Brief

한눈에 보기

- Improving fuel-burn efficiency is the most effective approach to reducing emissions in the coming decade.

- Bain research shows that a cumulative investment of $1.3 trillion in sustainable fuel production would satisfy only about 20% of forecast 2050 aviation fuel demand.

- Battery-electric propulsion is the clear winner in system efficiency, making it the optimal solution to decarbonize aviation in the long run, well after 2050.

- Hydrogen is unlikely to offset a large portion of aviation emissions by 2050 given the high cost of production, supply challenges, and operator economics.

To make flying sustainable, airline associations and a growing number of governments have pledged to achieve net-zero carbon emissions by 2050. It is a moonshot challenge. To decarbonize commercial aviation in that time frame, the industry will need to dramatically accelerate fleet renewals with more efficient aircraft and invest in new propulsion technologies. But each of the three main technologies to lower emissions—sustainable aviation fuel (SAF), hydrogen, and full-electric propulsion—faces big obstacles.

Without major scientific breakthroughs, getting to net-zero emissions will take longer and require trade-offs, particularly if air traffic continues to grow. Our research shows that there is no clear solution for decarbonizing the bulk of commercial aviation by 2050, even assuming major technology advances and cost reduction. SAF, the most promising option, is limited in quantity and expected to remain expensive, government incentives and mandates notwithstanding. Green hydrogen and electric propulsion may become viable alternatives to Jet A fuel for smaller aircraft by 2050 but not for the bulk of commercial flights.

Advancing all three fuel alternatives will require trillions of dollars in coordinated investments in R&D and renewable energy sources. In fact, that approach, absent unprecedented government subsidies, would increase the cost of flying and reduce air travel.

For leadership teams, placing multiple bets may be tempting, but it also risks slowing progress. The most effective medium-term solution for reducing aviation emissions is a shift to hybrid-electric aircraft powered by SAF blends. In the second half of the century, battery-electric aircraft are expected to be the surest path to decarbonizing aviation.

Commercial aviation’s transition to net zero will be long and complex. Many assumptions could change as technologies evolve. In the current climate, with huge pressure on original equipment manufacturers and the rest of the industry to act quickly, the risk of distraction and wasted investment is significant. Strategies designed for uncertainty can help companies focus on the right pragmatic steps forward and emerge well positioned for success in a new era.

Reality check

As the pressure to reach net-zero aviation emissions by 2050 grows, many are betting that a combination of SAF, hydrogen, and electric can make it happen. But most studies overlook the vast capital expenditure needed to make alternative jet fuels viable, the limited availability of renewable energy sources and natural resources to produce them, the competition with other industries for the same supply, and the resulting impact on the cost of air travel.

The vision to decarbonize the industry by 2050 involves big assumptions. First, airlines would have to dramatically accelerate aircraft renewal rates. Second, companies and governments would need to invest trillions of dollars in capital equipment to produce SAF and increase the necessary supply of renewable energy. Third, airports and airlines would have to adjust on-the-ground operations to manage the safety, logistics, and turnaround time challenges posed by these new fuels.

The ultimate winners in this race will take a strategic view, understanding that investments in future technologies will pay off only if the right resources are put against them. That means making trade-offs. Many companies, governments, airlines, and other stakeholders are placing big bets on all three technologies, including hydrogen—a strategy that could backfire if leadership teams are depending on widespread commercial viability by 2050.

Priority No. 1: Burn less fuel

Improving fuel-burn efficiency is the most effective approach to reducing emissions in the coming decade. Despite the promise of SAF, building the required infrastructure and increasing supply will take investments on an unprecedented scale—and time.

Historically, commercial aircraft manufacturers have delivered a 1% annual improvement in fuel-burn efficiency, which helped decrease emissions per passenger mile and lower the cost of air travel. However, this historical fuel efficiency gain is not enough to get to net-zero emissions or even offset emissions from travel growth, which is forecast at 3% per year through 2050. The industry will need to invest more in R&D and shorten the average aircraft life cycle. New engine designs such as open rotor, novel airframe designs, and lighter materials may help accelerate the pace. Airlines are also looking at optimizing operations, including more efficient routing and alternative ways to taxi aircraft without using engine power.

