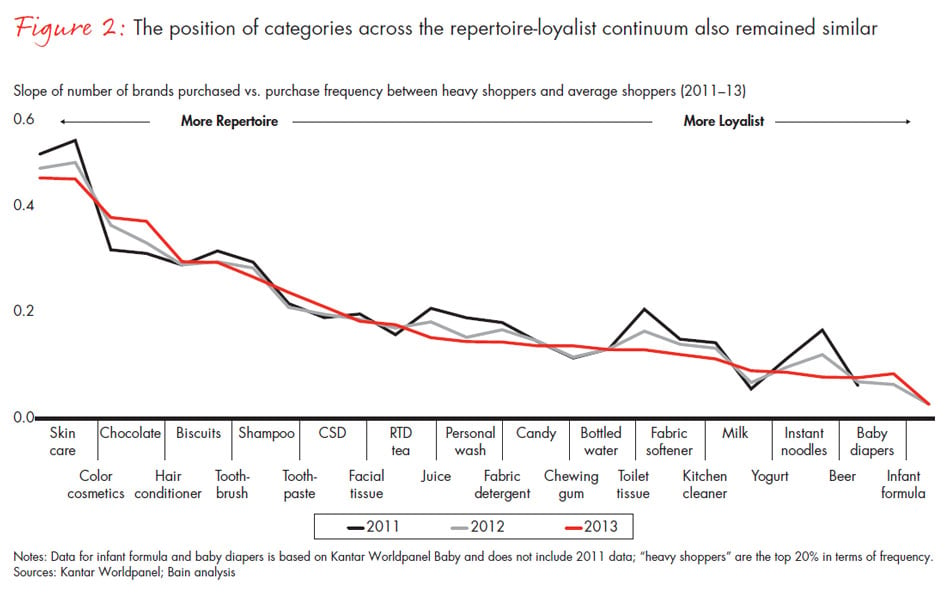

The position of categories along the repertoire-loyalist continuum in 2013 was similar to that of 2011 and 2012. Among repertoire categories, the more frequently shoppers buy in a category, the more brands they tend to buy. Among loyalist categories, shoppers tend to buy the same brands even when they buy more frequently (see Figure 2).

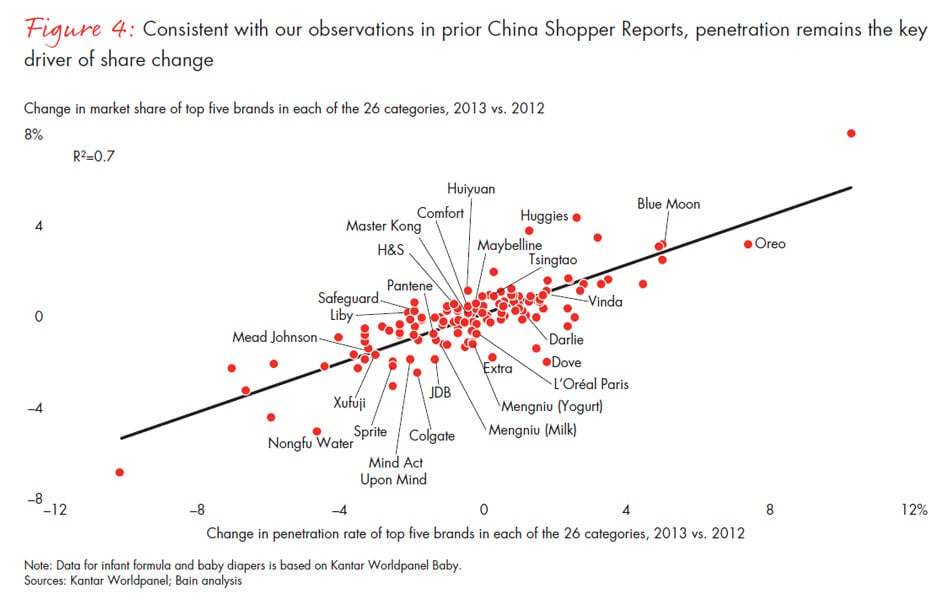

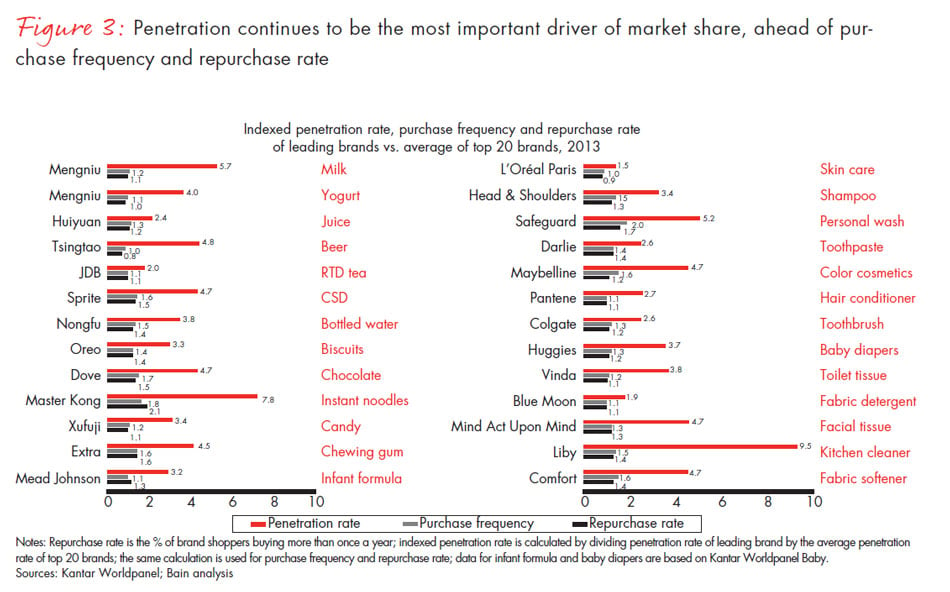

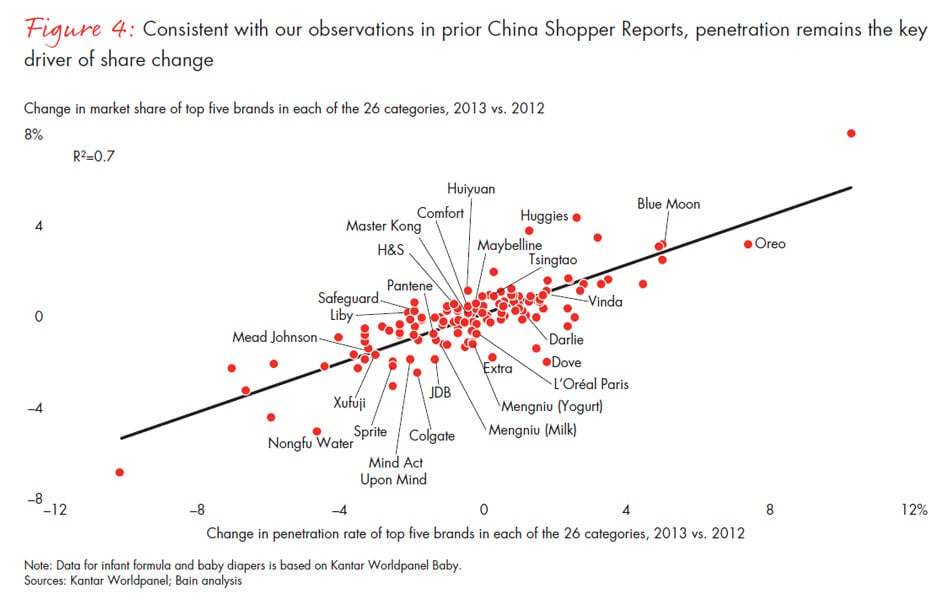

Our 2012, 2013 and 2014 China Shopper Reports established that gaining market share is imperative, and penetration is the key driver of market share—well ahead of purchase frequency and repurchase rate (see Figures 3 and 4).

The leading brand’s penetration is two to 10 times higher than the penetration of the average 20 brands in their category. This difference in penetration between leading brands and other brands is significantly larger than the difference in frequency and repurchase rate for the same brands.

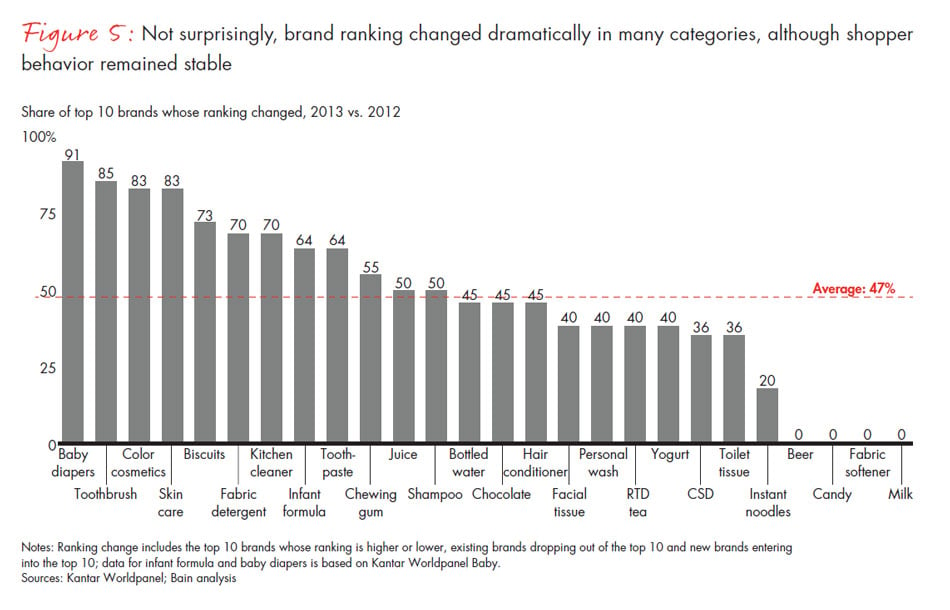

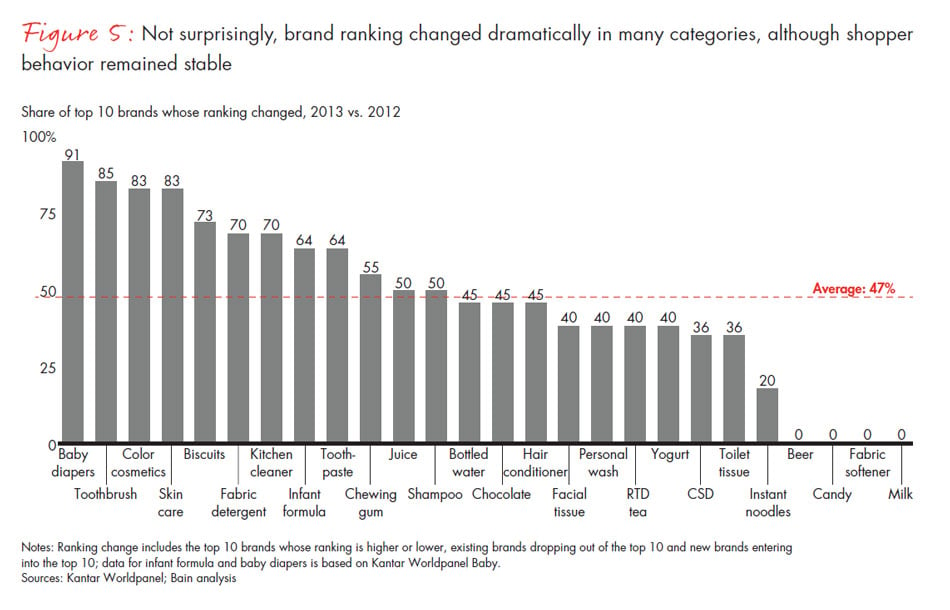

Brand ranking changed dramatically in many categories among the top 10 brands, although shoppers’ behaviors remained stable (see Figure 5). Not surprisingly, some category leaders failed to sustain their position and lost it to others.

