論説

概要

- While many people remain deeply cautious about returning to activities that involve human proximity, Bain’s new survey of US consumers found six distinct segments that show divergent behaviors. The pandemic thus adds a new dynamic to segmentation strategy.

- Although health concerns touch most respondents, the economic fallout has been more stressful for people in three segments. Political beliefs also come into play, as one segment expresses more frustration with government and business restrictions than with the pandemic itself.

- Companies that gain a deep understanding of each segment’s specific priorities and that adjust their marketing and overall propositions accordingly stand to gain both market share and customer loyalty.

- Even for products that appeal to several segments, a tailored approach stands a better chance of resonating with each target segment.

Conflicting emotions toward the coronavirus and social distancing have been on vivid display in recent months. Massive mask-less partying at some homes rented through AirBnB’s platform prompted the company to announce a new global policy banning parties and occupancies of more than 16 guests.

In the US, 426,000 vehicles converged on Sturgis, South Dakota, for an annual motorcycle rally, with few masks and little social distancing observed at the packed taverns, parades and concerts. “I don't want to die, but I don't want to be cooped up all my life either,” one rider told a reporter of the break from his routine. “This is a major experiment,” he acknowledged. “It could be a major mistake.”

Yet around the same time, airline flights worldwide were down by nearly 48% year-over-year. Around the US, many extended families that normally held annual reunions turned instead to virtual gatherings over Zoom. Virtual summer camps emphasizing arts, sports, science, computing and other activities were flourishing. And parents of school-age children everywhere are adapting to the constant changes of hybrid on-site/virtual school experiments.

The great reluctance rages on

After nine months of Covid-19, many people remain deeply cautious about returning to activities that involve human proximity. As we wrote several months ago, we expect to see a spectrum of behavior, with some people continuing to shelter at home and even embracing the new ways of life, while others return gradually to wider activities—some motivated by financial necessity, others by skepticism or a higher tolerance for personal risk.

Bain & Company’s latest survey of US consumers, conducted with Dynata, shows that Net Comfort Scores (a metric of comfort with activity during the pandemic) have plateaued and remain negative on many activities. While safety measures have helped, reluctant US consumers are looking for a reliable, widely available vaccine above all other factors to help assuage their concerns, our US survey found (part of a global survey of nearly 16,500 consumers).

