Report

At a Glance

- Financial services embedded into e-commerce and other software platforms accounted for $2.6 trillion, or nearly 5%, of total US financial transactions in 2021, and by 2026 will exceed $7 trillion, our research finds.

- Payments and lending will continue to be the largest embedded financial services but will be bolstered by the growth of adjacent value-added services, including insurance, tax, and accounting.

- Demand will grow because the “better together” proposition promises to improve customer experiences and financial access, along with providing cost reductions and risk benefits to companies.

- Incumbent financial institutions face the threats of shifting economics and adverse selection with this new value chain, but they can also realize tremendous growth if they identify where to play across specific vertical segments.

A completely new proposition for financial services customers

The rise of embedded finance marks a new era, not only for banking transactions but also for how consumers and businesses build and manage relationships with financial services more broadly.

In 2019, we wrote about the burgeoning movement of fintech from a business model unto itself to a key ingredient in the software platform stack—the “fourth platform.” Since then, the transition has been swift and unrelenting. Several platform archetypes have emerged, including e-commerce (such as Shopify), food delivery services and rideshare apps (Uber, DoorDash), and wellness (Mindbody). These offerings are supported by an army of well-funded fintech enablers, which help platforms deliver products and services. End users increasingly prefer the convenience of using payments, lending, insurance, and other financial services embedded in their day-to-day software, rather than accessing standalone services from traditional financial institutions.

Written in collaboration with

Written in collaboration with

Yet despite the rapid growth of embedded financial services, there has not been much quantitative exploration of the industry’s dynamics. To that end, we set out to quantify the size, growth profile, and economics of the key offerings powering the rise of embedded finance, focusing on the US market. Consisting of over 50 interviews with industry practitioners, market experts, and analysts, as well as a synthesis of published data, this research also draws on our collective experience working with software platforms, enabling firms, and license and regulatory services providers.

We found that embedded finance already accounted for $2.6 trillion, or nearly 5% of total US financial transactions, in 2021, and by 2026 it will exceed $7 trillion, or over 10% of total US transaction value. Demand will grow because the proposition promises to improve customer experiences and financial access, along with providing cost-reduction and risk-reduction benefits to companies throughout the value chain.

What it Takes to Prosper in the New Value Chain?

Listen to Episode 3 of Deciphered as Bain’s Adam Davis and guests Matt Harris and Sophie Guibaud dive deeper into how big the opportunity for embedded finance could get, some of the pertinent use cases, and how wannabe players in the new value chain can start thinking about how to build necessary capabilities to serve customers.

These developments herald a transformative financial moment. Embedded finance enables customers to have a new type of relationship with financial providers, giving them access to services as a by-product of the software they use and the goods they consume. While some companies will hesitate and possibly miss out on the opportunities, others will take the lead and figure out how to reap the benefits. This report explores these benefits and how firms can capture them.

The research results in brief

In 2021, US consumers and businesses poured $2.6 trillion in transactions through embedded financial services. When consumers tap “confirm” on a rideshare app, they are usually too busy scanning the road ahead to consider the technical acrobatics occurring in the blink of an eye. When they click “pay now” in their online shopping cart, they rarely appreciate the feats of engineering happening in the background.

Though the domain of embedded finance expands by the day and draws in more financial offerings, we focus here on the key segments of embedded payments, lending, banking, and cards within the US. These segments lead other products in terms of digital maturity, revenue generation, and use cases currently served.

Our research reveals several insights:

- Embedded finance can provide a much better value proposition. Customers benefit from contextual, seamless experiences; platforms can unlock new use cases and often use proprietary customer data to improve financial access, while reducing costs for their end customers.

- The new value chain favors platforms. The traditional, bank-driven value chain shifts to a new ecosystem that typically requires four main participants: the end customer, platforms that own the customer relationship, software enablers that help meet complex regulatory and technological requirements, and a regulatory services or license provider. Firms can take on multiple roles and models.