On average, about 50% of the top 10 brands changed their ranking in 2013 vs. 2012; some gained share but some lost share. In some categories, the battle for the No. 1 position among top players is ongoing. For example, among the five fabric detergent brands fighting for leadership—Blue Moon, OMO, Liby, Diaopai and Tide—the leading brand changed every year from 2011 to 2013, with Blue Moon becoming the leading brand in 2013. Similarly, Olay, the No. 1 skin care brand in 2012, lost its market leader position to L’Oreal Paris in 2013.

There are winners and losers, but it is not because shoppers behave differently. The winners successfully adapt to actual shopper behaviors, and focus on driving penetration.

Three things winners do right

As we established in our 2012, 2013 and 2014 China Shopper Reports, we’ve entered an era in which brand growth will primarily come from share gain.

In order to achieve growth consistently, brands need to do three things right:

1. Obsess over actual behaviors, not professed behaviors

Consistent with our 2012 and 2013 reports, our 2014 study of actual purchase behaviors reinforces our findings that brand choices are largely subconscious for Chinese shoppers—what shoppers say they will do is not necessarily consistent with what they actually do. Nonetheless, when assessed on a broad scale, shoppers’ seemingly random behaviors are, in effect, predictable.

Here are some possible explanations why:

The evidence shows that shoppers do not think about brands. Instead, they think about many other topics important to them—their jobs, friends, families, holidays and leisure activities. As a result, their brand choices are largely subconscious and influenced, for the most part, by circumstances, such as whom they shop with, how much time they have and which brands capture their attention as they walk into a store.

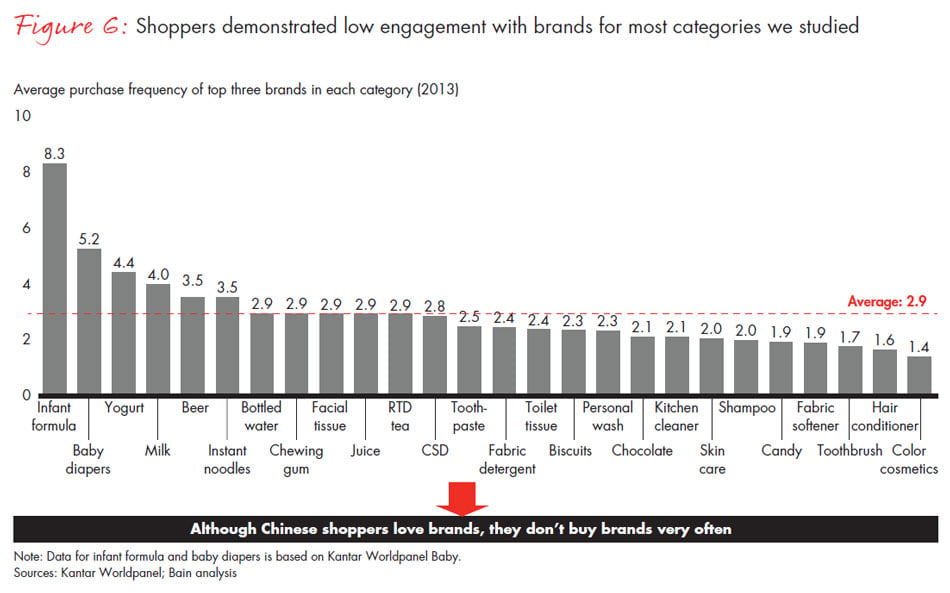

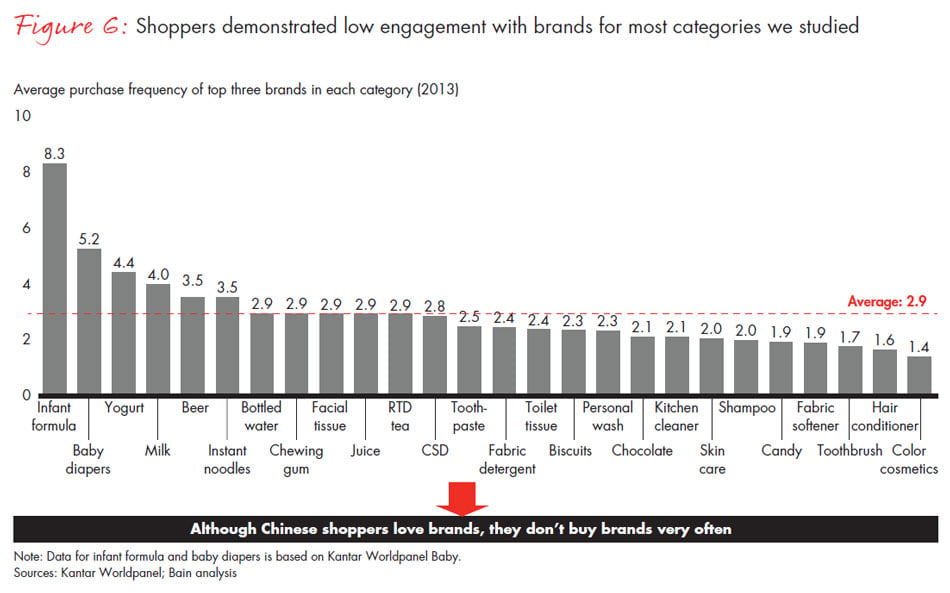

Overall, Chinese shoppers demonstrate very low engagement with brands for most categories we studied (see Figure 6). The average purchase frequency for the top brands among the 26 categories is less than one purchase every four months—a very low purchase frequency. Yet low-frequency shoppers represent a significant percentage of each brand’s shopper base and contribute a significant share of its revenues.

