Brief

}

}

At a Glance

- Many companies use carbon offsets as part of their decarbonization strategies, but the reputational risk is considered high, often for good reason.

- Global standards are emerging to help define appropriate levels of quality for carbon offsets on both the supply and demand sides.

- The proposed global standards will help companies market their use of offset credits with greater confidence.

- Increasingly, companies are using complementary technologies including satellite imagery and on-ground remote sensors to develop offset ratings similar to corporate credit ratings.

To offset or not to offset? This is no longer the question. The latest Intergovernmental Panel on Climate Change (IPCC) report, released in April 2022, made abundantly clear that businesses and governments will need to pull all levers—emission avoidance, reduction, and offsetting—to limit a global temperature rise to 1.5 degrees.

Beyond committing to net-zero targets and undertaking efforts to decarbonize their own operations and value chains, many businesses are choosing to offset emissions on the path to net zero. Even in that end stage, offsets will likely continue to play a role, as leading target-setting initiatives acknowledge. The Science Based Targets initiative (SBTi), for example, requires companies to offset remaining carbon emissions—estimated to be up to 10% of total emissions—that cannot be cut using other measures in order to qualify as net zero with the SBTi.

Many emitters have begun to integrate offsets outside of their own business activities as part of their decarbonization strategies. However, there are two main pitfalls to this approach. First, an overreliance on offsets to tackle climate change can expose companies to claims that they are not sufficiently committed to reducing in-house emissions. Second, using poor-quality carbon credits raises questions about a company's actual impacts, and by extension, an emitter’s commitment to decarbonization. Thus, companies sometimes view these potential reputational risks as too high.

Those reputational risks will increase under a growing body of legal requirements in many jurisdictions. The Securities and Exchange Commission (SEC), for example, has proposed a rule that would require corporations to report how many offsets they use, what type, and the price they pay. If adopted, the SEC requirements will bring climate reporting and disclosure standards to companies in the US, similar to those introduced by regulators in other countries, allowing investors and other stakeholders to more accurately assess and compare the actions companies are taking to decarbonize, including the use of carbon offsets.

Companies can already buy and retire offsets in the voluntary carbon market, thereby claiming to finance the corresponding emissions reductions and potential co-benefits, such as conserving biodiversity or alleviating poverty. However, compared to commodities markets, the credits traded lack standardization and the trading infrastructure is immature. But the voluntary carbon market has reached an inflection point, with rapid growth in the past three years and many new actors entering the market, on both the supply and demand sides. This rapid scaling has highlighted some of the limitations of the market: low market transparency, insufficient standardization, and lack of consensus on what constitutes accepted behavior. Clearer guidance is needed on how to create, trade, and use offsets, while mitigating the associated risks.

The two standards that will shape the voluntary carbon markets

Fortunately, two key standards are emerging that have the potential to address some of the current market risks: The Voluntary Carbon Markets Integrity Initiative (VCMI) is developing guidance on what is an acceptable and meaningful approach to offsetting to help bring transparency to the demand side. The Provisional Claims Code, currently in the public discussion phase and described in more detail below, will provide guidance to buyers of offsets on appropriate marketing claims based on the chosen offsetting approach and help to avoid greenwashing accusations that draw into question the consistency between a company’s use of offsets and its broader climate change strategy.

A second initiative, the Integrity Council for the Voluntary Carbon Market (ICVCM), is developing a standard for high-quality carbon credits on the supply side, with draft guidelines released for public comment in July 2022. Market participants currently use many different definitions of offset quality; the ICVCM aims to provide a unifying global standard that builds consensus. The ICVCM's Core Carbon Principles and Assessment Framework will help to define some of the most commonly used concepts that contribute to offset quality such as high additionality, or the degree to which a specific carbon credit is directly financing carbon reductions; the absence or presence of carbon leakage, with lower leakage reflecting higher quality; and the permanence of emissions reductions or avoidance.

Combined with the emergence of standardized offset project ratings, which can function like credit ratings for offset projects, and leveraging technology like satellite imagery, remote sensing, and machine learning, the guidance by the VCMI and the ICVCM should enable corporations and investors to participate in the voluntary carbon market with confidence—a critically important piece of the puzzle to reach the 1.5-degree goal. Both bodies, which are supported by many public and private sector stakeholders, will issue final recommendations toward the end of 2022 or in early 2023.

How the VCMI draft guidance helps corporations in their offsetting endeavors

In a long-awaited move, the VCMI published in June a draft for a global standard to assess companies’ claims about progress toward net-zero internal climate targets and their use of carbon offset credits.