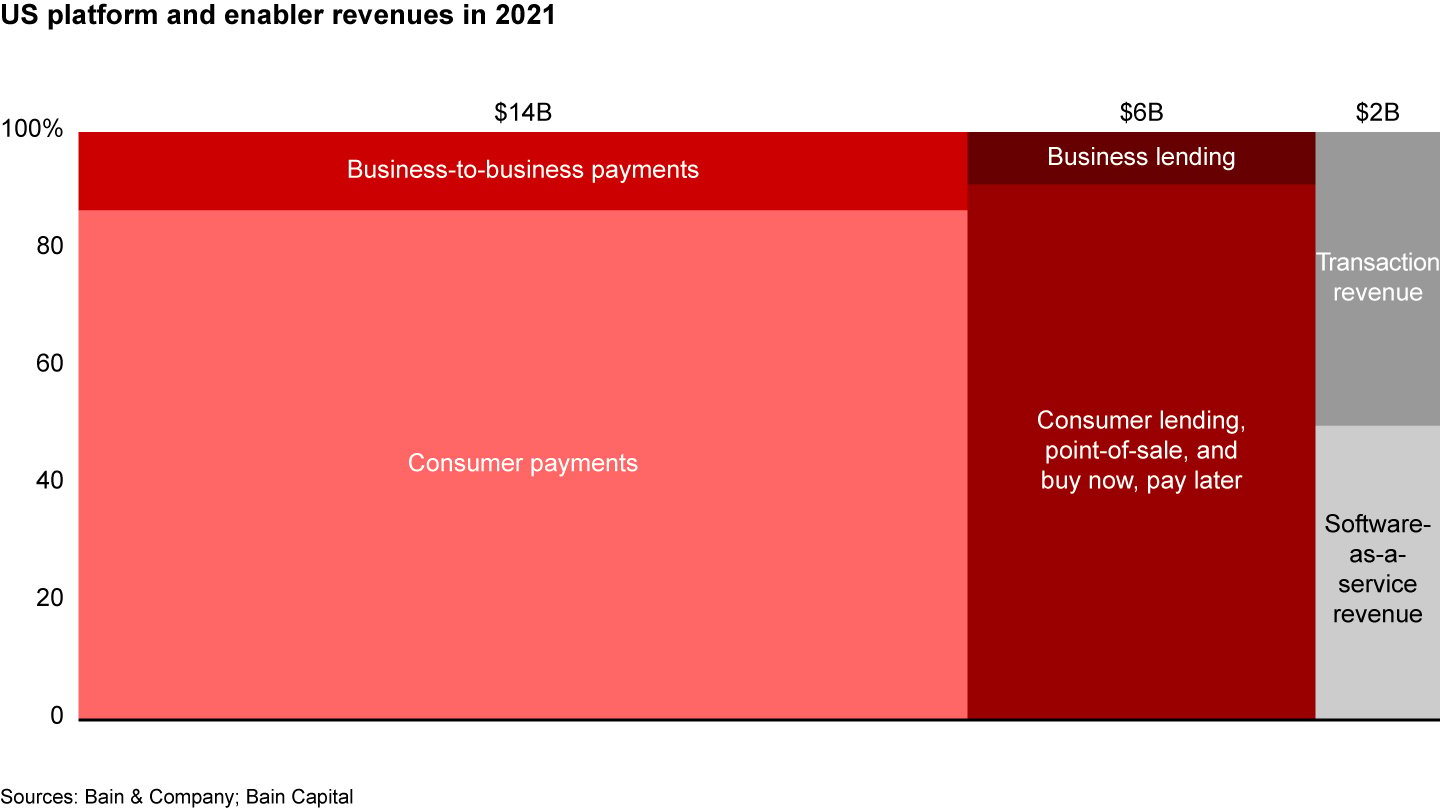

- The market is large and growing. We estimate the 2021 US market for platforms and enablers at $22 billion in total revenue across payments, lending, banking, and cards. We expect this market to more than double to $51 billion by 2026. The transaction value of embedded finance also will surge from $2.6 trillion to $7 trillion in 2026.