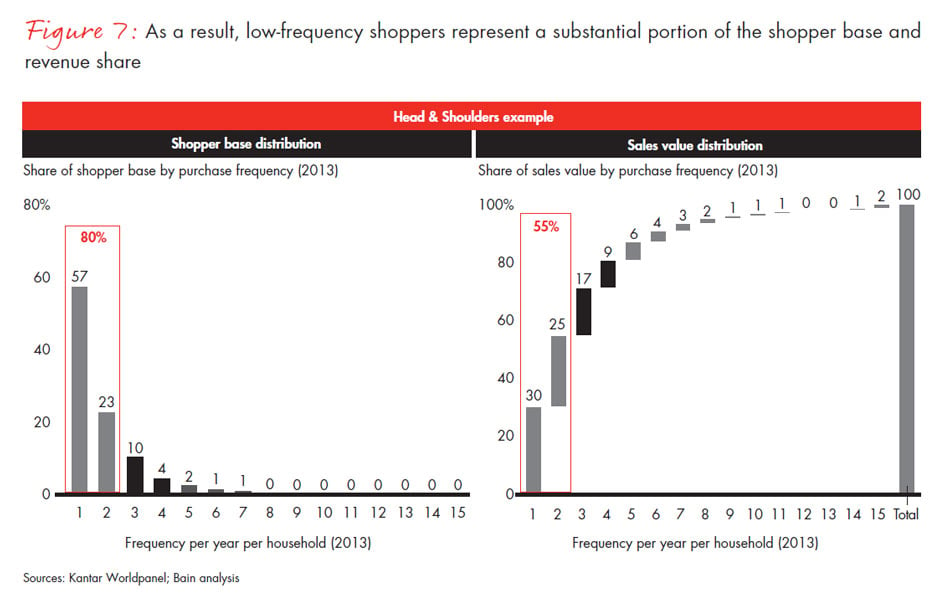

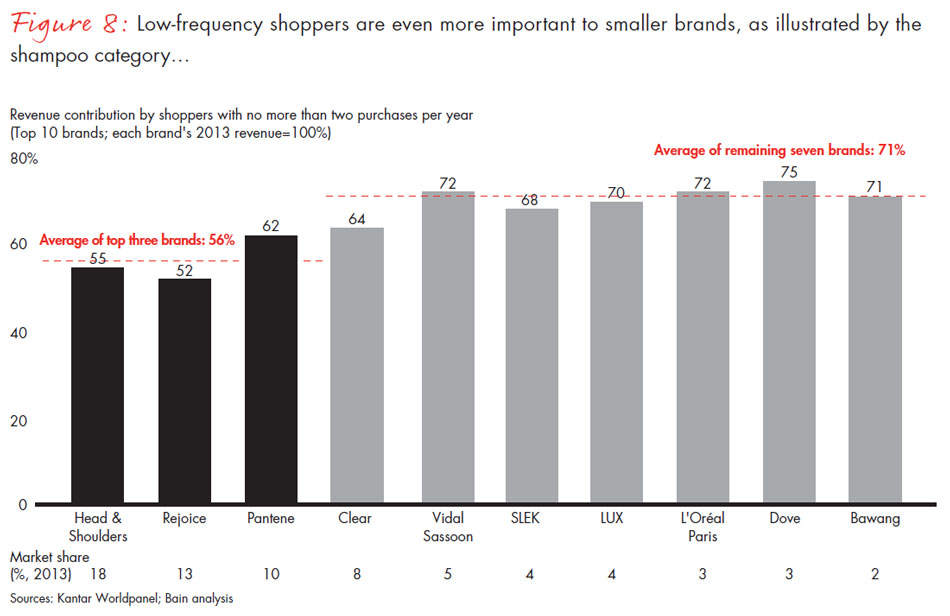

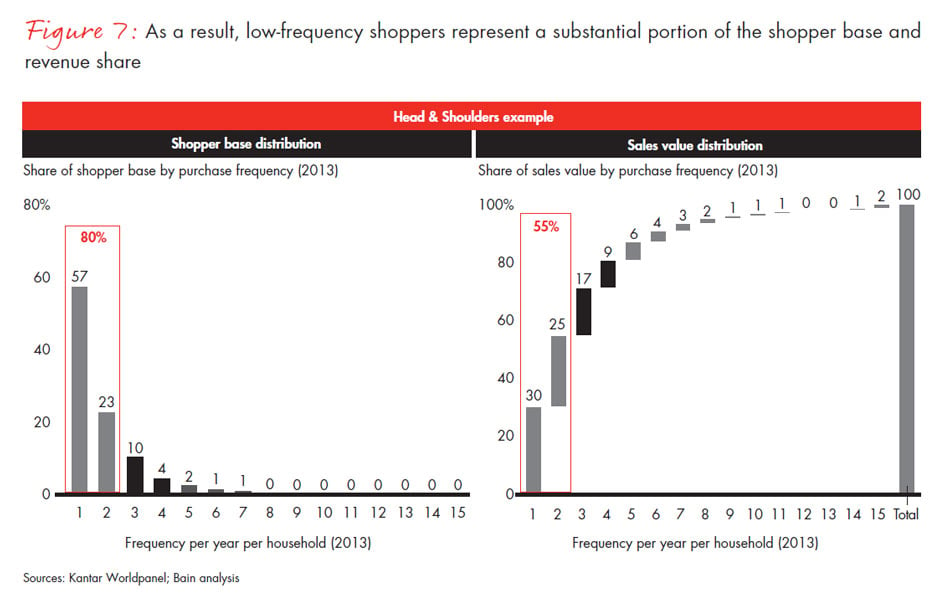

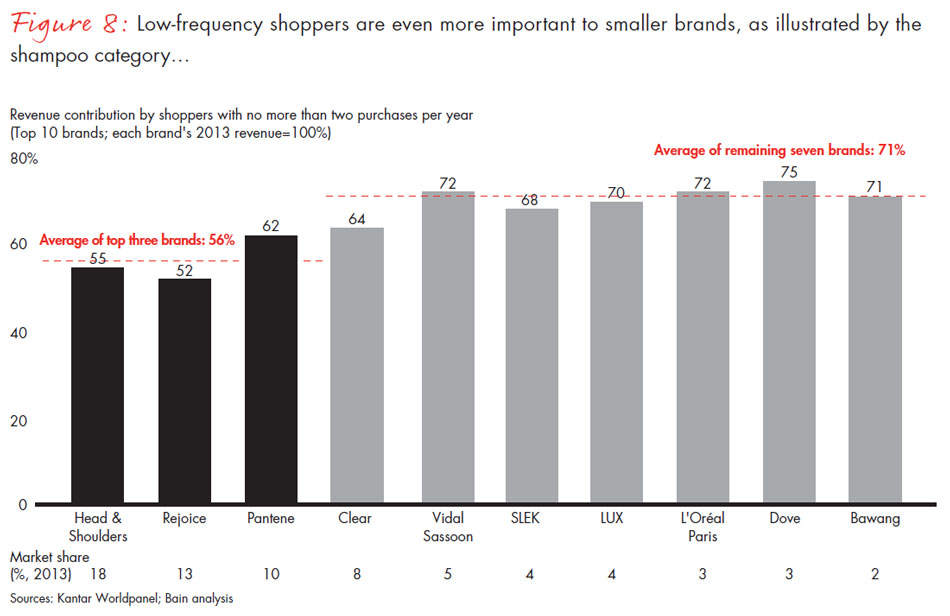

Consider the shampoo category: 80% of Head & Shoulders shoppers purchase the shampoo no more than twice a year, yet they represent 55% of the product’s total sales (see Figure 7). We also determined that such low-frequency shoppers are even more important for smaller brands (see Figure 8).

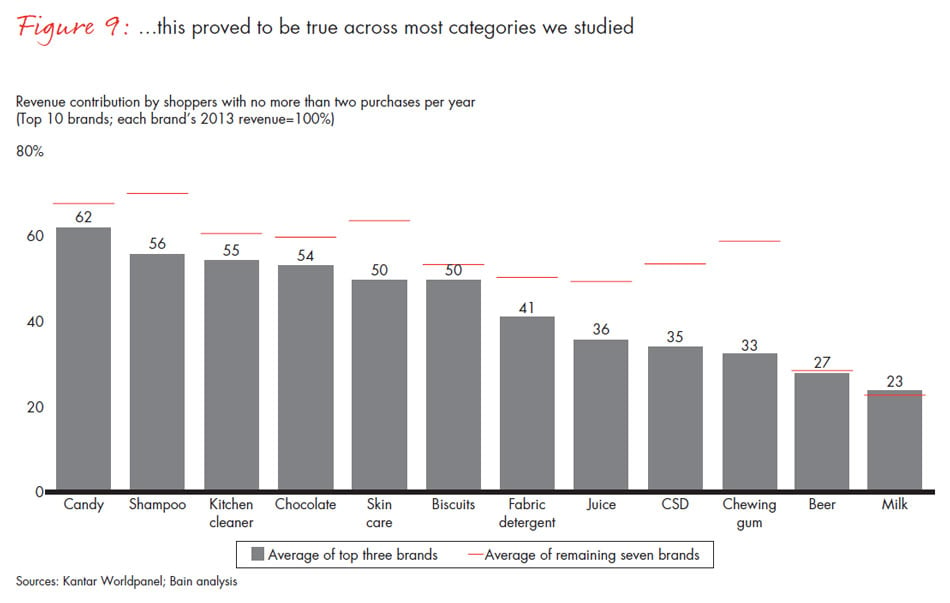

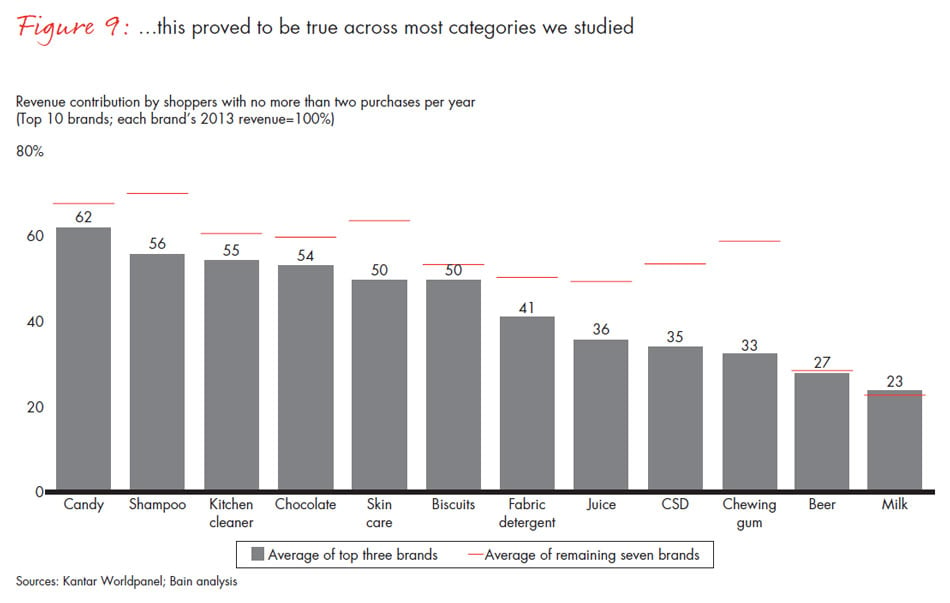

Low-frequency shoppers, those who make no more than two purchases per year, demonstrated similar behavior across most of the categories we studied (see Figure 9). Therefore, the only way to grow a brand is to have as many people as possible buying it, rather than to expect a few people to buy it more frequently.

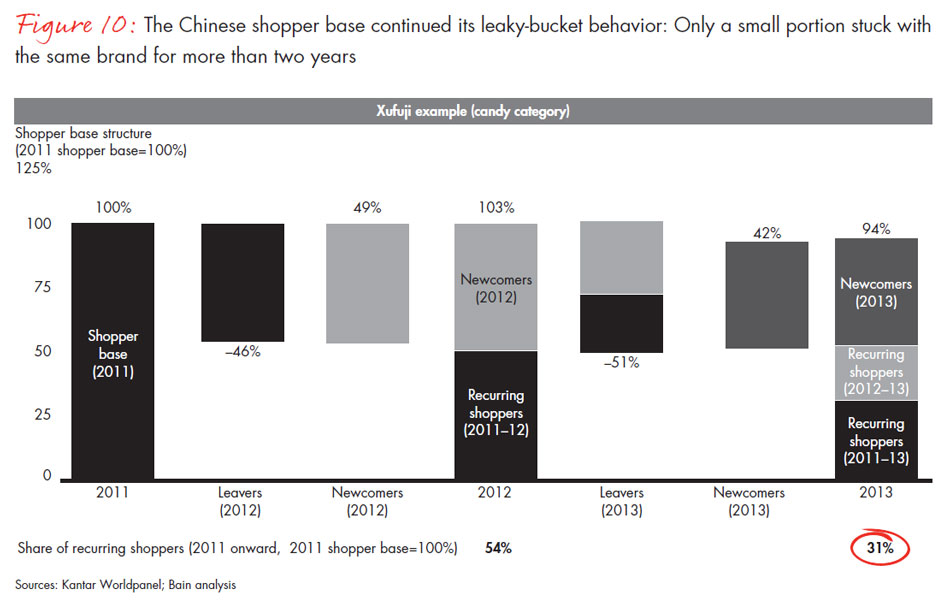

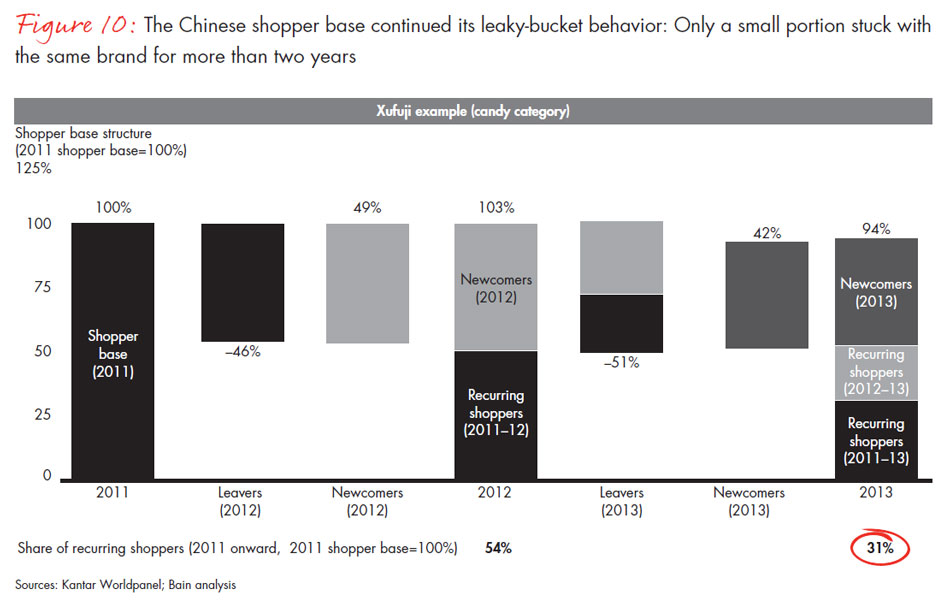

Another shopping behavior to obsess over is the “leaky bucket” syndrome. First introduced in our 2013 Shopper Report, we conducted a leaky bucket analysis, covering a two-year period (see Figure 10). We confirmed that each brand’s shopper base continues to experience a high level of churn for all the brands we studied, regardless of a brand’s size. Just because some customers buy your brand this year doesn’t mean they will repeat next year. In fact, a majority of shoppers leave after two years.

