Bain Alliance Ecosystem

Bain + CEPRES

Bain + CEPRES

A partnership that delivers unbeatable insights to private equity investors.

Bain Alliance Ecosystem

A partnership that delivers unbeatable insights to private equity investors.

It’s a powerful combination: Bain, the leading advisor to all private equity stakeholders, has teamed with CEPRES, the leading digital platform for investment analytics and data solutions for private capital markets. Together we provide general partners (GPs) and limited partners (LPs) with unparalleled access to analysis of deal-level returns and operating metrics.

The result: Our private equity clients will now have unrivaled insights to guide their strategies and investment decisions, enabling them to achieve entirely new levels of value.

Bain's Hugh MacArthur outlines the continuing trends in private equity and breaks down the landscape for investors over the past year.

A powerful, intuitive digital advisory product that gives private equity investors unprecedented insight into which deals have the most potential and where hidden opportunities exist to create value.

Learn more Contact Us

For the past decade Bain has published the industry’s most comprehensive report on private equity. CEPRES was the first organization to “look through” private market funds to underlying deal and asset performance on an individual basis. Our partnership will provide PE stakeholders with the best and most trusted insights available, detailing both “what happened” and “why it happened,” so they have the data, tools, context and insights they need to make investments that continue to outperform.

Bain's Nirad Jain explains how the firm leverages CEPRES data to help PE clients make smart investment choices.

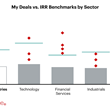

The latest update to the platform, Portfolio Diagnostics, lets private equity firms compare their deals against sector-specific benchmarks in one integrated view

Learn More

The last five years have been the best in the history of the private equity industry, but the same macroeconomic tailwinds that helped drive growth during this time also obscured the fact that many firms failed to achieve the margin goals they initially set out to achieve. As the industry moves into a new economic cycle, firms cannot rely on multiple expansion to deliver the returns investors demand. Those that have strong deal theses and plans for achieving value will emerge as the winners.

Deal data—truly credible, granular deal data—will change the way the private equity industry works.

Bain and CEPRES recently collaborated on important research into how funds fared during the last downturn, including how various factors affected deal outcomes, how timing before, during and after the crisis affects returns, and which sectors and subsectors held up well (or fared poorly).

Moving forward, Bain and CEPRES will expand their joint research efforts and also develop ground-breaking products that will provide the private equity industry with powerful new capabilities to improve investment performance.