- Different sectors and services are developing at different rates. Adoption curves vary, with retail and e-commerce platforms serving as the major use cases for embedded finance solutions today. While payments and lending will continue to be the largest segments of embedded finance, we expect to see growth in insurance, tax, accounting, and other services.

- Traditional financial services have reached an inflection point. Traditional institutions face the threats of shifting economics and adverse selection with this new value chain. Yet they can also tap tremendous growth potential, especially if they identify where to play across specific vertical segments. Investing in the right capabilities will ultimately lead to opportunities to serve the new value chain in multiple ways.

We expect the projections in this report to persist despite the current macroeconomic volatility and near-term recession risk. Our projections cover a five-year horizon that looks beyond short-term economic turmoil, including a recession that would chiefly affect the prospects for embedded payments over the next 18 months. We would expect accelerated growth coming out of any future recession, resulting in broadly the same outcomes over a five-year horizon. While all market projections come with risks, our forecasts reflect a sensible central projection of the growth trends in this market.

What is embedded finance?

Embedded finance began as technology to merge software and commerce business models. Today, the use cases continue to expand, from Shopify's embedded banking offering, Shopify Balance, to a myriad of buy now, pay later (BNPL) options at online checkout.

For this report, we define embedded finance as a nonfinancial software platform providing an adjacent financial service, for which it takes some degree of economic ownership. This allows the platform’s customers to take advantage of a value-added offering within the native customer journey.

Most of these services have a financial core, such as banking, payments, lending, or insurance. Other categories have recently emerged, including compliance (tax, accounting), human capital management (payroll, benefits), and procurement within marketplaces. Embedded offerings can be built through a continuum of integration patterns—from a deep reliance on enabling partners for infrastructure and domain expertise (known as the “thin stack”) to being entirely insourced and owned by the platform directly (the “full stack”)—depending on the platform’s capabilities and desired risk/reward profile (see Figure 1).

The new value chain

Four types of participants contribute to embedded finance: the end customer, a platform, a software and data enabler, and a regulated entity. The companies involved have carved out specific propositions, with different ways of interacting (see Figure 2).

We excluded the following offerings from our research, as they do not meet at least one element of our definition:

- Fintechs and digital banks with new features or products. The platform is a financial institution at its core.

- Cobranded credit cards. The offering is not embedded into the native digital customer journey.

- Closed-loop digital cards or in-store loyalty spending programs. Digitally stored value and loyalty offerings, such as those provided through the Starbucks app, are an edge case; views may differ on whether this meets our definition or not. We have omitted the offering because it is a digitally native, closed-loop prepayment rather than a contextually embedded service with shared economics.

Software plus payments: Better together

The success of embedded finance lies in is its ability to deliver a superior value proposition. Customers prefer the bundle, due to a combination of three factors:

- Enhanced customer experience. An entrepreneur creating an online store using Shopify, for example, is provided with payments processing as a matter of course. She has a better experience through streamlined onboarding, unified dashboards and tools, and one fewer vendor to manage.

- Cost savings. Platforms often cross-subsidize their offerings, reducing costs for customers. Toast, which provides point-of-sale software and hardware, uses its payments revenue to subsidize its hardware, lowering overall costs for restaurant owners.

- Access and risk. Platforms use a vast well of customer insights to assess risk. This triggers better financial accessibility for customers who might be ignored, rejected, or mispriced by traditional institutions that have fewer contextual data points.

Platforms are partnering across the new value chain to deliver these benefits to customers and differentiate their core services. In turn, this increases their ability to spur sales in their core business. For example, embedding payments into the native invoicing workflow improves accounting or business management software for the merchant, significantly reducing time spent reconciling payments and invoices.

Embedding financial services helps platforms drive superior economics, increasing customer lifetime value. With minimal incremental customer acquisition costs, platforms can raise average revenues per user, while keeping customers longer. The service gets more entrenched in customers’ respective business processes and adopted by the end users. This creates a virtuous cycle where the “better together” value proposition accelerates customer acquisition, while the additional revenue can be reinvested in the business to spur further growth.

