Press release

SINGAPORE, August 1, 2024 - Southeast Asia is likely to outpace China in gross domestic product (GDP) and foreign direct investment (FDI) growth over the next decade, according to the ‘Navigating High Winds: Southeast Asia Outlook 2024 - 34’ report released today by the Angsana Council, Bain & Company, and DBS Bank.

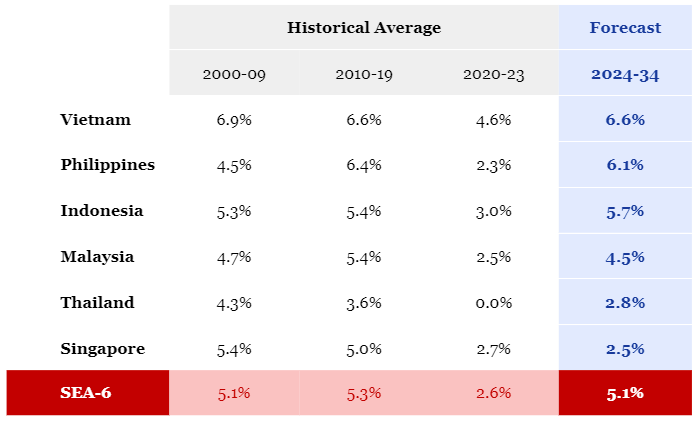

The GDP of the top six economies in Southeast Asia (SEA-6) is projected to grow at an annual rate of 5.1% on average with Vietnam and the Philippines driving the region's growth, each expected to exceed 6%, and Indonesia tailing close at 5.7%. For the first time in a decade, SEA-6 has attracted more FDIs than China. In 2023, SEA-6’s FDI amounted to $206B while China recorded $43B. Between 2018 and 2022, SEA-6 grew its FDI by 37%, compared to China’s 10%.

The report provides a 10-year growth forecast for SEA-6 economies by reviewing factors which impact labor, capital and productivity. It highlights historical economic performances of SEA-6 markets against traditional and contextual drivers of growth.

Southeast Asia to transition from resurgence to growth in next decade

Over the past 30 years, Southeast Asia’s GDP growth has been moderate, with Vietnam succeeding as the regional leader in most metrics. SEA-6 grew significantly slower than China or India. Between 1993 and 2003, real GDP growth in the SEA-6 countries averaged 3.8 times. In comparison, China experienced a much higher GDP growth of 11 times, while India saw a growth rate of 6.6 times.

One notable aspect is that most Southeast Asian countries saw their manufacturing value-added (MVA) as a share of GDP peak in the 2000s. The region then ‘prematurely de-industrialized’ as China became more competitive.

Yet, Southeast Asia has improved its fundamentals for a resurgence in growth. Southeast Asia’s domestic capital formation is increasing steadily, reflecting businesses’ confidence in most countries in the region. In the past decade, the region has strengthened its key sectors such as export-oriented manufacturing, semiconductor packaging, and attracted investments in growth sectors such as data centers. The rise of technology-enabled disruptors (TEDs) has introduced increased competition and innovation even in traditional sectors of the economy. Countries such as Malaysia, the Philippines, and Indonesia have refocused their strategies towards growth, while Vietnam has already raced ahead of the pack.

“As a result of strong domestic growth and the China +1 strategy, we are increasingly optimistic that Southeast Asia will outpace China's growth in both GDP and FDI in the next decade. However, multinational investments will be highly contested, with the competition between countries improving outcomes for both businesses and consumers,” said Charles Ormiston, Advisory Partner at Bain & Company and Chair of Angsana Council.

“The world has turned increasingly protectionist and inward-looking in recent years, a trend unlikely to change. Yet, most Southeast Asian economies and companies are well placed to find opportunities as capital allocation is recalibrated across geographies and sectors, while dealing with tech disruption and climate change. We think the doomsayers are wrong; a decade of tailwind awaits the region,” said Taimur Baig, Managing Director and Chief Economist at DBS Bank.

SEA-6 is expected to grow by 5.1% on average annually over the next decade

Despite a slowdown in growth in Vietnam, it is still expected to lead the region growing at 6.6% GDP growth on average over the next decade. Vietnam’s export-oriented economy is well-positioned to capture “China + 1” opportunities. Its domestic ecosystem promotes healthy inter-provincial competition and cultivates a strong workforce. This combination sets Vietnam up well to attract diverse investment sources, while developing its economy.

The Philippines, expected to grow at 6.1%, benefits from a pro-growth administration that is prioritizing infrastructure investments, particularly with renewable energy projects garnering investor interest. It can also reap demographic dividends, unlike Singapore and Thailand which will face challenges in this area.

Indonesia is expected to grow at 5.7%, but it has strong potential to exceed this forecast given the availability of resources, a growing population and workforce, and a thriving ecosystem of entrepreneurship and innovation. It needs to improve its MVA, going beyond commodities, and embrace keeping the economy open and competitive.

Likewise, Malaysia, which is expected to grow at 4.5%, shows signs of doing well with recent efforts to attract FDI, leveraging its past successes in growth sectors such as semiconductors. It could also be the main beneficiary of flow through of opportunities from Singapore, particularly reflected in the sharp uptick in data center investments. Malaysia’s data center capacity has the potential to more than double the capacity of Singapore, which hitherto has been the leader in the region.

