Brief

Резюме

- As global turbulence continues, the risk of recession is rising.

- B2B companies that anticipate how to seize opportunities unique to times of increased turbulence are more likely to capture outsize gains leading up to, during, and after a recession.

- For CEOs, general managers, business unit heads, and their sales leaders, this time is different, as digital tools have dramatically changed the sales management landscape since the last downturn.

- Such tools help companies know which deals to walk away from, and how best to amplify low-cost channels, detect and reinforce effective behaviors, and raise the game in pricing.

Record inflation, supply chain shocks, volatile energy prices, and rising interest rates have raised the risk of recession in most countries. With growth and profits squeezed at many business-to-business companies, executives are thinking hard about how to sell more effectively and efficiently.

And while executives might have been through a prior recession drill, the sales management landscape has changed dramatically since the last downturn. Add the fact that these macro issues did not exist simultaneously during previous recessionary periods, and a better response playbook becomes essential.

Indeed, recessions catch many companies by surprise, forcing draconian measures just to survive. In the 2001 recession, total sales for the S&P 500 declined by 9% from its prerecession peak to its trough 18 months later—almost a year after the recession officially ended.

These periods also present unique opportunities for well-prepared companies to take advantage of the turmoil and gain share. Companies that take an aggressive approach to seizing opportunities unique to recessions are more likely to capture outsize gains leading up to, during, and in the years following a recession. Prior to the past recession, both eventual winners and eventual losers in a group of 3,500 companies worldwide experienced double-digit growth rates. Once the recession struck, performance began to diverge sharply—the winners continued to grow while losers stalled out. The performance gap widened during the recovery (see Figure 1).

Most sales organizations do not seem to be prepared for a recession. A Bain survey of sales operations executives, in partnership with Research Now SSI, found that only 43% of sales organizations develop plans for a recession well in advance of it. Advance planning helps companies cut costs and gain market share. Some 86% of companies that create a plan well in advance focus on using the downturn to gain market share, compared with only 50% of companies that create their plan shortly after the recession hits.

Digital planning tools and analytic techniques that have flourished in recent years open new go-to-market approaches for companies to thrive in a downturn—as long as companies stay true to three time-tested principles.

The first is to align resources with market opportunity. Sales capacity tends to get rusted in place, and when markets move quickly, the return on cost of sales inevitably starts to flatten. So commercial executives must align their sales capacity with the growth opportunities in the market. Second, sales leaders must sweat the details of daily execution. No digital tool can compensate for a lack of discipline at the front line. Small behaviors—from trimming administrative tasks in order to spend time with customers, to streamlining the number of people who attend a sales pitch, to putting controls around discounting in order to limit price leakage and earn that last dollar of price—add up to big results.

The third principle involves getting the back of the house in order. A lean, nimble commercial operations group keeps the trains running on time, feeds insightful data and analytics to the front line, and supports fast decision making by sales management.

If a company heeds these three principles, it has a solid foundation on which to survive through a recession. To go a step further and use the recession as an opportunity to improve one’s competitive position, companies need additional preparation. Specifically, they can tap digital tools to accelerate their sales execution, in the ways we describe below.

Zero-base sales capacity. It seems obvious that sales representatives should serve the most promising accounts and territories. Yet too many sales teams use outdated practices in making account and territory assignments. They rely on broad-brush research reports to calculate overall market size, or backward-looking sales data and a “thumbnail” to determine how many reps they need and where to assign them. A Bain survey of 870 B2B executives worldwide shows the extent of the challenge. Fewer than 20% of respondents said they have a data-driven, quantified understanding of the total market opportunity and untapped customer potential. Even fewer regularly zero-base required sales capacity and coverage for this market opportunity.

