Founder's Mentality Blog

In his new book, Zero to One: Notes on Startups, or How to Build the Future, PayPal Cofounder Peter Thiel argues aggressively that the goal of any new start-up should be to build a “creative monopoly.” By that he means entrepreneurs should aim to create a new market and be the only competitor in it (think Google in search advertising). There’s no point in becoming yet another competitor in a crowded market (think most airlines).

Thiel powerfully advocates for the role of creators in business―those companies that create what he calls “entirely new categories of abundance” (see this Wall Street Journal adaptation). He contrasts creators with undifferentiated competitors that fight endlessly (and earn little to nothing) to win a piece of a static industry. In our language, Thiel is arguing for the power of insurgents over incumbents, where the insurgent’s world is about creating new markets and the incumbent’s is too often about dividing up existing markets. He writes:

“So why are economists obsessed with competition as an ideal state? It is a relic of history. Economists copied their mathematics from the work of 19th-century physicists: They see individuals and businesses as interchangeable atoms, not as unique creators. Their theories describe an equilibrium state of perfect competition because that is what’s easy to model, not because it represents the best of business. But the long-run equilibrium predicted by 19th-century physics was a state in which all energy is evenly distributed and everything comes to rest—also known as the heat death of the universe. Whatever your views on thermodynamics, it is a powerful metaphor. In business, equilibrium means stasis, and stasis means death. If your industry is in a competitive equilibrium, the death of your business won’t matter to the world; some other undifferentiated competitor will always be ready to take your place.”

For incumbents, of course, this is a bleak vision. It assumes they are destined to fight tooth and nail for a smaller and smaller piece of a dying ecosystem. When they ask (as they always must), “Where should I put the next dollar of investment―in my core, fighting for leadership or in a new market?” it would seem the only rational answer would be to milk the old market to invest in a new one.

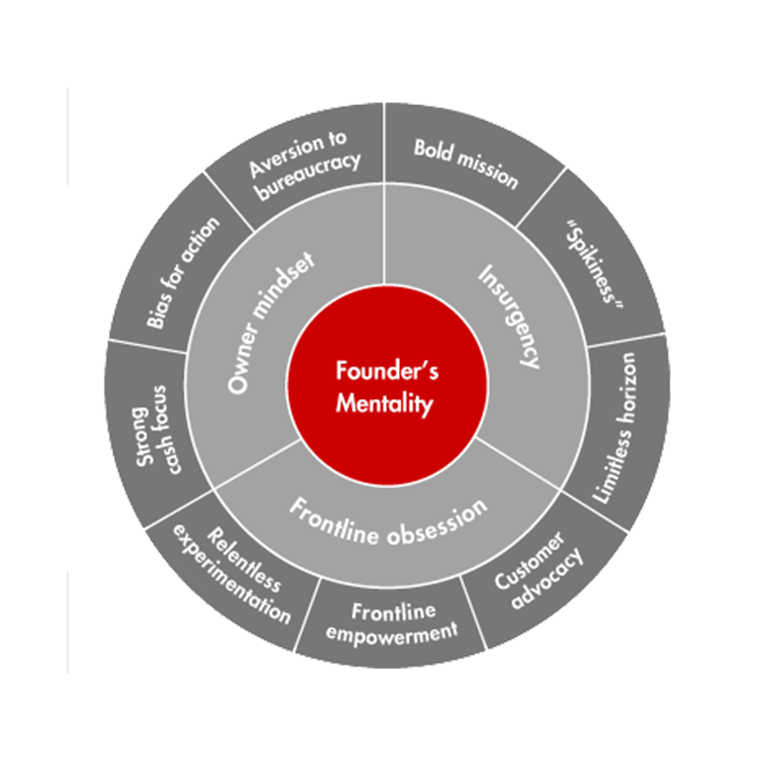

About the Founder's Mentality

The three elements of the Founder's Mentality help companies sustain performance while avoiding the inevitable crises of growth.

In our book Profit from the Core, however, we frame the challenge for incumbents differently. The data shows rather convincingly that most large companies would be well advised to focus on driving their core businesses to market leadership before trying to chase the next new market. But what’s crucial is this: Unless these incumbents learn to adapt by pursuing true innovation in their core businesses, they will, indeed, face commoditization of their offerings. Absent innovation, they can only purchase share gain with lower prices and margins, which means they will ultimately enter into a downward spiral toward profitless prosperity.