The most attractive option to bend the curve on fuel efficiency is to make hybrid-electric aircraft with external electric propulsors. We’ll talk more about that below.

SAF: The quantity challenge

After improvements in aircraft fuel efficiency, SAF is a second promising option to lower emissions quickly and extensively. It has two key advantages: It can replace Jet A with limited changes to aircraft and infrastructure, and it can be used for all types of flights, including long haul. Most engines today are already certified to use a 50% blend of SAF and jet fuel, and certification to use 100% SAF is expected before the end of the decade.

The most prevalent and mature SAF, hydroprocessed esters and fatty acids (HEFA), is made from cooking oil and animal fats, which can also be used to produce renewable diesel. HEFA’s main drawback is its limited feedstocks, which curb supply and undercut producers’ ability to bring cost down. We expect HEFA fuels to satisfy a maximum of about 8% of Jet A fuel demand in 2050.

Synthetic or e-fuels produced by combining green hydrogen with carbon dioxide pulled from the atmosphere or industrial sources could, in theory, offer unlimited capacity, if governments and industry invest substantially to increase the supply of renewable energy. Still, this technology has not yet been proven at scale.

Our research shows that, even with major investments in biofuels and e-fuels, rapid technological progress, and significant cost reduction, the supply in 2050 will fall far short of aviation demand. A cumulative investment of $1.3 trillion, for example, would scale SAF production volume to only about 20% of forecast 2050 aviation fuel demand. And $10 trillion of production and renewables capex would be needed to replace standard jet fuel (see Figures 1 and 2).

The aviation industry is also competing with other industries, such as trucking, for access to renewable fuels. And for refineries, it is less profitable to increase the share of SAF compared with renewable diesel, absent government support.

