The Situation

Acquiring a major supplier was part of PharmaCo's* global strategy to grow its market dominance with an expanded product line, enhanced scale and stronger innovation abilities.

But PharmaCo knew the risks. Too often strategically sound deals fail to live up to expectations because of three major stumbles: missed targets, loss of key people and poor performance in the core business. PharmaCo faced an added merger complexity because this was a cross-border deal, which required addressing regional and cultural differences and geographically dispersed operations and employees.

To succeed, the CEO and senior leadership needed an integration plan that clearly defined the payoffs—and risks—and how to overcome them. Only then would the merged company be able to hit its performance targets.

Our Approach

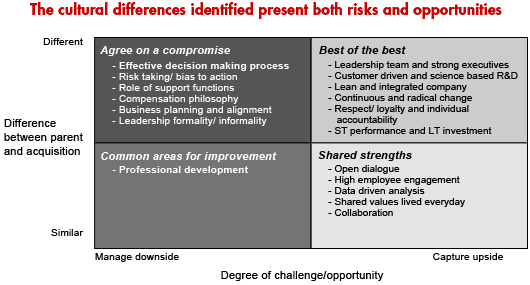

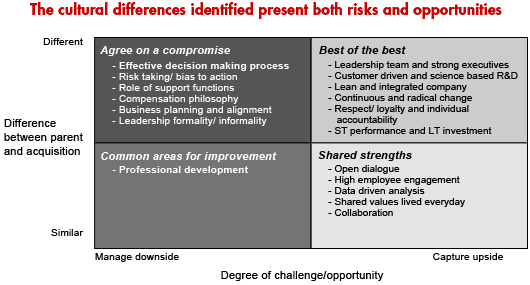

Working collaboratively with senior management from both companies, we assessed the biggest integration risks and provided options for mitigating them. Distinct differences emerged between PharmaCo and the acquired supplier, which was more customer-oriented and focused on innovation.

We helped senior leadership tackle the three major risks:

- Clarify and define a compelling shared vision during workshops with both management teams.

- Plan for business disruptions by identifying people most impacted by change and organizational trouble spots; develop a short- and long-term mitigation plan that mobilizes leaders and supports key employees.

- Prepare to integrate the cultures by prioritizing major differences and developing an action plan.

Our Recommendations

We recommended PharmaCo's leadership adopt a two-part integration:

Pre-merger would involve employee training, customer support and communications from trusted managers to prepare employees.

Post-merger would include launching transformation initiatives that align organizations around a shared vision and changed behavior to deliver results:

- Transform the culture in priority areas; develop a vision of the future and a "one-team" attitude.

- Enlist Change Sponsors to win buy-in by creating a Sponsorship Spine—an unbroken chain of people who support change from the bottom up to the executive suite.

- Speed execution with decision planning that tracks progress and mitigates ongoing risks.

- Gain a sustained competitive advantage by building a repeatable model for change.

The Results

With our risk assessment and disciplined integration plan, PharmaCo and its acquired supplier defied the merger odds. Both companies generated record quarterly results—even while still executing the merger.

Performance

- PharmaCo's sales surged 21%, with margins rocketing up 44%.

- Acquired supplier increased sales 14%, generating a 24% increase in operating profits.

Integration

- PharmaCo's acquisition closed on schedule.

- The new joint leadership team took over on day one.

- Initiatives to mitigate risks were put in place as planned.

The key to PharmaCo's success: recognition that change takes place over time. PharmaCo's advanced planning has allowed it to deliver on the merger's promise—while protecting its core business, retaining talented employees and strengthening customer relationships.

* We take our clients' confidentiality seriously. While we've changed their names, the results are real.