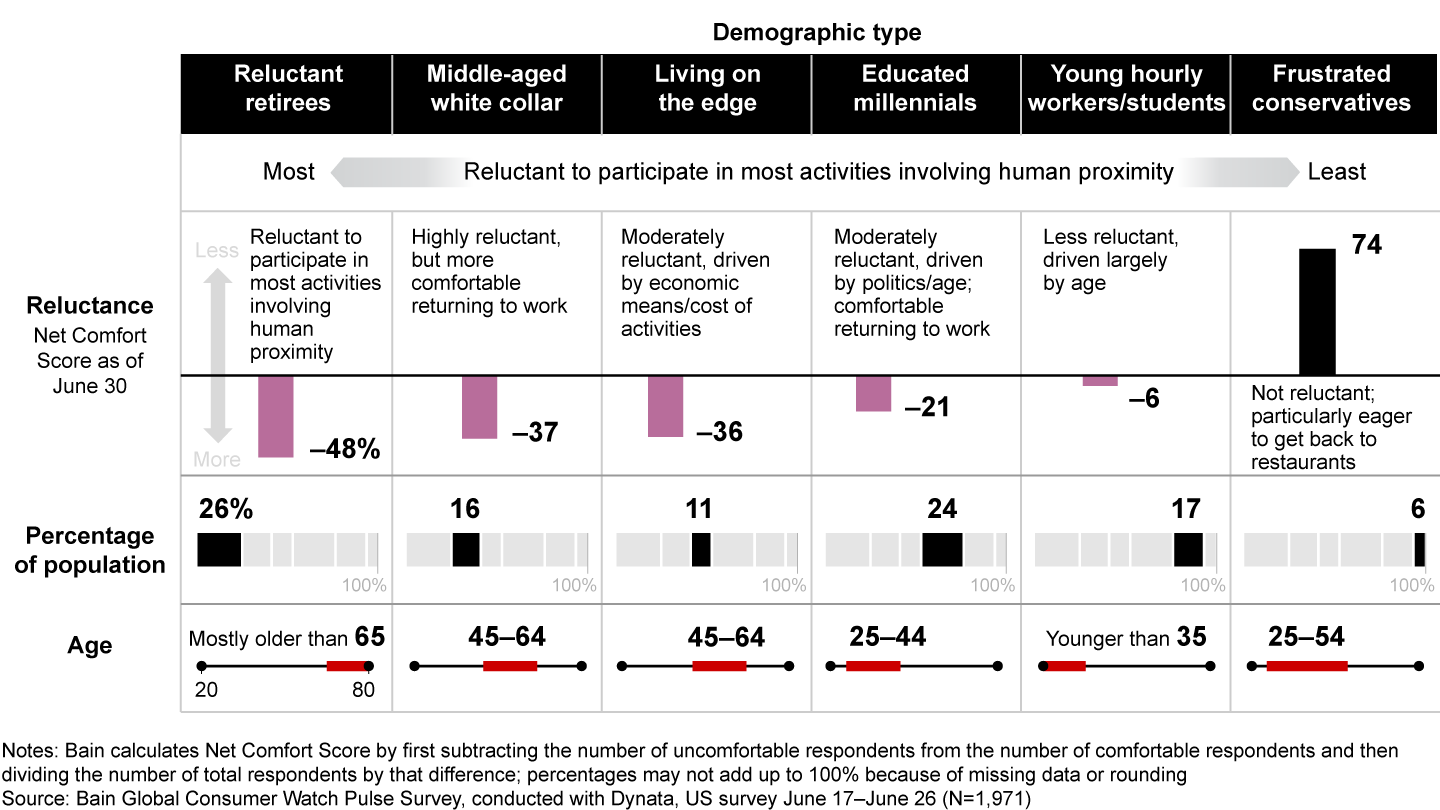

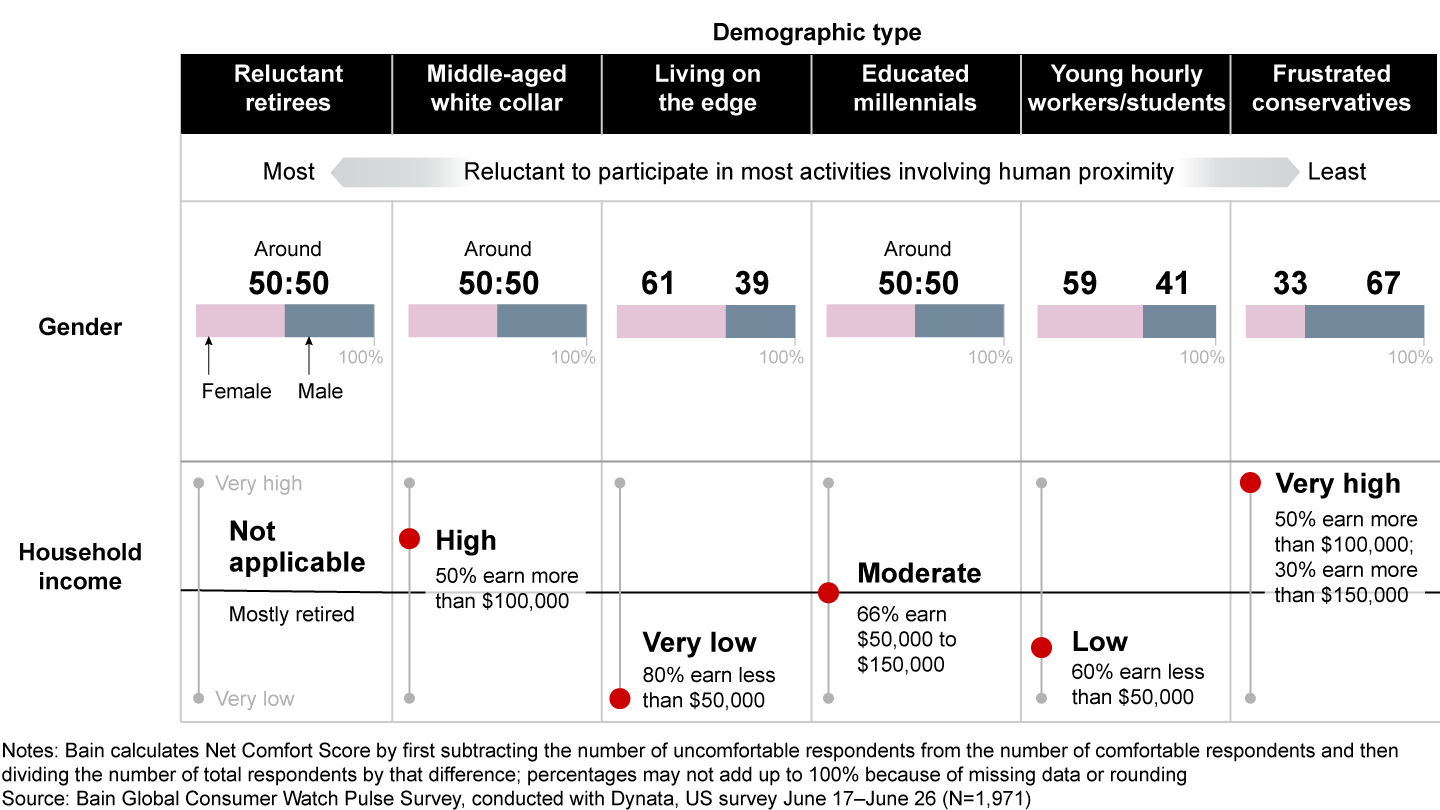

Beneath the averages, however, we found distinct consumer segments that show divergent attitudes and behaviors. While companies have long served different segments with tailored marketing, product features and prices, the pandemic adds a new dynamic to segmentation strategy. Understanding how different consumer segments think about the disease, physical restrictions and government actions has become critical to maintaining or expanding sales during this prolonged period. Selling even a single widely used product becomes more complicated by the range of reluctance as people navigate a fraught terrain. Yet the overlay of reluctance also presents companies with an opportunity to serve segments that have some clear priorities.