In order to compensate for the loss, brands need to continuously recruit shoppers. Because a brand’s shopper base is a leaky bucket, a brand seeking to grow must not only attract new shoppers each year, but also replace its lost shoppers with new ones. Since purchase frequency and repurchase rates are low for many brands, brands must find ways to recruit customers every single time they go shopping.

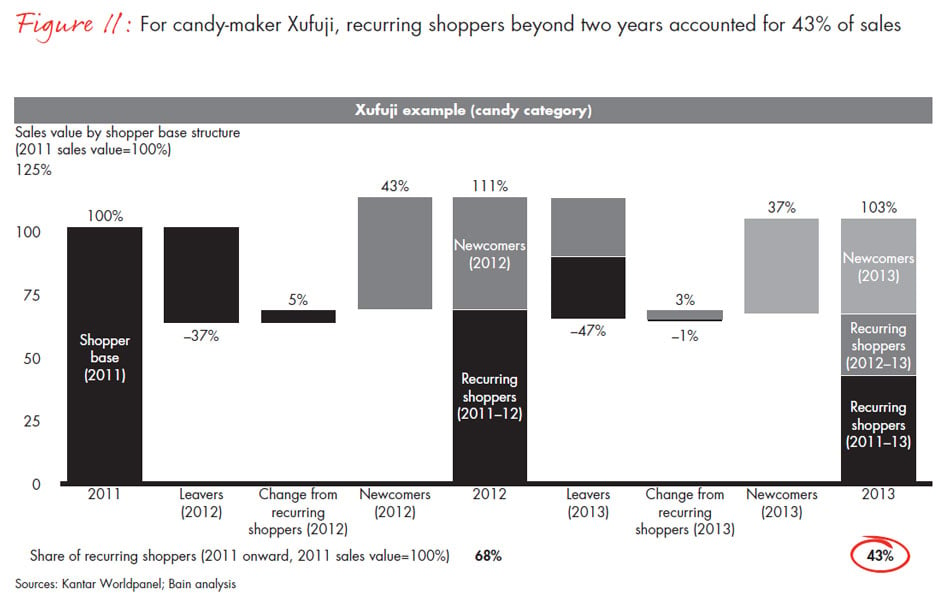

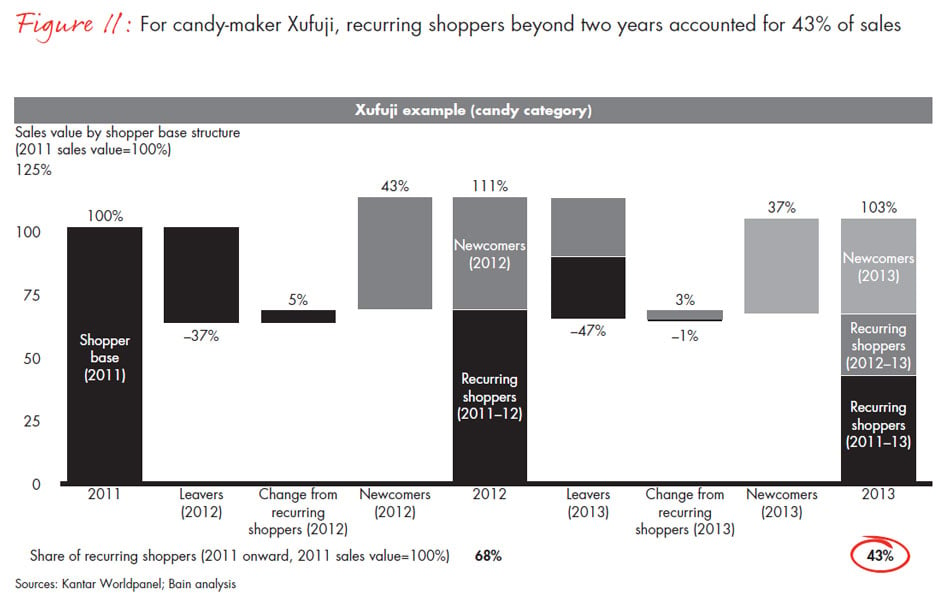

Consider Xufuji candies: 46% of shoppers who purchased Xufuji candies in 2011 left in 2012, while more than one-third of its 2012 revenue came from newly recruited shoppers. This pattern continues every year: Almost 70% of Xufuji’s 2011 shoppers had left by 2013, while more than half of its 2013 revenue came from shoppers who were recruited in 2012 and 2013 (see Figure 11).

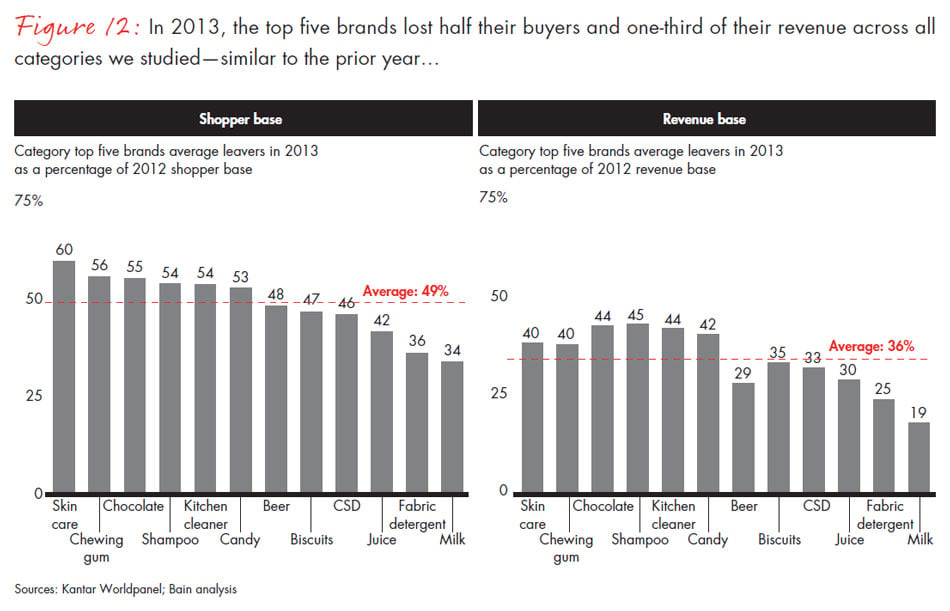

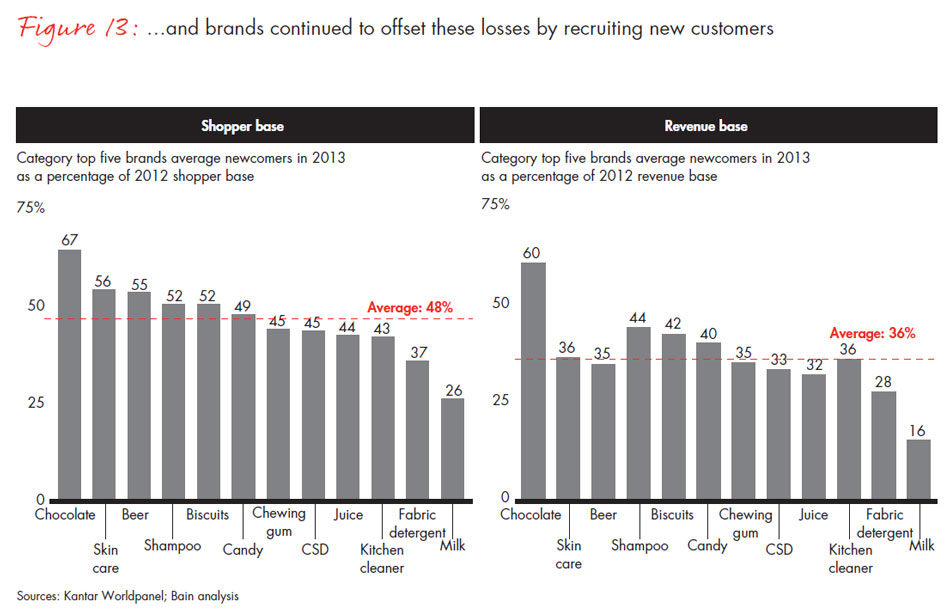

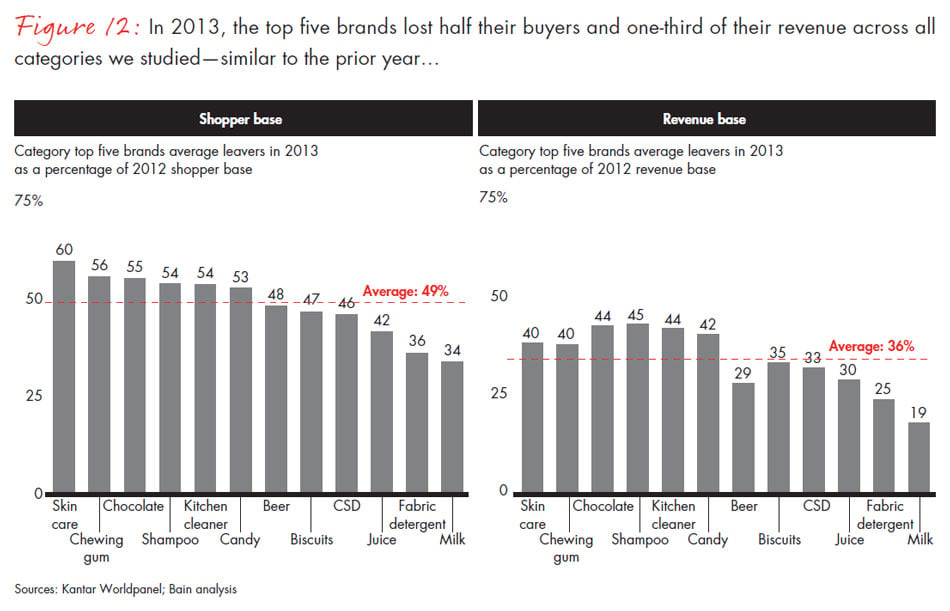

This is also true for other brands in other categories (see Figure 12). On average, the top five brands lost half of the buyers who had contributed more than one-third of the brands’ revenues between 2012 and 2013 across the 12 categories we studied. As we might expect, the churn rate is less pronounced in loyalty categories such as milk. The leading milk brand, Mengniu, lost “only” 31% of its shopper base over two years, representing less than 20% of its sales.