A $51 billion market opportunity

Our sizing focuses on the largest embedded finance markets today, namely payments, lending, and banking, as well as the subcategories within them. We expect the US market to more than double from $22 billion in 2021 revenue to $51 billion by 2026 across those three markets—a 19% compound annual growth rate (see Figures 3 and 4).

Revenue growth will stem primarily from a substantial increase in transaction value through embedded finance platforms. We will see increasing penetration in certain industries and significant revenue multiples across smaller subsegments, such as business-to-business (B2B) payments and BNPL.

Consumer payments

Consumer payments, or merchant acquiring, enables merchants to accept payment from their customers across payment channels (invoices, point of sale or PoS, keyed entry, web checkout) and methods (credit card, debit card, automated clearinghouse or ACH, wallet). For most software programs focused on small and midsize businesses (SMBs), consumer payments are typically one of the first financial services to be embedded, given the friction those customers face in setting up payment acceptance.

Historically, merchants signed up for payment services via independent sales organizations to be approved by an acquiring bank—an arduous process that could take months. Over the past 15 years, new software-centric firms have created a function in the value chain, the payment facilitator, that underwrites merchants on the acquiring bank’s behalf and streamlines the delivery of payment acceptance capabilities. Today, a vibrant ecosystem of consumer payment enablers includes large, modern payment facilitators such as Stripe, PayPal, Adyen, and Square; legacy embedded enablers such as Global Payments and Worldpay; and start-ups such as Finix, Fortis, and Payrix.

Consumer payments account for more than 60% of all embedded finance transactions. In 2021, US customers spent $1.7 trillion via embedded payments, generating $12 billion in net revenue, based on an aggregate take rate of around 75 basis points (see Figure 5). Platforms and enablers shared the $12 billion revenue at an average take rate of just under 40 basis points each.

While embedded consumer payment experiences are proliferating, adoption has concentrated in vertical software platforms across e-commerce, retail and restaurant PoS, wellness businesses, nonprofits, and field services. Indeed, one payments software executive calls payments “the catalyst to offer other financial products.”

By 2026, we project that consumer payment transactions through embedded platforms will more than double, reaching $3.5 trillion and earning platforms and enablers $21 billion in revenue. This will flow from faster penetration of embedded payments among industries including retail and food services, where it will nearly double to capture 70% of SMB transaction volume. We might also see new vertical categories emerge as digital payments become more prevalent.

By 2026, platform revenue will more than double to $14 billion, with take rates remaining largely flat. Meanwhile, enabler revenue will rise only slightly to $7 billion, with a significant drop in pricing and take rates, from an average of 38 to about 20 basis points, due to increased competition.

B2B payments

In the US, B2B payments accounted for $27.5 trillion in transaction value in 2021, with accounts payable and accounts receivable (AP/AR) services representing around 90% of the value. B2B embedded payments have not penetrated as deeply as consumer embedded payments, in part because of a heavy reliance on checks and ACH payments relative to other payment methods, such as eCheck and virtual cards.

Large banks have made inroads with embedded B2B payments, but in the past few years several payments and AP/AR automation platforms have emerged—Bill.com, Billtrust, AvidXchange, and Taulia, to name a few—to more fully define the ecosystem and accelerate adoption.

In 2021, embedded B2B payments generated $1.9 billion in revenue. Card transactions accounted for $0.7 billion of revenue, split evenly between platforms and enablers, while ACH accounted for $1.2 billion of total revenue.

By 2026, we expect B2B payments to reach $33.3 trillion, with embedded payments taking a considerably higher share as buyers shift to eCheck, virtual cards, and value-added ACH to streamline operations and simplify AP/AR reconciliation. During this time, the B2B embedded payments market will nearly quadruple from $0.7 trillion to $2.6 trillion, with revenues growing proportionally from $1.9 billion to $6.7 billion (see Figure 6).