Six US consumer segments for the pandemic

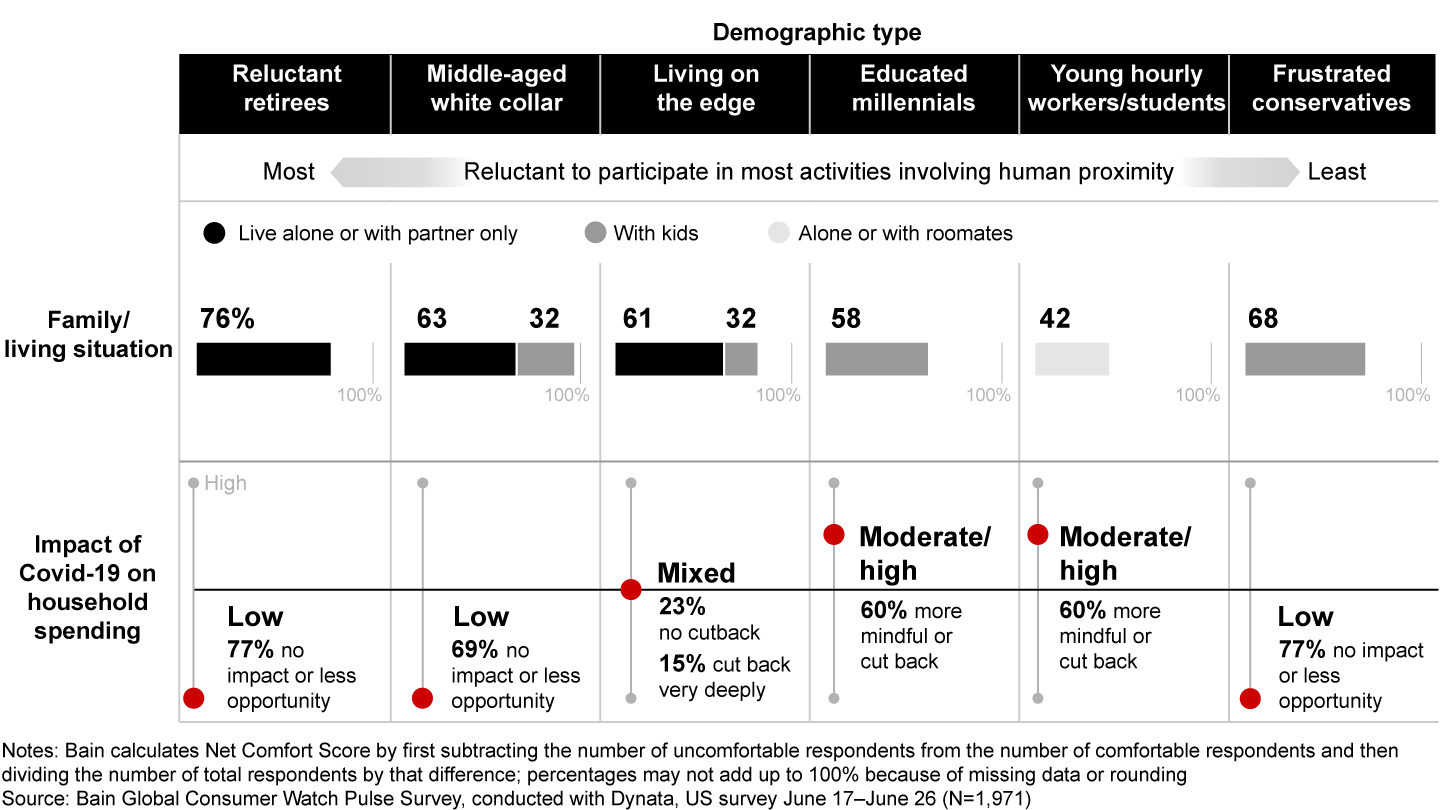

When we analyzed our survey of nearly 2,000 US consumers (a representative sample of the country’s population) along demographic, economic and political dimensions, six distinct segments emerged. Besides the dimensions of age and income, political orientation surfaced as a strong predictor of attitudes and behavior—not surprising in one of the world’s most polarized countries. The segments range from most to least reluctant as measured by the Net Comfort Score (see Figure 1 slideshow):

- reluctant retirees, who make up 26% of the population;

- middle-aged white collar, 16%;

- living on the edge, 11%;

- educated millennials, 24%;

- young hourly workers and students, 17%; and

- frustrated conservatives, 6%.

The survey also reveals how the pandemic has changed shopping and purchasing behavior.

- First time online: Younger and wealthier segments are more likely to try online purchases for the first time and to prefer it to shopping in a store. That doesn’t mean companies can launch a mediocre website or mobile app and expect people to embrace it. Consumers of all stripes have come to expect simple, convenient apps and websites, with the bar on a user-friendly design rising every day.

- New brands experimentation: A significant share of people in each segment have tried a new product brand or grocery store brand (see Figure 2). The reasons vary by age. Most retirees and middle-aged white-collar consumers have tried new things because the brands they normally buy were not available. Younger respondents were more likely to want to try something new, while those living on the edge mainly looked for less expensive brands. So while this trend does not presage a massive shift in households’ product repertoire, there are opportunities to gain new customers in certain segments.

- Expanded life at home: A large majority of respondents in most segments intend to continue at least some of their new homebody behaviors after the pandemic subsides. For example, roughly 30% intend to eat, drink and exercise more at home than before the pandemic, and about 20% intend to do more personal care at home. Frustrated conservatives are the exception, intending to go out to bars, restaurants and personal care settings more frequently (see Figure 3).

- Larger, healthier or less expensive products: All segments except frustrated conservatives report buying larger pack sizes in order to reduce trips to the store. And all segments except for those on the edge and young hourly workers have sought out healthy food; the lower-income groups emphasize low-cost options. Frustrated conservatives, by contrast, have been spending more on their home life as they spend less out of the house.