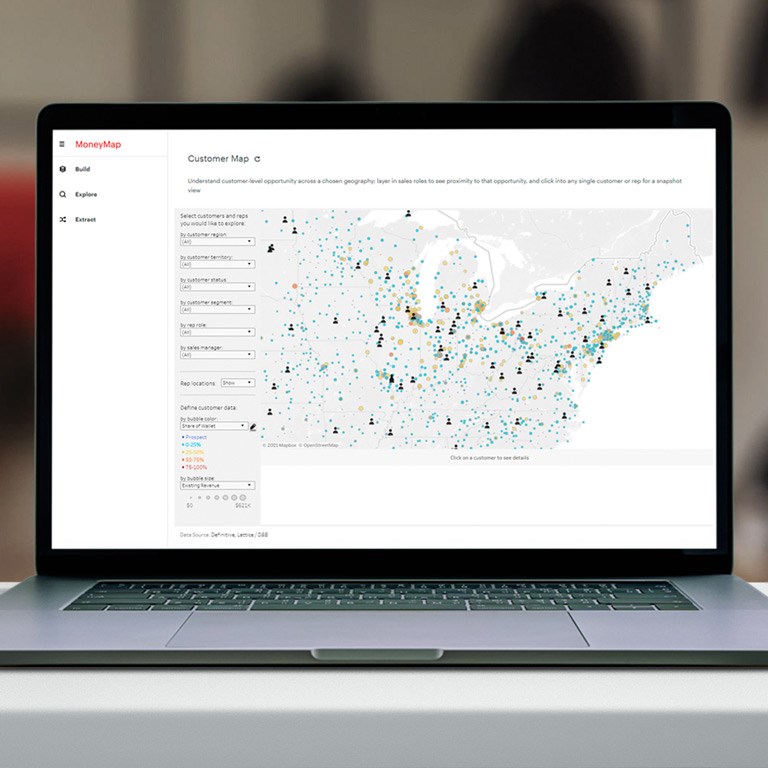

MoneyMap℠

To win in today’s market you need a clear view of where the opportunity lies. MoneyMap, part of our Coro℠ suite of digital solutions, offers the comprehensive, granular visibility you need to up-sell, cross-sell and capture new business across complex customer segments.

Digital tools can help make more accurate matches. Case in point: Vertiv, a provider of digital critical infrastructure to data center and communications networks companies, has built an opportunity calculator using a heuristic model powered by a few salient data points such as the number of racks a facility can hold. The calculator quantifies the wallet size for three main product lines within each of the top 100 accounts, and estimates the total available market for smaller accounts in each territory. With this new process, Vertiv was able to expand its understanding of the potential market of its top five customers by one-half (see Figure 2).

With the market opportunity defined, sales executives can better focus their resources. High-performing sales groups zero-base their sales capacity and coverage plan every year. They take a blank-sheet approach to resource planning, examining all expenses for each new period, not just incremental expenditures in obvious areas. One industrial company, for instance, makes account assignments in a cloud-based sales planning platform. This allows them to regularly refresh the market opportunity, reallocate coverage, and generate quotas. Having a dynamic model helps keep sales capacity synced with market opportunity.

Know when to walk away. Many sales teams lose track of which accounts consume most of their time and how they spend the time they do have with customers. Worse, most don’t have a quantified view of profitability by customer, product line, and transaction. Few accounting systems can easily report profitability that way.

ProfitCube℠

As critical as profitability is, it’s often difficult to understand exactly where profits come from. ProfitCube helps you both analyze your profitability and take actions to improve it.

To counter this problem, one cloud services provider went through a data-intensive effort to quantify transaction-level probability and concluded that, no matter how it cut the data, deals under $2,000 were unprofitable. At the same time, the company found many undercovered accounts. This analysis gave executives the fortitude to prohibit the smaller deals, and with the sales team focused on closing larger deals, the company hit its sales plan one quarter later, after several quarters of misses.

Amplify low-cost sales channels. In other situations, rather than walking away from revenue, some companies can devise a channel that can close small deals profitably. It’s a myth that a field sales rep needs to touch the customer in order to make a sale. To the contrary, inside sales has become a viable way to serve complex products with long sales cycles (see Figure 3).

Consider the case of an online advertising and software company serving car dealers. After a series of acquisitions, the company’s sales force was underperforming. In particular, selling to and servicing smaller dealers became so costly that it led to low or negative margins for those customers, and consumed too much sales rep time. For smaller dealers, the company shifted to an inside sales center that not only reduced costs but also improved the dealer experience by increasing the attention paid to a typically underserved segment. Sales reps, meanwhile, were freed up to spend more time on larger project sales. As a result, the company increased its new customer acquisition threefold over the prior year and reduced its customer attrition by a healthy margin.

A shift to inside sales usually requires better digital marketing capabilities, which B2B organizations have been slower to develop than B2C companies. New data sources and predictive analytics software can help them identify target accounts and allocate marketing and sales initiatives in real time. For example, an IT services company uses Lattice Engines, which crunches data such as signs of new technology adoption, web search activity or a social media presence, to predict customers who are ready to buy based on similarities to the company’s current high-value customers. Another tool, DiscoverOrg, offers organizational data that might indicate intent to purchase, such as job postings for a vice president of network. After deploying these tools, the IT services company’s sales team doubled its rate of scheduling a first meeting with a prospective customer.

Detect and reinforce effective behaviors. For companies with hundreds or thousands of frontline sales reps, executives traditionally fielded surveys and time-and-motion studies to understand what separates top performers from the rest. Increasingly, though, firms have turned to analytics engines, which mine online calendars and email traffic; these engines help identify exactly which behaviors correlate with top sales performance. Those behaviors can serve as the basis of training, reinforced daily by frontline managers.

A B2B technology supplier used Microsoft Workplace Analytics and other digital sources to track the behaviors of its sales rep. The data highlighted that top performers were three times as likely to interact with multiple groups inside the company, twice as likely to collaborate with peer reps, and 50% more likely to have weekly pipeline reviews with direct managers. The high-performing reps prepared more for meetings and sought out coaching. Training on such behaviors, consistently reinforced by managers, can lift the productivity of lower performers.