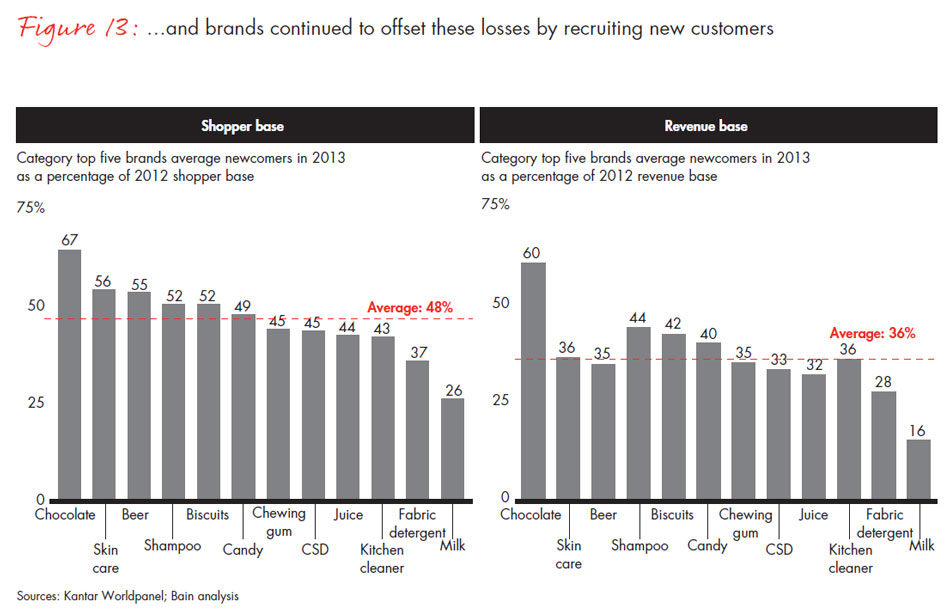

Key takeaway: It is critical for brands to focus on constant recruitment, year in and year out, to compensate for losses from leavers (see Figure 13). This strongly reinforces the point we made earlier: The only way to grow a brand is to have as many people buying it as possible, rather than expecting a few people to buy products more frequently.

2. Clearly define the battlefield by understanding shopper overlap

We found that the competition that brands face in China is much broader and more complex than generally thought. In fact, their competition extends far beyond their target segments.

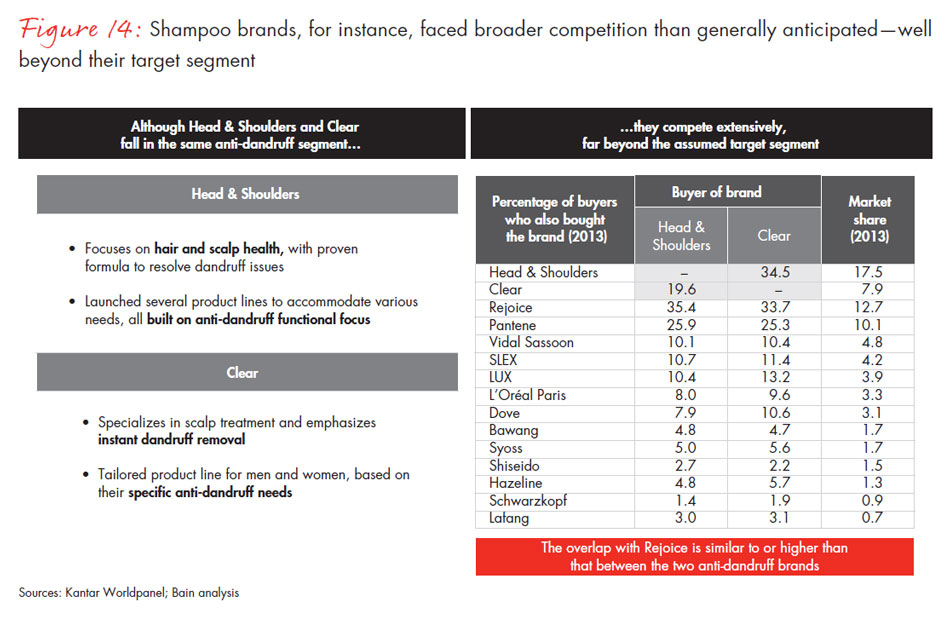

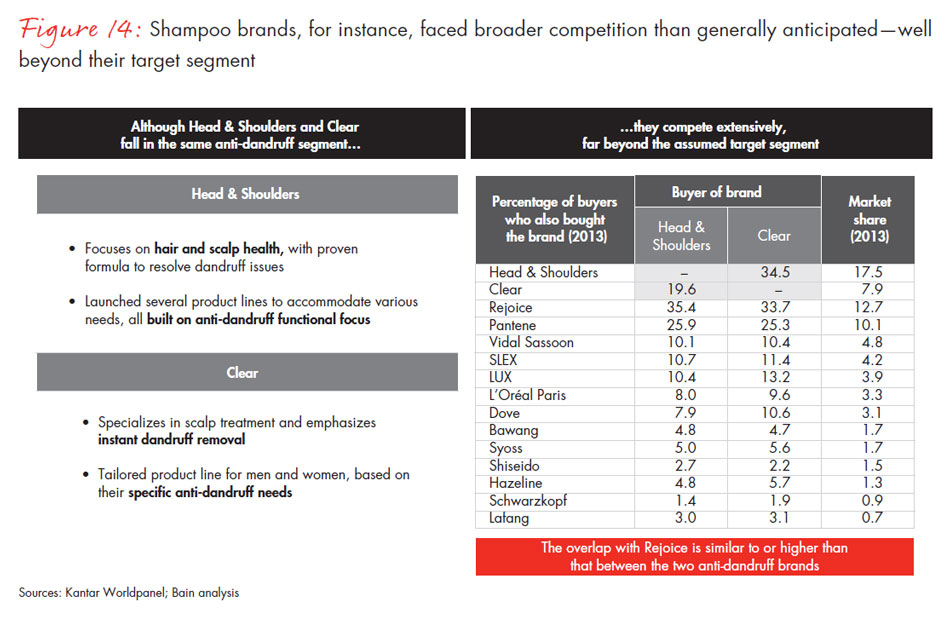

Take shampoo, for example: Conventional wisdom in selling shampoo has been for brands to position themselves around functional benefits. Head & Shoulders (H&S) and Clear promise anti-dandruff results; Pantene promises to improve the health of hair with its Pro-V formula; Rejoice emphasizes silky, smooth and tangle-free hair.

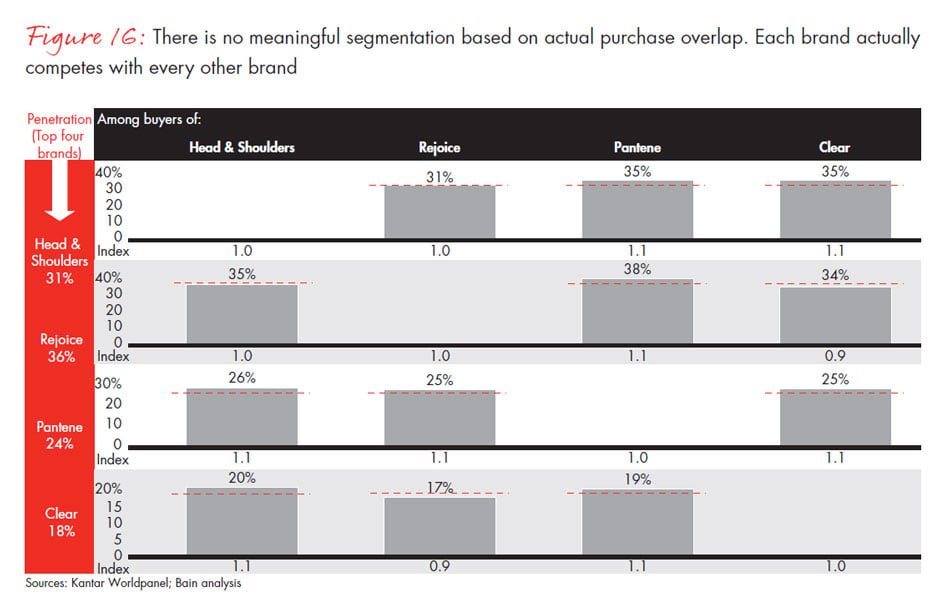

Rigorous shopper overlap analysis shows, however, that there is a considerable amount of competition across these four brands. We found that 20% of H&S shoppers also bought Clear; this is to be expected, given that they compete in the “anti-dandruff” segment. However, we found that 35% of H&S shoppers also bought Rejoice and 26% also bought Pantene.

In other words, the data shows that H&S overlaps more with Rejoice and Pantene than with Clear, despite their different positioning (see Figure 14).

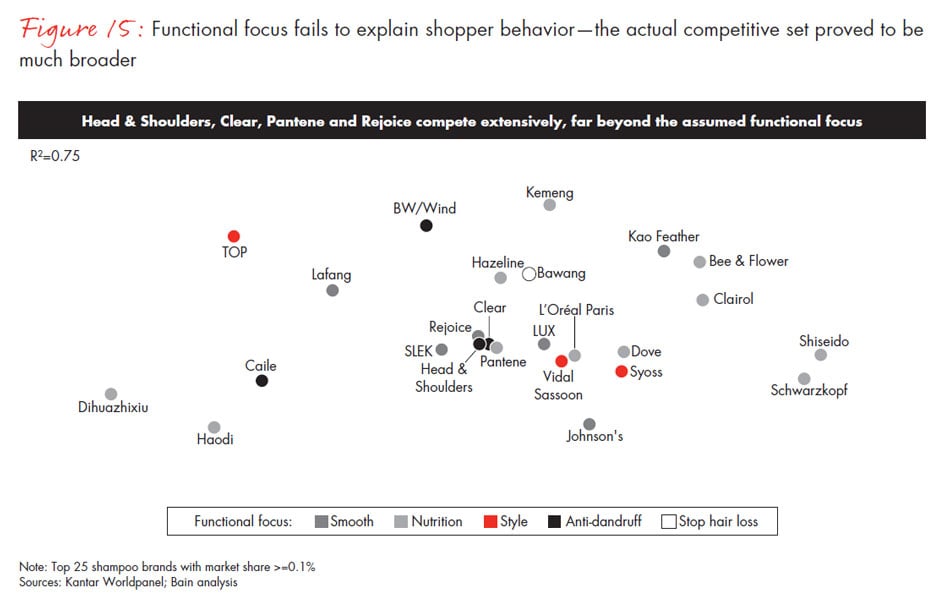

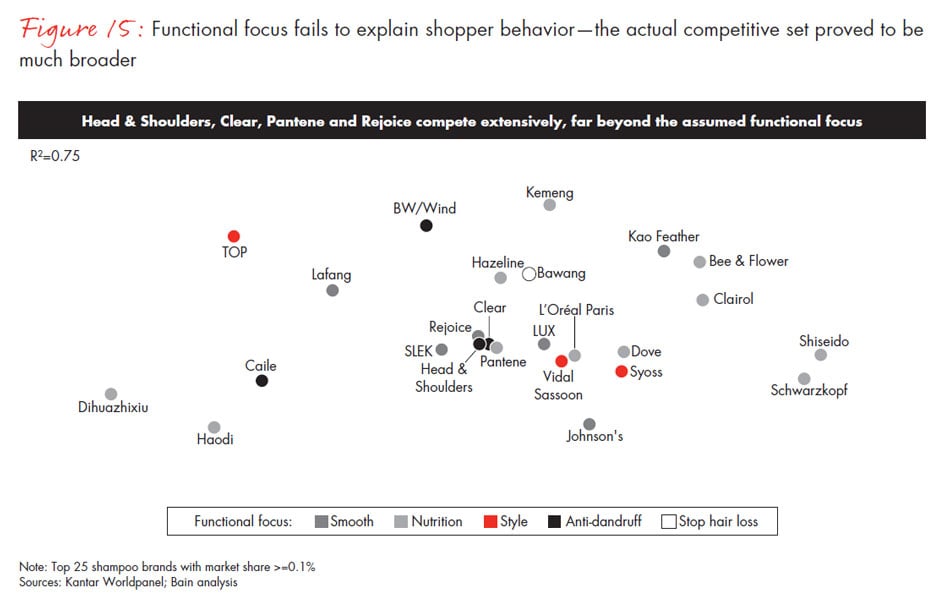

Key takeaway: The data would suggest that the competitive set in the shampoo category is much broader than what is implied by the functional benefits of each brand (see Figure 15). We used multidimensional scaling analysis (MDS) to analyze the shopper overlap data across different brands. MDS is often used to assess a brand’s competitors in the market. On the chart, the smaller the distance between two brands, the higher the likelihood that both brands occur in the same consideration set and therefore compete with each other.