This is a lesson too many incumbents forget. It is also one the best insurgents exploit when they successfully disrupt static industries with innovative solutions. While there are some extraordinary stories of incumbents creating bold new markets―Thiel, in fact, mentions Hewlett-Packard’s innovation track record in the 1990s―we know from the long list of fallen incumbents, like Kodak, Blockbuster, HMV, BlackBerry, Barnes & Noble and Nokia, that big, established companies too often lose the innovation (or industry disruption) game.

The real question is, why? Given their market power and resources, incumbents should be consistent market makers. Their experience should afford them more consumer insight, more shopper insight, more channel insight, more assets, better balance sheets, higher levels of expertise, more and better talent, great systems and so on. If you think about it, they should be able to run circles around the start-ups.

What gets in the way, of course, is that many large companies develop an incumbent mindset. We’ve shouted it from the rooftops―the bigger a company gets, the smaller it thinks (see here and here)―and Thiel really brings this alive in his book. Start-ups see the whole world as their market. They are insurgents at war against industries, and they are determined to work across market boundaries. Too many incumbents are narrow cast―they are precise in defining the industries in which they compete and try to dictate the rules of the game in each market. Insurgents are out in the field doing battles. Incumbents hunker down behind the castle walls, trying to defend what they’ve got. Insurgents think in ones and twos, so stopping one activity and starting the next is relatively simple (albeit not painless as Steve Blank and Ben Horowitz continually point out). Incumbents think in millions of units, so starting and stopping activities involves moving around lots of heavy machinery.

Most important, insurgents are on a nobler mission to create something new and bold, to disrupt industries on behalf of underserved customers. Incumbents are those industries and, at their very worst, they see their jobs as fighting the future and protecting the status quo for as long as they can. The incumbent mindset turns the focus or the innovate question into an “or” issue: Do we focus on our core, or do we innovate? Until they recognize that innovating to renew the core itself is the central challenge, incumbents are doomed to stasis―and, as Thiel argues, stasis means death.

It is important to note that Thiel’s perspective derives from the worlds of venture capital and start-ups, and that colors his view of big companies. But he offers two crucial ideas that I think are profoundly relevant to incumbents: He urges companies to restore their faith in intelligent design and in undiscovered secrets.

Thiel contends that you can’t adapt and iterate your way to a transformational outcome. Great businesses, he says, don’t arrive at the top of a Darwinian process of endless, mindless adaptation. They are the product of intelligent design, meaning they start with a big, transformational idea and then go for it. He makes an extraordinary case for this with start-ups, but is it true for incumbents? We think it is half true.

Incumbents, of course, should not be mindless and must operate with intelligent design. But some of the most extraordinary new areas of growth for incumbents come after years of incremental adaptation around the core. The path isn’t always known perfectly at the outset, but emerges over time after two or three generations of adjacent moves. When Disney produced The Lion King, it did not set out to transform musical theater with the No. 1 play of all time. The transformation was the result of multiple moves to exploit the company’s animated characters across multiple platforms.

But this doesn’t take away from Thiel’s insight here. Incumbents must also set out to be future makers by devoting a meaningful slice of their time and resources to pure innovation. At least in theory, who would bet against an incumbent that can combine its substantial assets and scale with a start-up’s mindset? Like Google’s Larry Page, we call this blend of adaptation and innovation a 70-20-10 strategy and we will explore it deeply in upcoming blog posts. We will also examine why, in practice, incumbents are often so bad at leading industry disruption.

Thiel’s idea about secrets is more subtle―he contends most incumbents simply won’t devote the time and space needed to create new markets since they tend to believe that most secrets about serving customers have already been revealed. The market makers still believe in secrets. They still believe there are radically new ways to solve human problems. They have faith in lands and seas undiscovered. The insurgent mindset is the mindset of the explorer. The incumbent mindset at its worst is a commuter.

As we’ve said, there is no fundamental reason why incumbents can’t be market makers. IBM successfully transitioned from hardware to consulting services. De Beers created a new retail venture with outside partners. Some banking incumbents are winning in the digital space. Any strong, healthy incumbent has the potential to be a bold innovator. The challenge is learning how to get out of its own way and recapturing the explorer’s spirit at the heart of the Founder’s Mentality®.

Profit from the Core

Learn more about how companies can return to growth in turbulent times.