Five opportunities to accelerate growth in SEA-6

Looking ahead, to accelerate growth, SEA-6 needs to adopt strategies to redirect resources, make bold policy changes and take risks in five key areas. The report highlights five new growth opportunities for SEA-6 to raise growth beyond the expected forecasts. These include investing in emerging growth sectors, fostering TEDs, strengthening capital markets and expanding investments, accelerating green transition and embracing multilateral initiatives.

- Invest in emerging growth sectors

As an export-oriented region, SEA-6 has the infrastructure, relationships with multinational corporations, and government support necessary to further develop emerging, high-growth sectors. The region can gain a competitive edge by prioritizing next-generation sectors that fit with established clusters, workforce capabilities, and resources.

Thailand has consistently led the region in EV manufacturing FDI commitments by leveraging its existing automobile manufacturing base for four-wheelers, except in 2022 where Indonesia attracted more investments than Thailand. Indonesia, on the other hand, commands over 90% of EV battery manufacturing FDI (committed between 2019-2023), largely as a result of the nation’s efforts to integrate its nickel supply with downstream operations.

As global players actively diversify their semiconductor supply chains, SEA-6 has the opportunity to capture investment inflows provided the region continues to enhance its capabilities. Malaysia is currently leading the region in packaging and testing, attracting over 61% of FDI committed since 2019. It would do well to upgrade into more value-added parts of the supply chain, as other countries compete in less technologically and more labor intensive parts of the semiconductor supply chain.

-

Foster TEDs

As Southeast Asia often protected its domestic services, the region’s services productivity and innovation historically lagged large domestic markets, such as the US, India, and China (even if they also offered some protection against foreign participation).

Encouragingly, the advent of TEDs has sparked investment, innovation, and productivity growth in the services sector, driving higher growth rates overall. The total value of private tech investment deals in SEA-6 surpassed that of India in 2022, with Singapore and Indonesia witnessing the largest deal flows. The region also experienced a 170% increase in the number of unicorns from 2017 to 2022.

“Technology transformed the US, and then China, and accounts for much of the resilience in their economies. It has also brought about deep challenges, including disruptive social networks and wasteful business practices. Southeast Asia is at an inflection point. We have the opportunity to think about leveraging tech meaningfully--to be using tech to drive more innovation in our private sector, to ensure our communities benefit from tech, and to draw more investments and capital formation to increase our living standards. It’s up to us to learn from the lessons from others and be proactive in leveraging technology.” said Peng T. Ong, Trustee of the Angsana Council and Co-Founder and Managing Partner of Monk’s Hill Ventures.

-

Strengthen capital markets and expand investments

The report notes that it is vital for economies to develop a diverse range of financial markets, products, and participants to grow. Singapore, Malaysia and Thailand lead in this for different reasons, and in general, fare better than China and India.

Southeast Asia must develop its banking, insurance, private equity, hedge funds, venture capital, and microlending sectors to attract investment and ensure efficient capital allocation. Increasing household participation in financial markets is essential for utilizing domestic capital effectively and achieving significant multiplier benefits. Indonesia has led in this area, with liberal banking regulations and fintech innovations improving access to financial services, especially in rural areas. As the region's capital markets develop, safeguards against corruption, fraud, and overspeculation are crucial.

-

Accelerate green transition

SEA-6 is well-positioned to produce low-cost energy due to its abundance of natural resources such as having over 30,000 GW of total solar power potential and substantial offshore wind potential in The Philippines and Vietnam. It should aggressively pursue green transition to further meet its climate goals and increase renewable green energy availability and revenue pools through the pursuit of new growth emerging green sectors. The Philippines and Vietnam have substantial offshore wind potential, and the region has vast untapped solar and hydropower availability. With improved grid infrastructure, government support, and financial incentives, Southeast Asia could deliver climate, economic, and energy security benefits regionally and abroad. Government policies play a crucial role in moving the needle on this, particularly by earmarking investments in grid infrastructure.

-

Embrace multilateral initiatives

Given its institutional set-up and diversity, SEA-6 cannot be approached as one market. Despite this, there are multilateral initiatives that can be meaningful for the region’s collective growth. SEA-6 needs to pursue economic integration to ensure free movement of people, capital and goods, harmonize the digital landscape to boost cross-border trade and innovation and drive green transition to ensure economic growth and resilience.

For more information or to arrange an interview, please reach out to:

Ann Lee - ann.lee@bain.com

Yan Xin Tay - yan-xin.tay@bain.com

About Bain & Company

Bain & Company is a global consultancy that helps the world’s most ambitious change makers define the future.

Across 65 cities in 40 countries, we work alongside our clients as one team with a shared ambition to achieve extraordinary results, outperform the competition, and redefine industries. We complement our tailored, integrated expertise with a vibrant ecosystem of digital innovators to deliver better, faster, and more enduring outcomes. Our 10-year commitment to invest more than $1 billion in pro bono services brings our talent, expertise, and insight to organizations tackling today’s urgent challenges in education, racial equity, social justice, economic development, and the environment. We earned a platinum rating from EcoVadis, the leading platform for environmental, social, and ethical performance ratings for global supply chains, putting us in the top 1% of all companies. Since our founding in 1973, we have measured our success by the success of our clients, and we proudly maintain the highest level of client advocacy in the industry.