When looking at the MDS findings in the shampoo category, we found that each brand was actually competing with a broader set of competitors, despite its functional focus. Although brands normally claim that they have clear target-shopper segmentations, in reality the segmentation is not clear cut. Narrowly defined segmentations will definitely mask the true nature of competitive dynamics among brands.

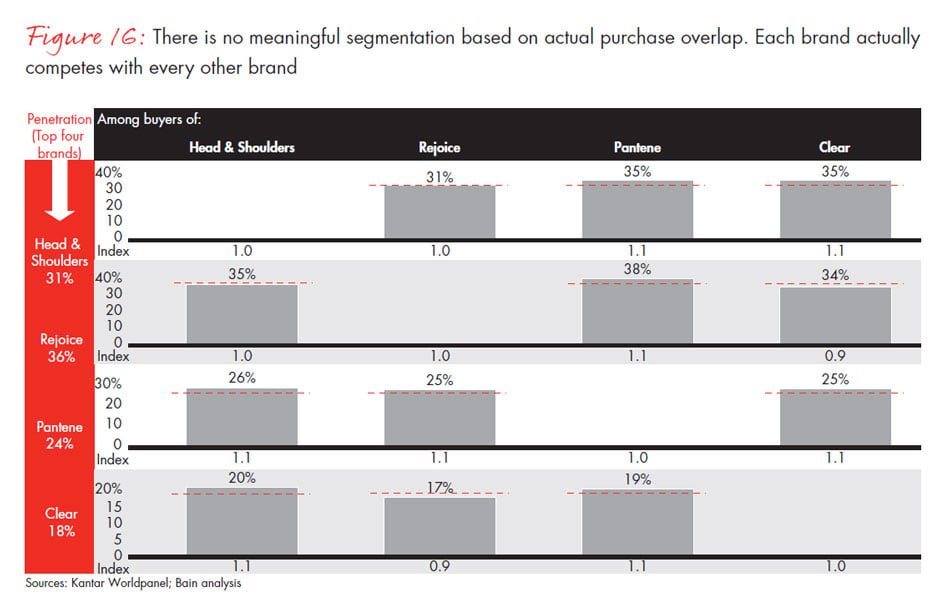

When we looked further at the shopper base overlap at brand level, each brand was competing with everyone else in proportion to its overall penetration. The overlap among brands is perfectly statistical and there is no clear and meaningful segmentation in the shampoo category based on the shoppers’ actual purchase behavior (see Figure 16).

3. Expand penetration by building three key brand assets

As we reported in our first volume of the 2014 China Shopper Report, along with our 2012 and 2013 Bain & Company and Kantar Worldpanel reports, shifting shopper behaviors mean that marketers can no longer grow by simply riding a category wave. Growth must come primarily from share gain. And penetration change is the most important way to achieve share change. In this section, we share more details about how marketers can accomplish this.

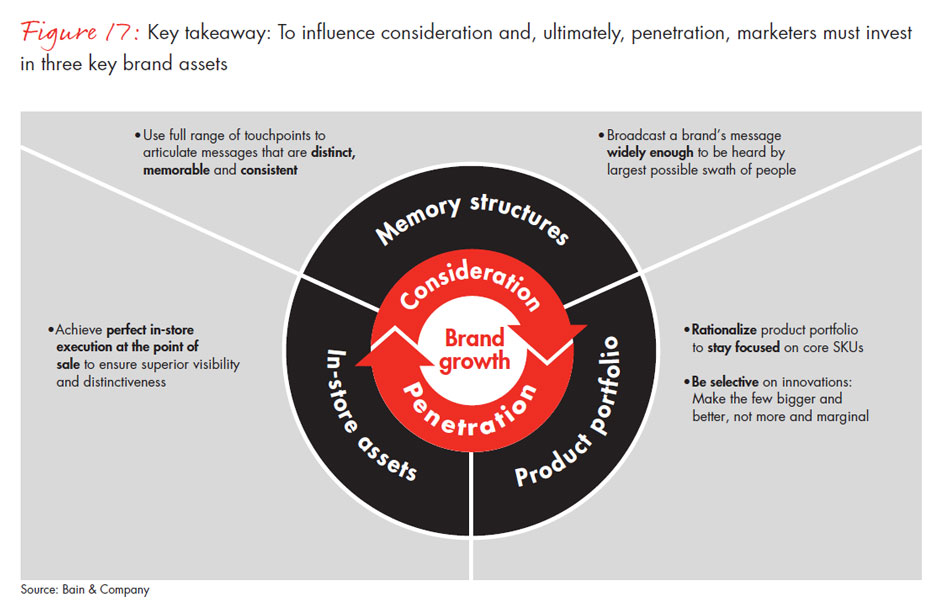

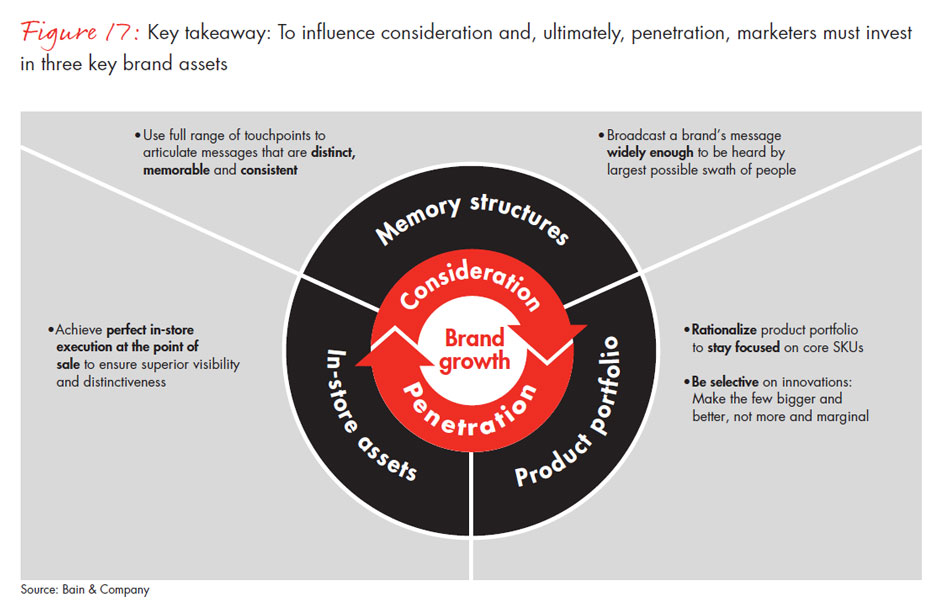

Building penetration depends on continually increasing brand consideration—the percentage of consumers who consider your brand for a purchase occasion. The steady path for brands to earn consideration and penetration requires investment in three key assets: memory structure, product portfolio and in-store assets (see Figure 17).

Asset #1: Memory structure

Because shoppers rarely, if ever, think about brands, marketers need to remind them about their brands when they go shopping.

This does not necessarily mean controlling what shoppers think about your brand. Instead, it means getting shoppers to think about your brand in the first place as they shop. To that end, brands must:

- Communicate consistently and at scale.

- Create saliency, so that shoppers think about your brand at the moment of truth; for example, this saliency can be created around shopping or consumption occasions.

Key takeaway: Brands must articulate distinct, memorable and consistent messages and use the full range of touchpoints to broadcast their messages widely. Distinctive brand cues, such as logos, tunes and packaging, are part of the memory structure and are used systematically by leading brands.

Asset #2: Product portfolio

Another key to getting shoppers to think about your brand as they shop: Simplify and rationalize your product portfolio. As we said in previous reports, too many brands and SKUs can result in ineffective advertising strategies, shopper confusion and other perception challenges that erode penetration. Too many SKUs will also increase distribution costs, which have already been growing as a result of China’s increasingly complex distribution network.

Winning brands stay focused on core SKUs and are selective when introducing innovations. They also know that the bulk of their advertising support should remain on their core SKUs.

To that end, brands must:

- Put sufficient focus on renovations and range expansions on existing “hero” SKUs to continue building them.

- Increase recruitment of new customers by using innovation to eliminate the barriers that prevent shoppers from buying your brand. Innovative SKUs must meet the highest threshold and demonstrate strong incremental potential; if they don’t, kill them quickly.

- Define a “Must Stock List” for each store type and align it with key retail partners.

Asset #3: In-store assets

Once brands target the most important SKUs, it’s essential that they adequately invest in in-store assets. Brands must achieve perfect in-store activation at the point of sale to ensure superior visibility and distinctiveness and to make shopper decisions easy.

Research shows that shoppers often make up their minds within just a few seconds in the store—and that they reconsider their choices every time they buy. More than ever, gaining control of the in-store experience is critical to win shoppers’ purchases and grow your brand.

To accomplish this, brands must:

- Create an in-store “picture of success” by establishing a clear vision that determines which brands and SKUs to place in which stores, where to place brands and SKUs, the number of shelf facings, and which types of layouts and promotions will activate shoppers and convince them to buy.

- Understand how consumers shop across different categories and utilize category adjacency to encourage consumers to purchase closely related categories and brands.

- Activate new customers every day, given their low frequency of shopping.

As we mentioned in another Bain report, “The new mission for brands: Winning shoppers in the store,” companies that rediscover their in-store-asset potential can watch sales grow by an additional 5% to 15% each year.

However, such improvement needs to be made over and over again. Shopper behavior and the retail environment continually evolve, and even the greatest success needs to be continually updated. In the era of super-fast shopper decisions and more competition for shelf space, the storefront has become a must-win battleground. Brands can no longer afford to stand still or leave anything to chance.

Three brand growth success stories

Three brands developed successful strategies that build on these three key brand assets:

Success Story #1: JDB capitalized on red-can memory structure

JDB, a popular ready-to-drink (RTD) tea brand in China, has enjoyed considerable success by capitalizing on the memory structure consumers have for its red-can package. Interestingly, the JDB brand of red-can products didn’t exist three years ago. Until 2012, red-can products were produced exclusively under another brand, WangLaoJi (WLJ). When a legal dispute caused the two companies to terminate their agreement, JDB launched its own red-can brand.