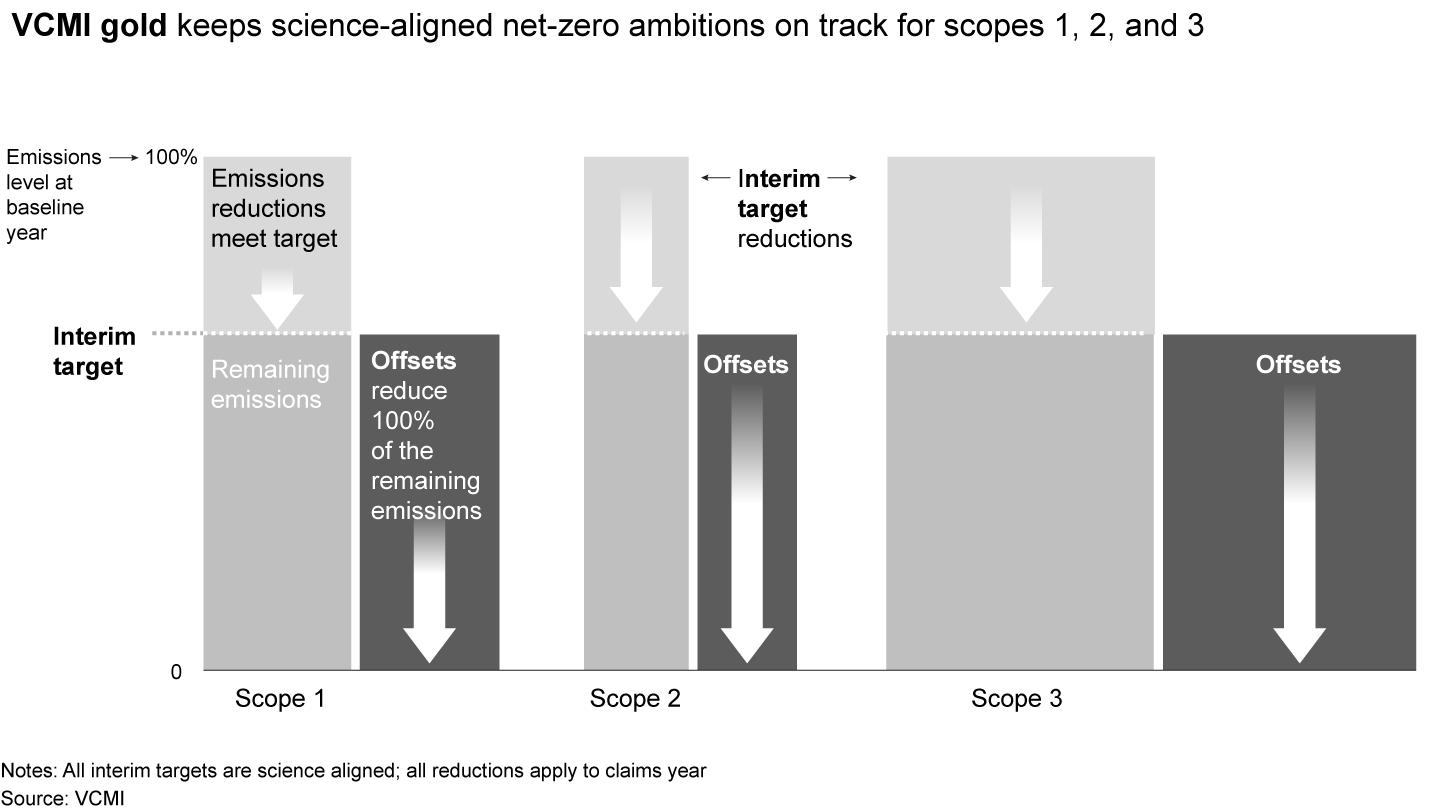

The VCMI’s Provisional Claims Code of Practice provides guidance on what constitutes reasonable marketing claims based on the use of voluntary carbon offsets and outlines a mechanism to rate corporate claims based on a framework to evaluate the integrity of those claims. According to VCMI’s code, credible claims on carbon market engagement need to follow a four-part approach: (a) embedding offsetting into a broader carbon commitment (SBTi); (b) defining the scope of claims clearly; (c) purchasing high-quality offsets; and (d) transparent reporting on all actions taken and offsets purchased. The draft also provides a framework for labeling enterprise claims under step (b) along three tiers of claims: VCMI Gold, Silver, and Bronze, allowing corporations to provide additional scope and context in their communications to stakeholders (see Figure 1).