- Affordable luxury: Nearly 45% of consumers have cut back on spending during the pandemic, while 38% of them, even 33% of those living on the edge, still look for ways to treat themselves.

On diapers and back to (something resembling) school

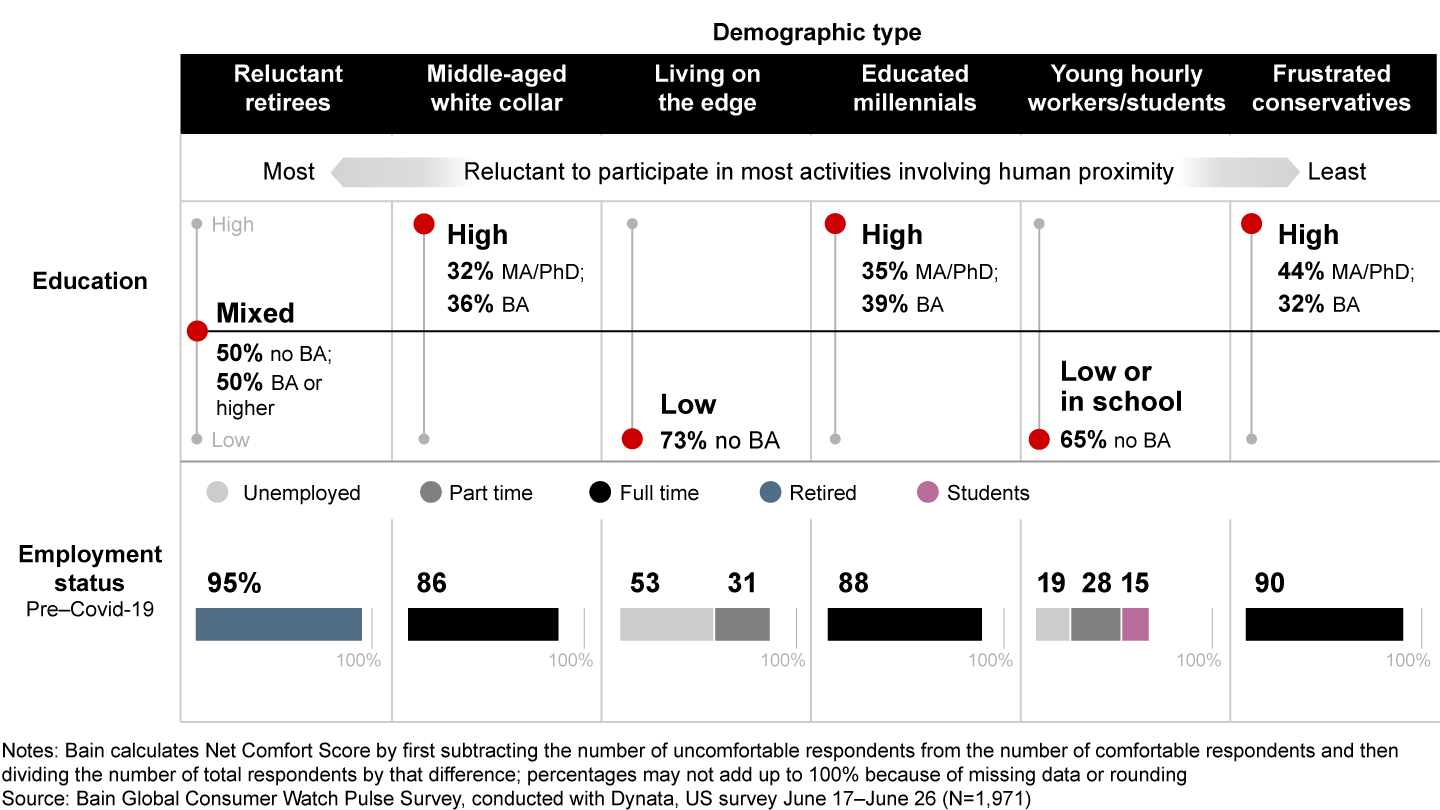

Although health concerns pervade the lives of most respondents, financial hardship also comes into play across much of the population. For people living on the edge, young hourly employees and millennial parents, the economic fallout from the pandemic has been more stressful than the fear of contracting Covid-19.