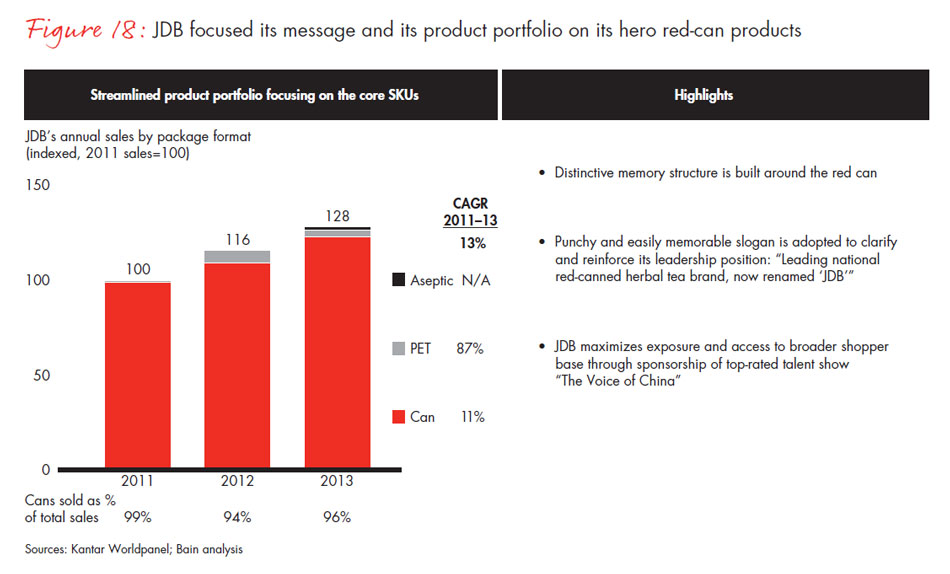

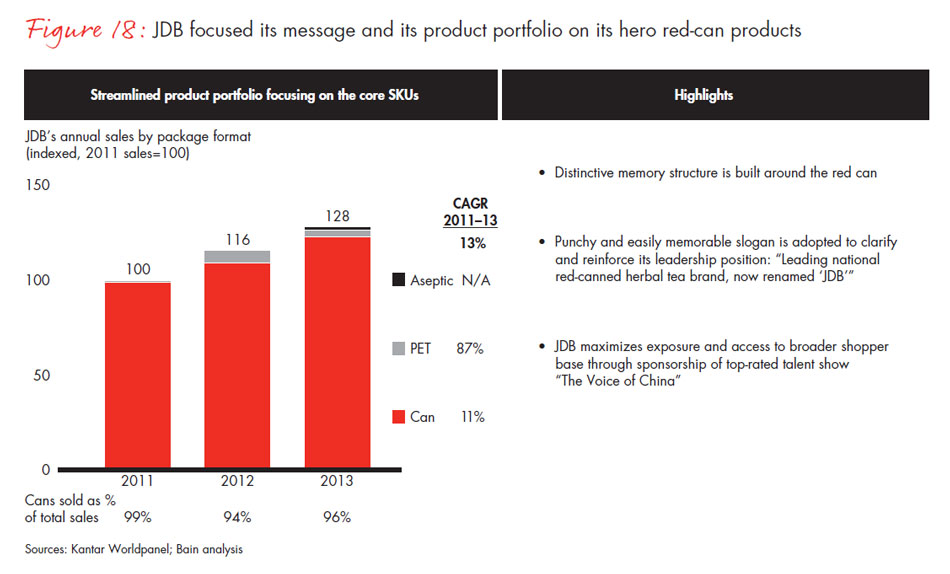

JDB focused exclusively on the red-can SKUs, either with single packs or multi-packs and invested heavily in advertising and in-store activation. JDB tripled its advertising budget between 2011 and 2013 and created a punchy, easily memorized slogan that helped clarify and reinforce JDB’s leadership position: “The leading national red-canned herbal tea brand, now renamed ‘JDB.’” By sponsoring a top-rated talent show, “The Voice of China,” the company maximized its exposure and access to a broad shopper base. JDB also produced strong in-store displays in key traffic zones in large modern trade stores and created customized promotions for different store formats.

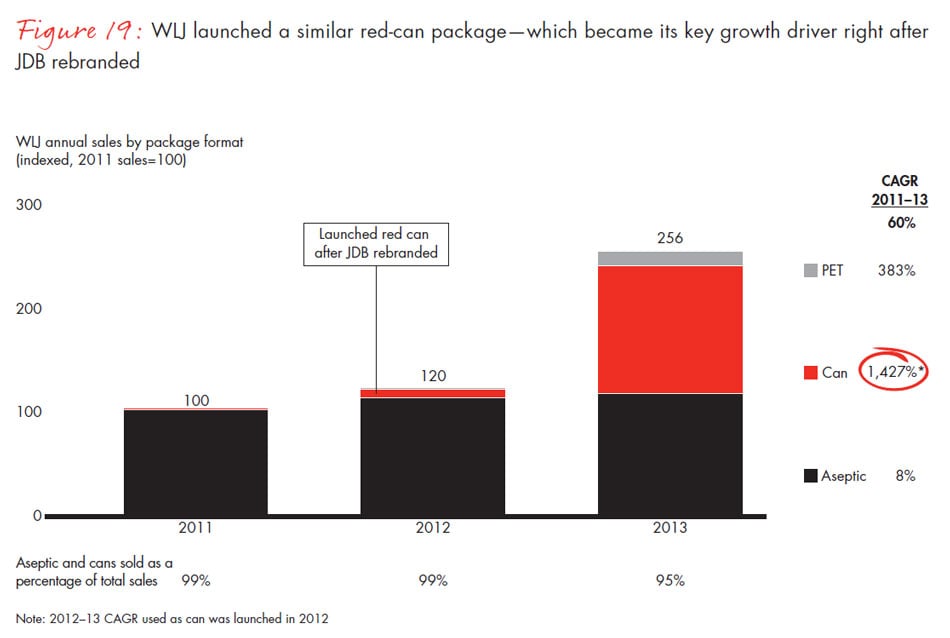

By effectively building upon consumers’ red-can memory structure, JDB grew sales 13% a year from 2011 to 2013 (see Figure 18). Meanwhile, WLJ’s annual sales growth reached 60% from 2011 to 2013. That growth came mostly from their red-can SKUs. WLJ benefited from JDB’s heavy advertising campaign around the red can and actually reduced its advertising spending between 2011 and 2013 (see Figure 19). As a result of these investments, the red-can SKUs across the two brands have grown 30% per year since 2011, which also contributed 80% of the RTD tea category growth.

Success Story #2: YNBY transferred its functional benefits from medicine to oral care

Over the last 10 years, YNBY built its toothpaste brand by successfully transferring its established memory structure around its traditional medicine’s anti-inflammatory and hemostatic effectiveness.

YNBY used to be a well-known medicine brand. Since 1971, it has been famous for its anti-inflammatory benefits and the ability to reduce bleeding. Its formula, more than 110 years old, is considered a national treasure by the Chinese government. Almost all Chinese consumers know this brand.

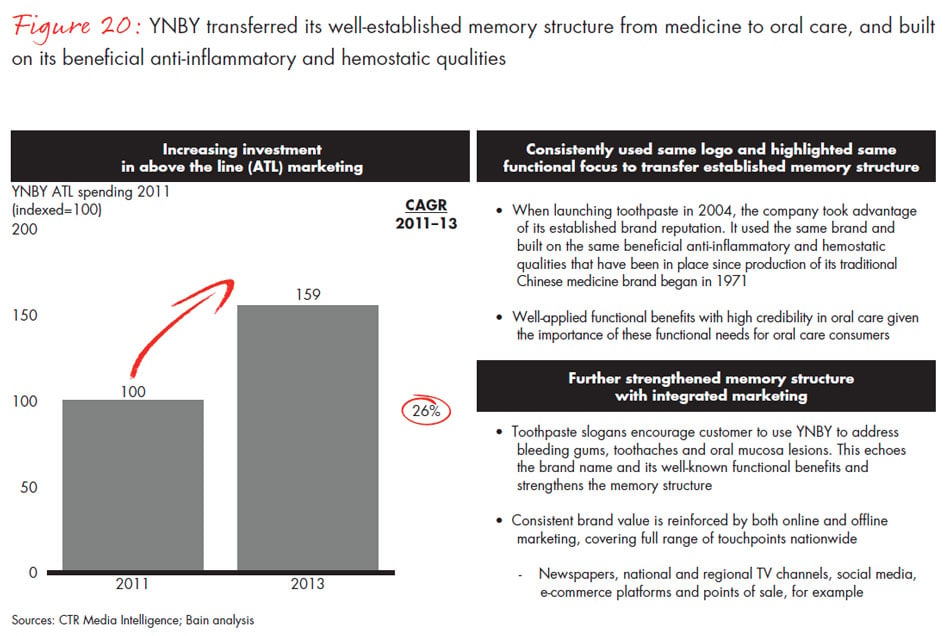

In 2004, it launched a range of toothpastes under the same brand name with the same functional benefits, which apply well to the toothpaste category. The benefits include preventing and reducing bleeding, gingivitis and periodontal disease. Consumers immediately embraced those functional benefits, and developed a high level of trust for the toothpaste brand. As a result, YNBY successfully transferred its established memory structure to toothpaste.

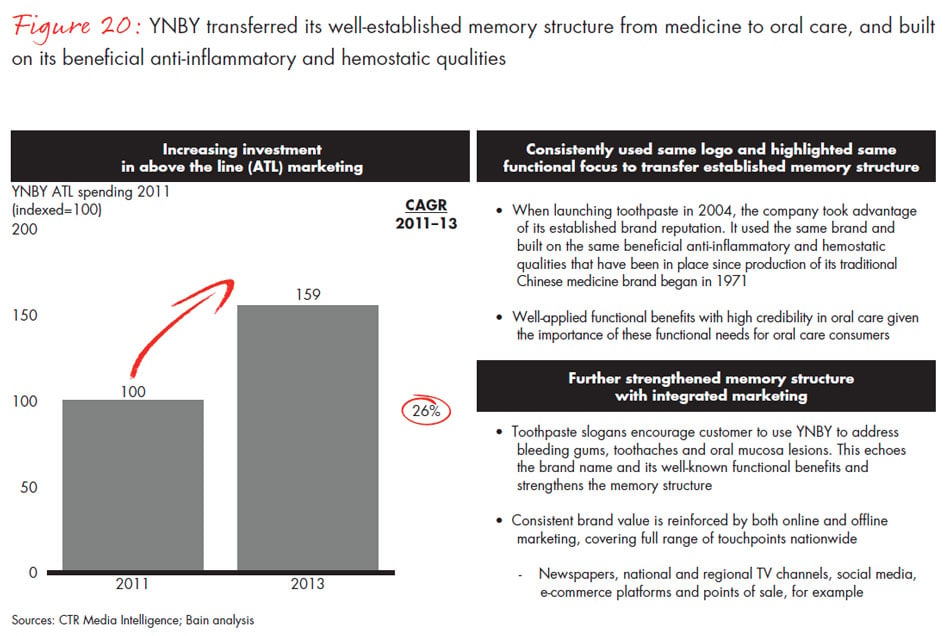

From 2011 to 2013, YNBY increased its annual advertising budget by 59% and reinforced its brand’s functional benefits with the message “Use YNBY to address oral health problems like bleeding gums, toothache and oral mucosa lesions” to strengthen brand name awareness and memory structure (see Figure 20). The company reinforced the message with online and offline marketing, covering a full range of touchpoints nationwide.