For B2B embedded card payments, as with consumer payments, we expect enabler take rates to face some pressure over the next few years. Platform take rates will rise slightly, leading to a 2026 revenue split of $1.5 billion for platforms and $0.8 billion for enablers, which reflects the overall increase in embedded B2B card payment growth.

For B2B embedded ACH, we anticipate that platforms will see just under $4 billion of net revenue from value-added services related to ACH in 2026, compared with less than $0.5 billion for enablers.

SMBs, which represent 57% of B2B card volume, will be significant adopters as embedded penetration rises from 5% in 2021 to 15% in 2026. Much of the growth here rides on ensuring that late or unpaid invoices are fulfilled, generally by integrating a one-click payment mechanism, initiated by the customer upon receipt. This is especially valuable for SMBs, for whom late payments can threaten viability; by contrast, large enterprises generally have treasury solutions offered by traditional banks, often bundled with lending and investment products.

Buy now, pay later

Over the past five years, BNPL has proliferated across e-commerce platforms, alongside the rise of unicorn enablers Affirm, Klarna, and Afterpay. Catalyzed by pandemic lockdowns, BNPL and PoS lending proved useful for consumers to access goods and services, even if they didn’t have all the money required at the point of purchase.

While BNPL and PoS offerings overlap and the terms are sometimes used interchangeably—both give customers the chance to pay for goods and services in installments at the point of purchase—for this report, we define BNPL as deferred installment payments that are interest-free. BNPL payments usually come in four installments, paid within 12 months. The enablers monetize through a discount rate on the total transaction value that they charge to the merchant.

Some $1.4 trillion poured through online retailers and marketplaces in the US in 2021. Around $50 billion of that went through a BNPL platform, or between 3% and 4% of total sales. By 2026, the total will grow substantially to reach $2.4 trillion in transaction value. With between 10% and 12% forecasted to be embedded, this would bring the BNPL market size to an impressive $265 billion.

We estimate that US BNPL revenues for enablers and platforms came to nearly $1 billion in 2021. We expect that sum to grow (albeit with compressed margins) to around $4 billion by 2026 (see Figure 7). BNPL transactions have soared in Europe, and the US BNPL market will likely follow suit over the next few years. In the UK, BNPL accounts for roughly 5% of online transactions, while in Sweden it makes up 23% of all transactions online.

Competitive intensity will likely compress margins. Today, BNPL enablers tend to achieve take rates of 150 to 180 basis points. By 2026, we anticipate that take rates will shrink to 130 to 150 basis points, despite a potentially rising interest rate environment.

Studies show customers spend a little extra at checkout through BNPL, and platforms benefit through increased conversion with bigger basket sizes. However, the economic rents of BNPL are evolving. Platforms may in time begin to renege on the current model, in which BNPL payers charge merchants and assume the risk of collection.

Point-of-sale lending

Point-of-sale (PoS) lending has existed as a credit option for consumers for many years. An alternative to BNPL, it’s often used for more expensive goods, such as furniture and large appliances, and includes interest, usually across 6- or 12-month terms—the fundamental difference between PoS lending and BNPL. However, as with BNPL, the value to the merchant comes through increased sales conversion and larger basket size. Platforms don’t generate revenue through interest and generally pay a certain percentage fee to enablers such as Affirm to operate.

In 2021, PoS penetration of total consumer transactions stood at around 4%, or roughly $428 billion. Traditional lenders finance the vast majority, leaving around 10% of PoS transactions made via embedded finance, resulting in a loan value of around $43 billion. By 2026, this market will grow to between $80 billion and $90 billion, with negligible growth of PoS transactions overall but an increasing share becoming embedded (see Figure 8).

Within embedded PoS lending, enablers and platforms should be able to increase their profits, despite shrinking margins. We expect revenues to jump from $4.2 billion to $7.5 billion.

Enabler take rates will likely decline. We estimate that PoS enablers today take a healthy 9% to 11% of the credit value. By 2026, we anticipate a decline to between 8% and 9%. This is still significant, especially when compared with the transaction returns of BNPL, but PoS has higher servicing costs as a consequence of the business model.