Serving these groups will become increasingly important for many companies, in part because they are so large. Take families at the base of the income pyramid, which before the pandemic were barely making ends meet. In 2017, some 17% of all children under age 18 in the US lived in families with incomes below the federal poverty threshold. Some research shows that, on average, families need an income of about twice that level to cover basic expenses, and using that standard, 39% of children (or 29 million children) were living in low-income families. Nationwide, parents of more than 7 million infants and toddlers were not able to afford diapers last year, the National Diaper Bank Network estimated. Recent layoffs will swell the numbers of unemployed people and push more families into periods of financial hardship.

The concerns of educated millennial parents differ from those living on the edge, but they may be just as intense, as the demands on working parents occasionally raise the levels of exhaustion and stress.

“We’ve relied a lot on screens,” one 35-year-old mother of two told us in an extended interview. “In an ideal world, I would say, ‘Yeah, we put them in front of ABC Mouse and they learned the alphabet.’ But that’s not really what happened. They were navigating toward the video content on ABC Mouse.”

Of all segments, this segment has altered its spending habits the most and has expressed the highest concern about contracting the novel coronavirus—anxieties that could rise further as schools start again (see Figure 4).

At the same time, they are quite open to new forms of digital interaction with companies. (The same 35-year-old mother, for instance, has converted to choosing her grocery basket online, then picking it up curbside. She also treats the family to meal delivery several times a week.) As a result, companies that ease the strains of millennial parenthood, a segment whose purchasing power will likely rise as its members progress in their careers, could foster new habits that endure well past the pandemic.