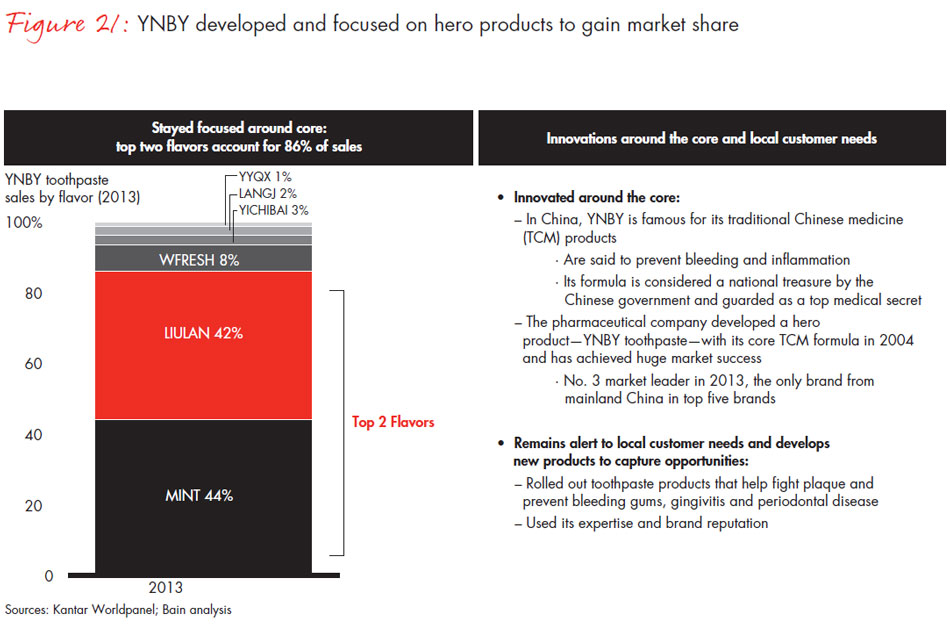

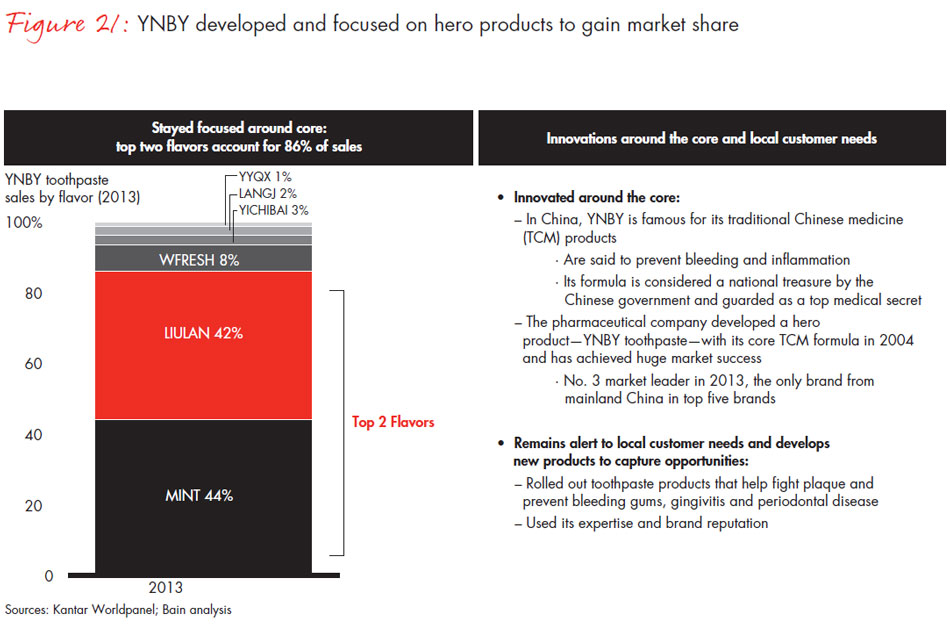

YNBY also managed its product portfolio: Of its six flavors of toothpaste, the company focused on the top two—mint and liulan—which represented more than 85% of its 2013 revenue (see Figure 21). It also heavily invested in in-store assets. It strived for a significant number of facing displays in targeted retailers and used strategically- located secondary displays to ensure superior visibility. YNBY also promoted its products in diverse ways, including free samples, coupons, brochures and partnerships with select restaurants to expand consumer awareness.

The result: YNBY has gained penetration and market share over the last three years, reaching 10.9% share in 2013. Sales have grown 30% a year in the last two years with a market share gain of nearly 2.6%.

Success Story #3: Master Kong capitalized on its distinctive logo

Master Kong has established a clear and distinctive logo that exudes “reliability” and “professionalism.” The Master Kong logo, launched in 1992 when the company first introduced its instant noodles, portrays an image of a professional chef. Master Kong has successfully built upon the reliable, professional memory structure of its well-known logo to not only increase penetration and market share in instant noodles, but also to expand into beverages and biscuits.

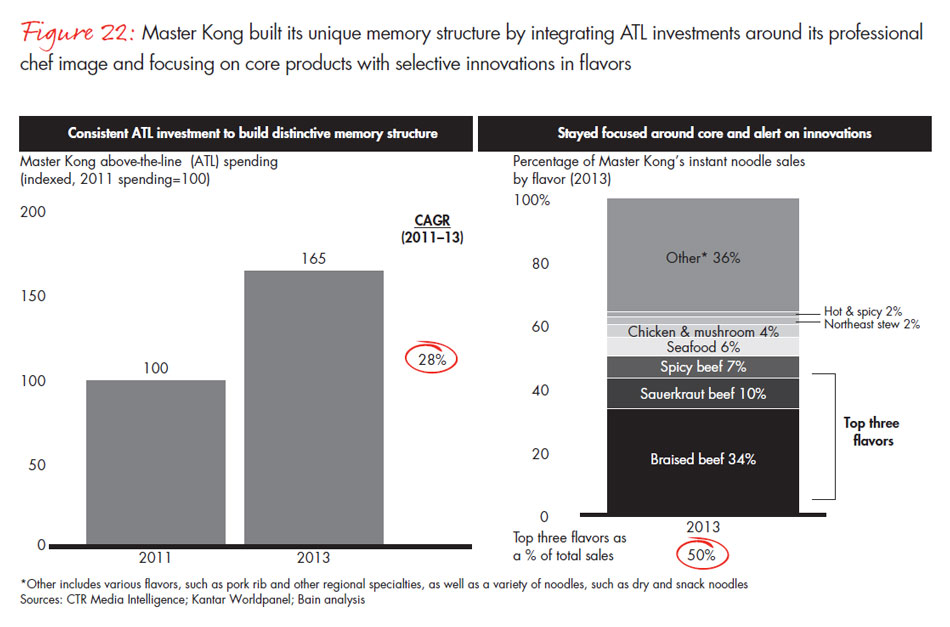

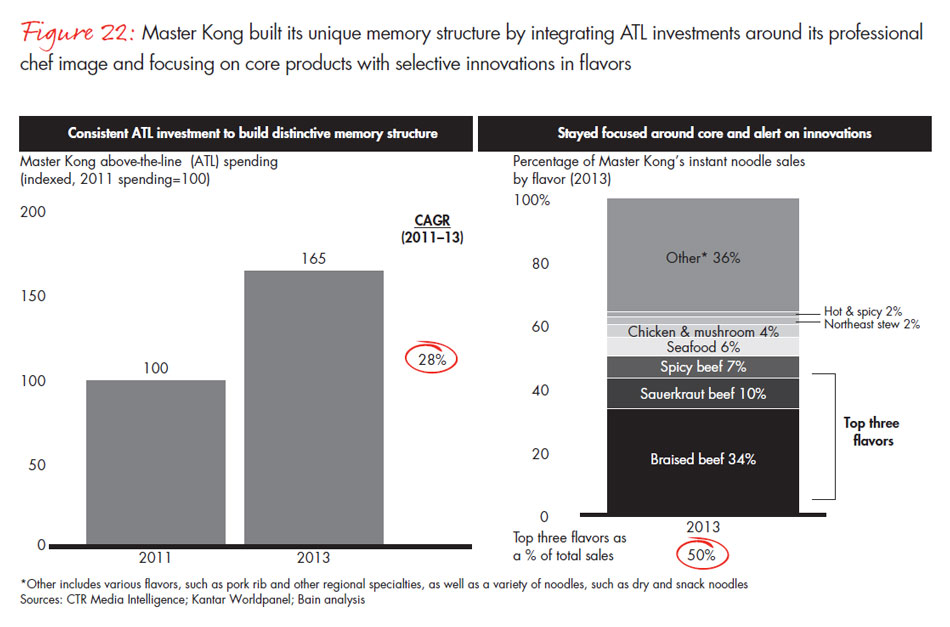

Master Kong increased its advertising budget by 65% between 2011 and 2013, consistently reinforcing the brand with the slogan “Reliably and professionally providing good and healthy products” (see Figure 22). The message has been repeated and reinforced in online and offline platforms, covering the full range of touchpoints nationwide, such as traditional media, digital and outdoor media and a variety of marketing events.

Its “hero” SKU is the braised beef flavor, which was introduced in 1992, and still accounts for one-third of its sales. Master Kong introduced new products based on beef and regional flavors to extend its penetration. For example, the spicy beef flavor is popular in China’s southwest regions. Its sauerkraut beef flavor was introduced after a competitor, Uni-President Enterprises, successfully launched a sauerkraut beef flavor. These regionally focused innovations have enabled Master Kong to reach 76% penetration in 2013, the highest of any brand across the 26 categories we analyzed.

Master Kong also invested heavily in in-store assets to reinforce the brand image, such as an in-store demo with promoters dressed as chefs. Promotion of the brand also included primary and secondary displays, gondola heads in modern trade, as well as aggressive penetration of traditional trade channels by signing exclusive partnership agreements.

The results: Master Kong gained penetration and market share in instant noodles over the last three years, reaching 56% market share in 2013. Total sales have grown 12% per year in the last two years and Master Kong gained 3.5% market share.

Acknowledgments

This report is a joint effort between Bain & Company and Kantar Worldpanel. The authors extend gratitude to all who contributed to this report, in particular Chris Wang, Cherry Hong, Nancy Hu and Eric Yue from Bain & Company, and Rachel Lee, Tina Qin and Tony Xue from Kantar Worldpanel.