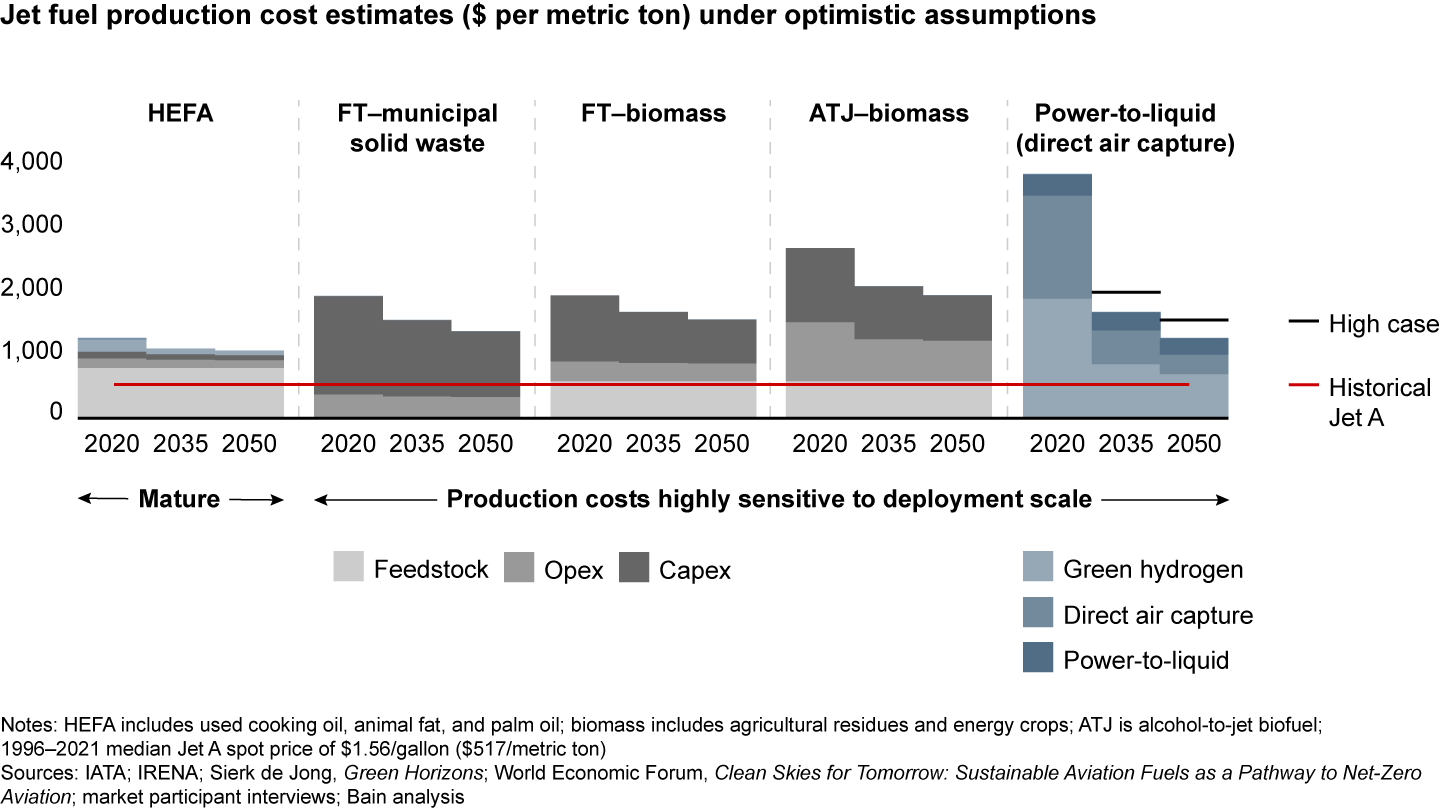

The production economics, especially for e-fuels, will improve over time, but through 2050, SAF is likely to remain more than twice as expensive as the recent historical average of Jet A (see Figure 3).

The advantage of electric power

Battery electric is the clear winner in terms of system efficiency, losing the least clean renewable energy to the fan blade (see Figure 4). That makes battery-electric aircraft the optimal solution for decarbonizing aviation in the long run.

Aviation will also benefit from battery advances in the automotive sector as the shift to electric vehicles accelerates. Advanced air mobility demonstrators are already showing the ability to support very short all-electric flights (less than 250 nautical miles or 460 kilometers).

Also, many aircraft systems have become increasingly electrified over time, making the transition easier.

Among the key challenges for electric propulsion:

- Battery densities are unlikely to evolve fast enough through 2050 to power most air travel covered today by narrow-body or wide-body jets (see Figure 5).

- Refueling will require significant investment in new airport infrastructure and affect aircraft turnaround times.

- Energy sources must be green, and they will also be in high demand in other industries.

Hydrogen: A long shot

Airbus is betting big on hydrogen to decarbonize aviation and has set an ambitious goal of producing its first entirely hydrogen-powered aircraft by 2035. But even if all of today’s turboprops and half of regional jets were replaced with hydrogen aircraft—a very optimistic scenario—the switch would address only 2% of revenue passenger kilometers (RPKs) and 4% of carbon emissions.

Hydrogen proponents cite its potential to eliminate nearly all carbon dioxide and other greenhouse gases from flight. However, the challenges of switching to hydrogen are considerable. For starters, it requires a new aircraft architecture to accommodate larger tanks, because of the low volumetric energy density of hydrogen. Airlines would therefore have to choose between losing flight range or passenger capacity, which would largely limit the use of hydrogen to regional aircraft.

Hydrogen is also difficult to transport and expensive to liquefy. Airports would need to remake fuel infrastructure to support liquid H2, a Herculean task. We forecast the cost of converting 53 airports in Europe at $50 billion to $65 billion. That investment would address just 10% of RPKs regionally, equal to 1% of global RPKs.

