Founder's Mentality Blog

On a trip to Switzerland recently, I had the great pleasure of hearing famed mountaineer Reinhold Messner speak at a corporate event. He was handing out copies of his latest book, My Life at the Limit, and I snatched one up to read on my plane ride home. Messner was the first climber to conquer all 14 of the world’s 8,000-meter peaks, the first to summit Mount Everest without supplemental oxygen, and has been to both poles and crossed the Gobi Desert. I’ll admit it’s far less glamorous, but his story also has parallels with how founders manage their profit and loss statements so effectively. Let me explain.

One of Messner’s many contributions to the world of climbing was that he helped pioneer the “alpine style” of mountaineering, in which climbers carry everything they need with them rather than establishing a fixed line of stocked camps. Alpine style is an alternative to “expedition style,” the traditional mountaineering strategy used by Sir Edmund Hillary and Tenzing Norgay when they were the first to conquer Everest in 1953. At that time, success required a massive effort to escort two climbers and their equipment (including heavy oxygen canisters) very close to the summit. This meant three climbers had to lead them to the final camp carrying 40 pounds of equipment each—the culmination of an expedition that required over 400 people and 10,000 pounds of baggage.

Messner recognized that you could radically alter the economics of mountaineering if you changed two major assumptions—the need for supplemental oxygen and the need to climb up and down the mountain to stock a line of ever-higher camps with supplies. Going up the mountain once with all your food and equipment would radically reduce duration risk—the risk that builds when a vast number of people in a single expedition are deployed on the mountain for extended periods of time. But it would also radically increase the acute safety risk faced by a smaller team with fewer supplies and less back-up.

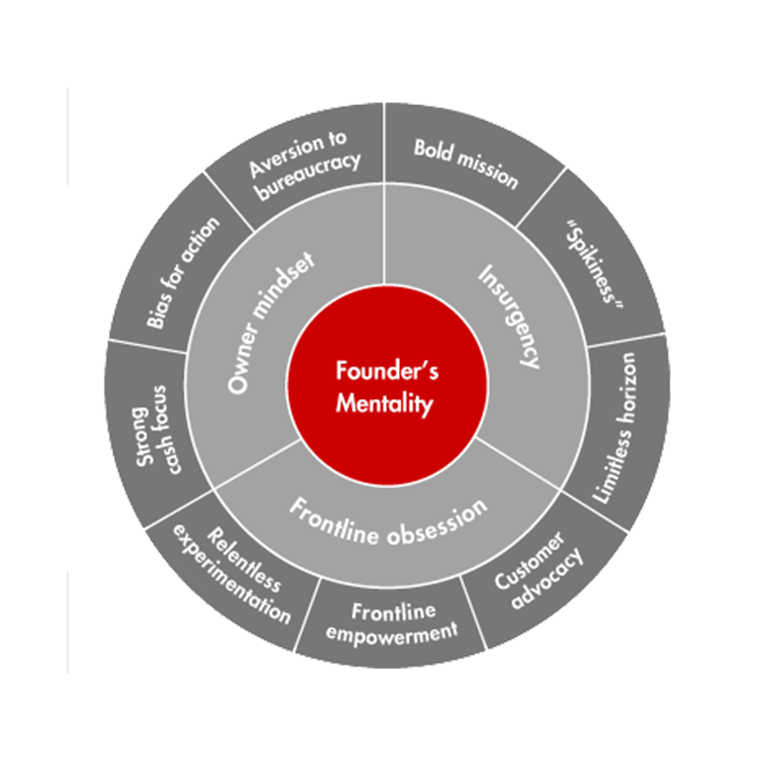

About the Founder's Mentality

The three elements of the Founder's Mentality help companies sustain performance while avoiding the inevitable crises of growth.

As Howard E. McCurdy, a professor at American University who has studied the economics of mountaineering notes, Messner “found the bottom of the cost curve.” But because he left himself no margin for error, “most people would not want to join him there.” Interestingly, McCurdy also found that modern climbers don’t really have to. He documented that mountaineering has undergone a form of continuous improvement that has opened it up to recreational participants (albeit highly skilled ones). After an exhaustive study of 25 climb attempts over 92 years, McCurdy concludes that the cost of climbing Everest has dropped tenfold with corresponding increases in safety and speed. He writes, “Commercial operators and modern climbers made simultaneous improvements in cost, risk and time. They did not need to trade risk for cost or cost for time.”