Business-to-business lending

Sparked by the pandemic, embedded B2B lending has gained momentum over the past few years, partly because of limited access to traditional bank lenders but also because the Paycheck Protection Program helped catalyze the online direct lending space. As one bank executive notes, “It’s hard for small businesses to get a loan. They have no collateral, and accounting records are designed to minimize taxes. Banks are not well positioned to underwrite small businesses.”

Examples of B2B embedded lending include Mindbody Capital, which offers credit to its SMB wellness customers through the core solution powered by Parafin, and Toast, the restaurant management and PoS solution that launched Toast Capital in 2019 to lend to its restaurant customers across the US.

As of 2021, we estimate that around $12 billion in B2B loans transacts via embedded finance. This is based on a total SMB loan value of just under $400 billion, where the individual loans are less than $1 million in value. Of this total, embedded penetration stood at around 3%, underpinned by the market shares of the relative embedded finance balance sheet providers, such as Cross River Bank. We anticipate rapid growth through 2026, with a fivefold increase in embedded B2B lending, bringing the loan volume to between $50 billion and $75 billion, or around 15% of the total, which will also rise slightly to around $430 billion.

The revenue model for platforms and enablers varies. The average time that the lender of record retains the loans can be as short as a few days, and the entity that bears the credit and underwriting risk will earn the lion’s share of the finance charges, which can typically be between 6% and 10% of the principal loan for merchant cash advances, significantly more than weighted-average SMB interest rates.

Assuming the platform does not take any credit risk, it can expect to take between 50 and 200 basis points of the total principal. This means B2B lending revenues, which equated to only $0.2 billion in 2021, should rise to $1.3 billion by 2026 (see Figure 9).

This is a floor for the revenue estimate. If platforms or enablers are willing to accept some of the underlying credit risks, they could earn significantly more. They could fund loans off of their balance sheet, take a first-loss exposure in a structured financing, or receive a credit performance fee as a partial or full substitute for their share of finance charges.

Banking and cards

Starting as a way for fintechs and neobanks to borrow the banking license of an established bank, embedded banking has historically been limited to prepaid or debit cards. New use cases then emerged, among gig workers and sole proprietors, and our research indicates that the market growth will continue alongside the rise of a broad set of enablers, including Galileo, Treasury Prime, Stripe, and Marqeta.

An example of embedded banking is Shopify Balance, which offers merchants a business bank account and debit card powered by Stripe Treasury. As an executive with a leading provider told us, “We cannot keep up with the demand. We can afford to be highly selective with the platforms we choose to partner with because there are so many requests.”

Much like embedded finance itself, the definition is evolving. While banking as a service (BaaS) can be considered as the provision of any part of the full value chain, for this segment we analyzed platforms that allow end users to set up banking and payment accounts and receive associated payment cards. The customer doesn’t interact with the underlying banking provider, except possibly to handle a dispute. Based on our definition of embedded finance, we have not included neobank- or fintech-issued cards here.

As of 2021, US consumers and businesses spent $3.60 trillion on their debit cards and $3.55 trillion on their credit cards. Between 3% and 4% of these transactions for debit cards, and less than 1% for credit cards, were conducted using embedded banking offerings. By 2026, the nonfinancial services market penetration for debit cards will increase potentially fivefold to around 15%, while we see the start of credit card SaaS models adapted for embedded finance. The total embedded penetration across both will average around 9% (see Figure 10).

Although competition will continue to compress providers’ margins, the revenues for platforms and enablers should still increase from $2 billion to $11 billion within banking and cards. These revenues are composed of transaction fees across debit and credit cards, which account for the majority of platform revenue, and SaaS fees charged to the platforms, which account for the majority of enabler revenue. Debit transactions compose the largest share of card issuance and transaction volumes, while the credit market remains small, with a limited number of enablers serving it.