Our research shows that generating 9 million metric tons of green hydrogen by 2050 would cost $250 billion to $400 billion, and that volume would cover a maximum of only 5% of the projected RPKs. Airlines also will face fierce competition for green hydrogen from other industries eager to decarbonize their operations. Unless governments provide strong mandates to ensure supply, aviation will struggle to get access to green hydrogen. Even if cheap green hydrogen is available at scale in 2050, the price of liquefying it by cooling it to negative 250 degrees Celsius is alone higher than the recent historical average price of jet fuel (see Figure 6).

In short, the cost, supply challenges, and operator economics make it unlikely that hydrogen will offset a significant portion of aviation emissions by 2050.

A way forward

The strategy that will decarbonize aviation the most by 2050 combines faster improvements in fuel efficiency with accelerated fleet renewal, maximum use of SAF—as much as the industry can get—and hybrid-electric aircraft. We expect hydrogen to play only a limited role.

In the 2030s, we expect to see the introduction of a new generation of single-aisle aircraft designed for greater efficiency with evolutionary engine advances. But the key to phasing out Jet A is the development of SAFs beyond HEFA and the scaling of e-fuels at reasonable cost.

Hybrid-electric aircraft will combine evolutionary efficiency gains with the emissions benefit of electric propulsion. In particular, hybrid aircraft with external electric propulsors would help serve peak energy loads at different flight stages, such as takeoff, to allow for greater efficiency while maintaining redundant power sources. They also would enable reduced drag on the air boundary layer, which has the potential to reduce fuel burn by as much as 8% to 9% compared with aircraft flown today, according to NASA’s Glenn Research Center. Hybrid-electric planes would also limit the need, for now, to build ground charging operations, since hybrid engines recharge during flight.

Where to invest

As leadership teams assess this complex and evolving landscape, their top priority is making the right investment decisions for the coming decades and choosing how to allocate incremental investments. Aviation industry leaders are aiming for the greatest emissions reduction possible by pursuing a strategy designed for uncertainty. That means diverting capital toward winning technologies, investing in no-regrets moves while selectively doubling down on “big bet” investments as technologies evolve.

Here’s what the initial elements of those strategies look like across key subsectors of the industry.

Commercial aviation manufacturers

- Leapfrog the historical fuel-efficiency improvement trend by pursuing disruptive advances in aircraft and engine technologies, including hybrid-electric architectures.

- Decide where to make big bets vs. hedges. Explore whether limiting investment now is an option for some technologies, like hydrogen.

- Prune business portfolios and take a zero-based approach to improving performance (Zero-Based Redesign) to free up cash for reinvestment.

- Realign operating models to foster innovation, improve talent productivity, and develop new capabilities, both in-house and through M&A and partnerships.

Airlines

- Accelerate fleet renewal, aiming to introduce at least two generations of more efficient aircraft into service by the 2050s.

- Promote the use of SAF. Give customers the option to choose SAF and offer incentives. Co-invest to develop SAFs and commit to purchasing portions of future SAF supply.

- Set ambitious targets to improve operational efficiency in the air (e.g., air traffic control optimization) and on the ground (e.g., decarbonizing airport operations).

Governments and industry associations

- Expand incentives such as green bonds and subsidies to scale up renewable energy infrastructure. Encourage investment in second-generation SAFs, beyond HEFA, and e-fuels.

- Create incentives for sustainable fuel makers to increase SAF production for aviation, to overcome the economic advantage of using the same feedstocks to produce renewable diesel for trucking.

- Set realistic expectations for achieving net-zero emissions. A zero-emission target for 2050 should incorporate the likely consequence of higher ticket prices and lower air traffic growth.

- Support the creation of functional, global book-and-claim systems that aggregate global business demand for SAF. The goal: to lower costs by stimulating demand.

Fuel providers

- Invest beyond HEFA into second-generation SAFs with fewer supply constraints, along with e-fuels. Consider joining a consortium of capital providers to share risk.

- Join industry efforts to incentivize large-scale SAF development.