The guidance will now move into a “road test” phase, leading to a final iteration after public feedback in the second half of 2022. Corporations are invited to participate in this road test phase by submitting comments by mid-August and apply the draft guidelines to their offsetting strategies. Adopting the VCMI guidelines early and pressure-testing them during this phase will allow corporations to actively shape the emerging industry standard and prepare for early adoption. Specifically, companies can apply the guidance to pressure-test their current use of carbon offsets and related claims as an integral piece of their net-zero strategies. Corporations can mitigate the risk of greenwashing accusations by aligning their offset strategies to the VCMI approach and tiers. They can also increase confidence in emissions scenarios by providing forward-looking guidance on offset demand. They can redesign offset procurement to balance quality and costs, and they can focus their carbon market participation, including moving upstream to secure the required supply of offsets at affordable price levels.

Several open questions remain, however, that corporations should watch out for, and maintaining flexibility will be important:

- What are the requirements for a science-aligned net-zero strategy, especially for oil and gas companies?

- The SBTi currently does not provide a method for the O&G industry and is working on an updated method.

- How quickly will consensus form around how to define quality for carbon offsets?

- VCMI does refer in its guidance to the ICVCM's Core Carbon Principles and Assessment Framework. Many market participants are now turning to the new field of carbon credits ratings for in-depth independent analysis on offset quality.

- How should offsets without corresponding adjustments from their host countries be treated in the offsetting strategy and claims?

- VCMI remains open in its current guidance and only requires transparent reporting on whether purchased offsets have included corresponding adjustments. VCMI contributors have indicated that stronger guidance on corresponding adjustments may appear in the final version of the document in early 2023.

Technology is a powerful complement to the emerging standards

Technology has transformed most markets, and it will transform the voluntary carbon market too. As momentum builds for the voluntary market to establish accounting and assessment principles for corporations on offsets, technology will help participants navigate the market as it becomes better defined.

Increasingly, companies are using technology to develop offset ratings similar to corporate credit ratings. The ratings typically assess carbon performance (does the project deliver against the objectives?); additionality (does the project truly deliver something that would not have happened without it?); permanence (will the positive impacts persist?); and co-benefits (positive impact on biodiversity and/or local community). Technology such as satellite imagery, drones, and on-ground remote sensors capture data that is often combined with machine learning to provide an unprecedented level of “ground truth.” In terms of accuracy, breadth, frequency, and cost, the technology-enabled approaches represent a step change over previous methods like sample inspections on the ground across large project and reference areas.

As the market matures further, and anticipates the upcoming guidance by ICVCM, offset ratings will incorporate the new standards and continue to evolve to help the market arrive at a consensus on how to define quality and measure individual offsets.

In focusing the market’s attention on the quality of carbon credits, the ICVCM is providing a valuable service. But it will not be able to provide in-depth assessments for every project in the market. This is why the ICVCM will produce a determination on whether or not its standards have been met by the applied carbon-crediting mechanisms and methodologies, which will ultimately be seen by the market as a minimum standard or quality floor. Many companies need more than this, leading to rising demand for in-depth analysis on all key aspects of a project.

Implications for corporations: The direction of travel is clear, with key signposts along the way

The voluntary carbon market is entering one of its most dynamic phases, characterized by strong increases in demand, demand for higher-quality offsets, and higher prices due to emerging supply constraints. For the voluntary carbon market to thrive, standards and technology are needed to help define what quality means in terms of using and developing carbon credits, but this also requires buyer willingness to pay increases in line with the improved quality standards. Emergence of market consensus on these important matters will be an iterative process, especially given the continuing development and evolution of carbon credits.

VCMI and ICVCM will help establish guiding principles in the near term, which will be used to evaluate corporate action. In countries with carbon policy, the principles and specific terms may be embedded in regulation. In those without, the principles will nevertheless shape the perceived quality of corporate commitments and progress.

Companies considering offsets as a component of their net-zero strategies should closely monitor the activities of the VCMI and ICVCM and take advantage of the comment and road-testing periods to experiment with how these standards will impact their strategies. Keeping a close eye on technological developments could lead to additional value for businesses that integrate emerging tools into holistic carbon market strategies.

To offset or not to offset is no longer the question. The question is now about how to participate and grow the carbon markets with quality and confidence.