So what does all this have to do with a founder’s P&L?

For a founder-led company, reaching the summit is all about maintaining growth while constantly reducing costs using whatever means possible. Founders understand both the risks and the power of radical innovation but are also constantly hammering away for continuous improvement. Incumbents, by contrast, tend to lose faith over time in both forms of cost control. Instead of lowering sales, general & administrative (SG&A) costs as a percentage of sales, for instance, they are content to allow them to grow at the rate of sales growth. This ignores the value of continuously improving costs and passing the benefit along to customers.

These five points summarize how founders manage their P&Ls to maintain momentum:

- It’s all about growth and cash: For founders, the most critical elements of a P&L are unit volume and cash. They recognize that without volume growth, the whole enterprise dies quickly and unless volume growth generates cash to reinvest in the business, the enterprise dies horribly. This creates a cultural obsession with growth—it is a non-negotiable of the business. It also creates a cultural obsession with yield—how does revenue received translate into cash?

- Costs come down—always: For founders, generating cash for investment means that the company’s cost of goods sold (COGS) must constantly decrease on a per-unit basis. COGS is subject to the economics of mountaineering—either we take risks and find alpine solutions or we focus on continuous improvement and have more patience. But costs must come down.

- They re-invest cost savings to gain share: Declining costs trigger a virtuous cycle of growth: An unrelenting focus on unit-volume growth ensures the opportunity to achieve the benefits of scale. This translates into decreasing COGS and the company either hands these cost benefits back to customers in the form of price reductions or re-invests the savings in innovations that customers need. That leads to further share gain and, ultimately, more unit-volume growth. What’s critical here is to manage the cycle. Someone has to care about unit-volume growth. Someone cares that volume growth delivers cost benefits. Someone cares how those costs benefits are re-invested in the customer. And finally someone cares how these re-investments translate into share gain. This is the heartbeat of the business and all managers feel its pulse.

- They view SG&A as an investment in tomorrow’s growth but it also must come down: This means that when founders add all other costs (SG&A) they do it with deliberation and dread. Think about it: The founding team must keep that wheel turning by converting cash and re-investing it in the business. At the very least, that means re-investing in working capital, which must grow to fund the business. The decision to spend money on something else must be made at the highest level because it has an impact on how much cash the company generates from unit-volume growth today. The team recognizes immediately that it must spend some money on R&D and marketing. But it should only invest more in SG&A expenses if the team feels that building new capabilities will help tomorrow’s cash and unit-volume growth. SG&A is a capability currency. It is a major investment in the future of the business. But like all other costs, it has to come down on a per-unit basis over time. The team assumes that it must invest upfront and will be rewarded with the need to invest less on a per-unit basis later.

- Zero-based budgeting prevails always: Finally, the founding team zero-bases the budget as often as possible. All resources are discretionary; all can and should be redeployed against the highest and best good. The business model is fluid and therefore the talent and costs associated with maintaining it must be fluid as well. There is no democracy in resource allocation. There is no benchmarking to industry performance, because to gain share, the founding team must define its own set of economics.

As we explore in these blog posts how incumbents can revive their Founder’s Mentality, it is illustrative to see how differently they view (and manage) their P&Ls:

- Many incumbents no longer believe unit-volume growth is the heartbeat of the enterprise—it has become discretionary and the virtuous cycle has ground to a halt.

- Many of them no longer focus ruthlessly on continuous improvement in COGS.

- While these companies do sometimes cut costs, they don’t always commit to re-investing those gains on behalf of customers and share gain.

- SG&A is typically just a tax of doing business—a static percent of revenue that is not viewed as capability currency.

- There is no commitment to zero-basing budgets and the need to rethink on a constant basis where and how to deploy resources to best fight today’s battles in a turbulent environment.

The economics of mountaineering are the economics of efficiency, and the most efficient are those who reach the summit. As incumbents ponder why they’ve stalled out short of their full potential, they might take a hard look at whether they’re still focused on climbing.