Automate account management. The highest-performing sales teams have a strong discipline of account management. Our Commercial Excellence X-ray benchmark database finds that these top performers are 2.2 times as likely as the lowest performers to have a high-caliber account management capability. Strong account managers keep an up-to-date view of the opportunity, share of wallet, map of decision makers and influencers, pipeline, and actions needed in each named account. Software applications such as Revegy, Altify, and ForecastEra automate this process and plug into a firm’s native customer relationship management platform, turning a tactical opportunity-tracking tool into a powerful strategic planning tool.

Analytics can be used to support retention and cross-selling efforts. An industrial equipment distribution company uses artificial intelligence (AI) powered by Lattice Engines to identify the right products to cross-sell to customers. In their pilot, sales reps with the AI recommendations achieved 3% to 4% higher sales than those without. Since adoption, the distributor has seen revenue increase for all of their reps.

Streamline and digitize the back office. A commercial operations group tends to be an early target for cuts in a recession. It pays to get ahead of cost pressures here by digitizing and automating large portions of the work, which reduces the need for employees to pull reports and manually reconcile numbers. To pay for digital initiatives, one can use traditional tactics including offshoring and process redesign. The best commercial operations groups use employees to execute analytics that produce valuable insights, such as mining the installed customer base for cross-selling opportunities.

Another digital opportunity involves the bid desk, or “configure, price, quote” process. For instance, one telecom company uses an iPad application to support executives’ review of deals. The app pulls in the level of risk, commercial viability, and strategic opportunity for deals of similar size, plus margin and expected win rate, making it easy to access the information in one place. Combining such factors into an integrated digital system unlocks back-office and frontline selling time.

Raise the game in pricing. Pricing is an opportunity for almost all B2B companies. Bain’s survey of sales and marketing leaders at more than 1,700 companies found that 85% of companies believe that their pricing decisions could be improved, and only 15% believe they have the right tools and dashboards to monitor and address their gaps. Even high performers on pricing see opportunities to unlock additional value through several distinct digital approaches:

- Dynamic deal scoring. By mining past transactions, current customer segmentation and preference data, win rates, and competitive pricing data, you can create statistical pricing guidance tailored to each deal.

- Market conditional algorithmic pricing. External market, customer, and macro data on areas such as supply and demand, imports and exports, or weather can help you derive the optimal price for a moment in time.

- Iterative machine learning. A/B testing in fast cycles allows you to learn the optimal prices at a SKU level, in order to achieve goals around margin and volume.

As price increases from multiple suppliers eat into B2B customers’ budgets, we expect customers to push back harder. So besides digital tools, companies should consider a set of bold but tailored pricing moves:

- Exchange price for other valuable features. Prepare for customers resisting a straight increase, by offering other benefits. These range from volume guarantees to bundled products or adjusted service levels.

- Enforce what’s already in the contract. Many companies put price increase contingencies in their contracts but don’t regularly enforce them and may not even be aware of them now. Check the contract terms for each customer, estimate the value of enforcing them, and equip employees with the relevant data and scripts to have a difficult conversation with confidence.

- Consider indirect increases. B2B companies can pass on surcharges for fuel, expedited shipping, inventory holding, and longer payment terms. Customer behaviors that cause profits to leak away from the list price—such as rush orders and small orders—should be tightened up.

- Adjust the product mix. During a period of inflation and supply shocks, what a company makes can be even more important than who it sells to. It’s critical to have a current SKU-level view of profitability, not just a customer-level view. Just as firing bad customers makes sense, so does dropping some marginally profitable products.

Companies with a direct salesforce face an additional challenge. Most sales reps will avoid uncomfortable pricing conversations with customers if they can. They will need clear data, tools, and scripts to use with their accounts, as well as account-specific targets, incentives consistent with the new strategy, and interim coaching for those who go off track. Sales reps should feel supported in doing the right thing for the business.

Start small, fail fast

The breadth of the approaches and tools discussed here can be both exciting and overwhelming. Sales executives may ask: Where should I start? Which ones will give me the biggest lift? Which can my teams most easily absorb?

We have seen commercial organizations successfully work through these questions with small teams that test and learn as they go. Many use Agile principles, setting up sprints to produce real business results, not just an improved process. Their only measures of success are incremental sales and profit margins.

The best initiatives start with a small group, which allows the team to quickly work out kinks in the process and try things that might not work, because the consequence of failure is small. Small successes can be scaled up quickly. One media company wanted to shift from a totally outside sales model to one with a more balanced mix of inside sales resources, but area managers were skeptical and feared channel conflict. So the firm started with one state, Florida, and within a few months was delivering much better results. Based on that success, the rest of the sales organization clamored to make the same move; six months later, the whole US sales organization had converted.

At a minimum, every sales organization should have a recession plan ready to go, spelling out which roles and activities have the weakest link to customer results and the lowest return on investment, as the areas to cut first. Savings could be diverted to areas with the highest ROI. The plan should also identify where key competitors will likely be vulnerable to a bid to take market share. Armed with the right digital tools, sales teams might almost look forward to a recession rather than fear it.