In 2021, transaction revenue via cards was weighted toward platforms at $0.75 billion, contrasted with enablers at $0.35 billion, of which over 90% resulted from debit transactions. By 2026, we expect both levels to rise based on higher volume of embedded transactions by nonfinancial institutions. This should cause revenues to reach just over $4 billion for platforms and $1.3 billion for enablers. In the same period, we expect enabler SaaS fees to scale proportionally, growing to over $5 billion.

This growth won’t come without a few bumps. With the squeeze on fees tightening, the strongest providers are looking to offer a range of value-added services as part of the package, such as anti-fraud, dispute management, know-your-customer, compliance, and merchant acquisition management.

Growth will depend on alignment between the platform’s ecosystem strategy and the requisite scale. Uber Money, for instance, allows drivers to receive payments in the driver app, then automatically transfer and spend directly from their debit card with associated benefits and rewards from Uber’s partners, making the ecosystem benefit the driver.

Market growth on the horizon

As embedded services evolve, the total addressable market stands to grow. Enablers will move beyond payments and debt into new value-added services, including insurance, tax, and payroll. Regulation technology and compliance functionality could also become embedded in the short to medium term.

Looking at industries, retail and e-commerce platforms form the lead use cases. They’re highly digitized, with universally accepted checkout and payment options. Two-sided marketplaces across meal and grocery delivery, ridesharing, and mobility are prevalent consumers of embedded finance, facilitating payment in and out for restaurants and gig-economy workers, and often generating revenue from debit card transactions.

Conversely, many other industries have been slower to advance digitally, because of a lack of disintermediation, regulatory influences, or customer preferences, and are therefore harder for embedded finance to penetrate. Real estate, for instance, lags partly due to payment type (reliance on checks and ACH) and partly because the transaction value is so significant it would likely be subjected to platform caps and regulatory and legal requirements (see Figure 11).

Who in the value chain benefits most?

As we survey the competitive landscape, platforms will continue to serve as the prime owner of the customer relationship, taking an increasing share of the embedded finance profit pool.

Enablers will need to manage their operating costs in a bid to secure desirable platforms. As enablers jostle for business, that further strengthens the platforms’ position. The exceptions here are large enablers that use their size to command a significant share of the economic rents. Empowered by numerous vertical partnerships with different platforms, dominant enablers would be able to secure better prices and direct developments in the market.

Moving in-house

Some larger platforms may decide to bring in-house certain enabling services in order to unlock marginal gains across that large scale. Relevant services could include some credit and market risk functions, as well as sales and support services, such as collections, which touch customers directly. This already occurs in payments, where platforms are becoming payment facilitators to maximize vertical integration and profits.

Should that happen, enablers will continue to play an important part in helping platforms navigate complex regulatory, financial, and technological requirements. Even if they do not build it themselves, the specialist knowledge of fintech experts and engineers will be crucial to platforms’ ongoing success.

Other parts of the value chain should remain as is. Providing core infrastructure and licenses will be largely commoditized and therefore continue to be outsourced. Larger banks, in turn, may lose their advantage in providing these services, due to regulatory arbitrage. For example, the Durbin Amendment limits debit card interchange fees for large banks, which favors smaller, Durbin-exempt banks to provide the infrastructure and licenses for products linked to debit cards.

What role for traditional banks?

In the traditional banking value chain, banks provided products and largely owned distribution and customer primacy. Embedded finance unbundles this business model. Banks still play the role of a regulated entity, managing the associated risks and balance sheets in a low-margin, low-growth business. For larger banks that hold significant customer primacy, the regulated entity role alone is no longer a viable option (see Figure 12).

That’s because traditional financial institutions face potentially deteriorating economics as providers of commodity services. Profit pools will increasingly favor platforms and enablers using superior technology, algorithms, and more contextual data to target the most creditworthy customers. In the future, only unprofitable or higher-risk consumers may default to traditional channels. Regardless of how banks grade loans, they won’t see the valuable lending opportunities.

