Forbes.com

As private equity grew in popularity in recent decades, PE general partners (GPs) set the ground rules by which their business relationships with limited partners (LPs) would be governed. Long unable to do much individually to alter the rules of how PE funds will be compensated and their contractual relationships defined, LPs are now pushing back with increased determination—and some signs of success. Indeed, as we report in Bain & Company’s Global Private Equity Report 2011, GPs and LPs are beginning to pursue a closer alignment of their interests by modifying fund terms and conditions.

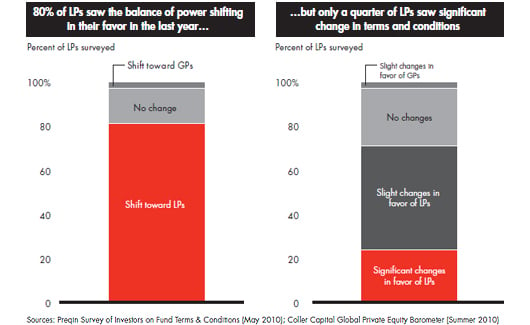

To a large degree, the conversation, which has gathered momentum since late 2009 with the launch by the Institutional Limited Partners Association (ILPA) manifesto calling for terms and conditions more favorable to LP interests, reflects a shift in the relative power of LPs to be more assertive. In a mid-2010 survey by Preqin, a PE research firm, 80 percent of responding LPs said they saw the balance of power tilt in their favor during the past year (see chart below). The practical effect of that realignment, however, has been modest so far. Only a quarter of LPs surveyed by Coller Capital in mid-2010 said they witnessed significant changes in terms and conditions by last summer; another 50 percent responded that there had been slight changes to LPs’ advantage.

Change will not come easily for LPs hoping to negotiate more favorable terms and conditions. Chief among the challenges they face is the simple fact that with the exception of a few large ones, LPs individually are not that powerful. LPs are a diverse and disparate group, and their opinions of which terms and conditions are the most urgent priorities for reform—and what changes are acceptable—differ dramatically. “Trying to get LPs to behave collectively is like trying to herd cats,” said a university endowment officer. Especially when it is difficult to gain access to a top-performing fund or to get in on an investment strategy where LP demand outpaces supply, the GP still has the edge in negotiations.

Still, LPs are beginning to see the majority of GPs willing to adjust some terms and conditions. Slightly more than half told the Coller Capital survey last summer that a majority of GPs were making a satisfactory effort to adopt the ILPA guidelines for financial terms. Areas where LPs say they have witnessed changes in the past year include adjustments to management fees, rebates on deal-related fees and to a lesser extent reductions in the hurdle rate and changes to the carry structure. An executive at a major US public pension fund told Bain that he expects to see much more of this going forward. “I don’t think there’s any big fund that’s going to be able to come back to market and expect to raise money without having addressed the economics,” he said.

Nearly three-quarters of the LPs in the Coller Capital survey reported seeing more willingness to adjust nonfinancial terms and conditions. LPs that Bain interviewed think it is simple common sense that the two sides should be able to rally around the ILPA position. “You read through those principles and it’s like okay, what part of motherhood and apple pie are you against?” said a private foundation executive.

This post was written by Graham Elton, Bill Halloran, Hugh MacArthur and Suvir Varma, leaders of Bain & Company’s Private Equity Group.