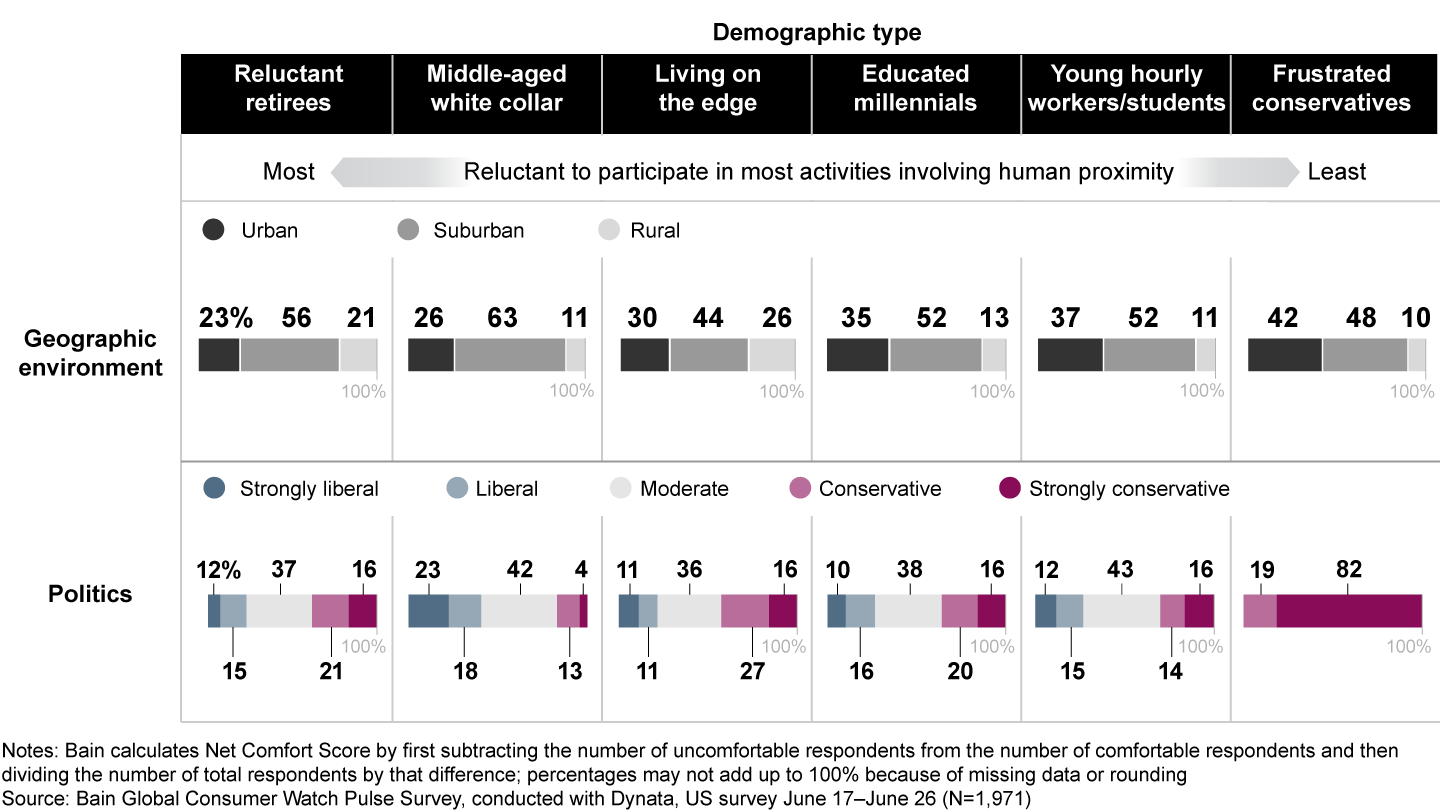

Drifting uneasily through these demographic and income variables is a third dimension: political orientation. As in other aspects of life, political beliefs have polarized attitudes toward social distancing in the US more than in other countries. Frustrated conservatives, who have very high incomes, express more concerns with government and business restrictions than they do with the pandemic itself. This polarization resembles the dynamic of how certain brands of luxury goods, cars, TV shows or other products skew heavily to one slice of the political spectrum.

Looking at other countries, we see some similar segments and behaviors, but with less political polarization or extreme experiences (see Figure 5). In Italy, for instance, no segment along the spectrum of reluctance stands out for its political views, and a stronger social safety net has tempered the anxieties even of people living on the financial edge.

More tailored than ever

For companies in consumer markets, reluctance has become as important to segmentation strategy as more traditional variables. Companies that understand the specific priorities of each segment and that adjust their marketing and overall propositions accordingly stand to gain both market share and customer loyalty.

Even for products that appeal to several segments, a tailored approach stands a better chance of resonating with each chosen segment. Chipotle Mexican Grill thus is rolling out “Chipotlanes,” drive-through pickup lanes for digital, contactless orders, yet it is also maintaining orders inside the restaurant. And Huggies, the disposable diaper brand owned by Kimberly-Clark, offers several tiers of diapers for parents seeking good value.

Turning to political orientation, it has become a useful filter—that is, in addition to demographics and income—for target marketing. The geographic dimension of political orientation is particularly rich. Mixed-electorate cities and counties have all but disappeared in the US, making targeting by political orientation more feasible. A cruise ship company or travel-oriented credit card, for instance, may get a higher response rate by targeting its ads to affluent suburban Houston than to affluent neighborhoods of San Francisco.

As the pandemic drags on, the calculus of consumers’ priorities has changed. To master this new math, managers can ask a set of penetrating questions.

- Which segments do we serve, and how comfortable are they with activities that require physical proximity?

- How can our products assuage consumers’ anxieties and reduce their health or financial risks and concerns?

- Are there digital alternatives that we can deliver reliably through a simple, convenient user interface?

- If we serve different segments that have divergent priorities, how should we tailor our marketing and product features to each segment?

- How should we incorporate political orientation, either explicitly or implicitly?

Consumers’ priorities may shift as health and financial conditions evolve, so confident answers to such questions will hinge on closely listening to feedback and watching behavior. That’s how companies can best serve segments along the spectrum of reluctance.

About the Research

Data powered by Dynata, a leading global first-party data and insights platform.