Instead, traditional institutions should view embedded finance as an opportunity to reinvent their core business, build new growth engines, and offer more interoperable products and services. One way would be to move up the value chain and offer enabling services, as JPMorgan Chase did when buying WePay, or to procure stakes in platforms. The sweet spot is likely a combination of all, depending on the vertical sector at play and the products in scope.

Building a successful embedded finance proposition will require a fundamental rethinking of the capabilities needed, especially in terms of risk. Having a certain share of nonbanked customers unconditionally processed through a real-time credit decisioning engine will challenge most banks’ tolerance for risk. Banks and regulators will have to get comfortable with platforms and enablers making credit decisions that may affect traditional balance sheets, based on real-time and contextual data held outside of the bank.

Three possible moves for banks. For banks considering the opportunities, it’s useful to think in terms of executing a portfolio play. Broadly speaking, we see three types of initiatives in this portfolio:

- defending current leadership positions and customer primacy;

- extending reach in another platform; or

- creating new growth engines by disrupting a new vertical industry.

Some firms have begun executing such portfolio plays. Goldman Sachs has taken strategic bets across the value chain, including cementing itself as the banking partner for Apple Card and a partner for Stripe Treasury, while also fielding its own distribution through Marcus and MarcusPay.

Fifth Third provides embedded credit and payment services to both small businesses and retail platforms. It has doubled down on the healthcare industry, acquiring the Provide platform to participate in distribution and enablement.

Next steps for the value chain

Embedded finance has brought challengers and stiff competition to banking territory. For those institutions and platforms already struggling with technology debt, embedded finance could prove too high a hurdle in the battle to stay relevant. Others will thrive amid the shift from closed to open IT architecture.

The key is to be practical and clear about monetization strategies, focusing on how to reach the volume necessary to justify the expense of building new capabilities. It makes sense to outline participation choices early, staying close to areas of strength and core capabilities. A fair share of what banks need they probably already have, so externalizing these services can become part of the first-draft architecture.

Enablers’ goal: making things easy

Although growth looks strong for enablers overall, the supply of new enablers could far outstrip demand.

The winners will likely provide a full suite of services, including some regulatory oversight, compliance, origination, and fulfillment. Enablers that take the hassle out of embedded finance for platforms through easy integrations and great servicing should hold the upper hand. They can choose a high-volume, self-service model, or a higher-touch operation across fewer, bigger platforms. And they may concentrate on specific sectors with large or growing addressable markets, where they can scale up and steadily improve the user experience.

Platforms choose their partners

Platforms have the chance to maximize retention and unlock new revenue streams for relatively low costs. Those that own distribution will be able to offer unprecedented convenience to end users, sparking large new revenue streams.

To succeed, they’ll need to choose partners carefully—institutions that truly meet their needs and enablers with a razor-sharp focus on fulfilling their requirements.

Moving forward

With a fast-paced development arc, embedded finance is attracting significant funding from venture capital and growth equity. The space will continue to be well funded as more use cases expand the addressable market.

Embedded finance will play a fundamental role in shifting how consumers interact with their finances. It will also change whom customers trust to interact with. The number of new enablers serving distinct niches will grow in ways that will both fragment and consolidate the value chain. This will give platforms plenty of choice to curate partnerships that suit their needs. As a result, customers will continue to experience more contextual, seamless, and accessible financial services.

About Bain Capital

Bain Capital is one of the world’s leading private investment firms with approximately $160 billion in assets under management. We pioneered the value-added approach to investing and have invested at the forefront of the technology industry in more than 370 companies since our founding in 1984. Our end-to-end technology platform through Bain Capital Ventures, Bain Capital Tech Opportunities, and Bain Capital Private Equity, enables us to invest in early-stage, growth, and buyout stage companies in alignment with founders, entrepreneurs, and management teams to help their companies to reach their fullest potential. We believe it takes much more than capital to enable success in technology—we provide access to a global platform, resources, and talent that help our portfolio companies navigate through crucial strategic decisions to succeed in rapidly evolving industries and enter new markets.