Quarterly Executive Survey on AI

Executive Summary

- Companies are moving quickly to explore ways for generative AI to enhance their business, with most already developing or deploying initiatives.

- Our quarterly survey on AI readiness shows that last year, executives were most concerned about quality and capabilities. But in 2024, many are already focused on delivering real value.

- Not surprisingly, technology companies are further along in their development of generative AI use cases, and they may already have more realistic expectations.

- Many companies are still building their generative AI solutions because the off-the-shelf ones are either not ready or not specific enough, though that will likely change.

For generative artificial intelligence (AI), if 2023 was about exploring possibilities, then 2024 is about delivering results and generating real business value.

Most companies are laying the groundwork: By the beginning of 2024, 87% of companies surveyed by Bain said that they were already developing, piloting, or have deployed generative AI in some capacity, with most of these early deployments in software code development, customer service, marketing and sales, and product differentiation (see Figure 1).

To better understand how companies are working with generative AI and how they are scaling up pilot programs to generate value across the enterprise, Bain is conducting quarterly surveys to assess readiness. Our latest survey finds that companies are investing heavily in generative AI: on average, about $5 million annually, with an average of 100 employees dedicating at least some of their time to generative AI. Among large companies, about 20% are investing up to $50 million per year. These investments reflect their priorities: More than 60% of companies surveyed see generative AI as a top three priority over the next two years, but only about 35% have a clearly defined vision for how they will create business value from generative AI.

Our survey in first quarter 2024 (our second overall) identified four interesting themes that reveal how companies are thinking about the technology in 2024 compared with how they saw it just a few months earlier.

Are we delivering value yet?

Across industries, conversations about generative AI are more earnest, moving from excitement and hype to more realistic assessments. Concerns about security and conversations around implementation are more deliberate and informed as companies have a better understanding of the challenges based on learnings from their pilot programs. Concerns about organizational readiness grew while those around quality and risk have declined (see Figure 2).

The initial security concerns were similar to what we’ve seen with other technology transitions, such as cloud. With cloud, however, it took much longer for security concerns to subside, and with generative AI, we are seeing much faster implementation and a faster shift to implementation-related concerns to get the value.

As with other digital transformations, merely automating a process or porting it to a new, more efficient technology doesn’t necessarily deliver enough upside to justify the investment. Real value comes from learning how the new technology changes not just how something gets done but what gets done.

Five areas show promise for using generative AI

As companies get their hands dirty with generative AI, they are reporting a small reduction in performance compared with expectations. Five use cases show signs of success: sales and sales operations, software code development, marketing, customer service, and customer onboarding. Meanwhile, use cases in legal, operations, and HR appear less successful (see Figure 3).

Tech companies are finding out first

In terms of general readiness, technology companies may be out in front, and they are learning how difficult implementation truly is. Technology companies are more likely to say that their data, resources, and policies are ready to support generative AI use cases than nontechnology companies, but they feel less ahead than previously. Compared with our October 2023 survey, companies in the tech industry were less likely to say that their data and security protocols were ready for generative AI, whereas companies across other industries reported about the same levels of readiness in both surveys (see Figure 4).

Buy or build? Yes.

Both approaches are being tested across use cases. Companies are buying third-party solutions when available but investing in tailoring them for their needs. As we might expect with a new wave of technology, many applications are built in-house simply because off-the-shelf versions aren’t ready yet or don’t meet expectations (see Figure 5).

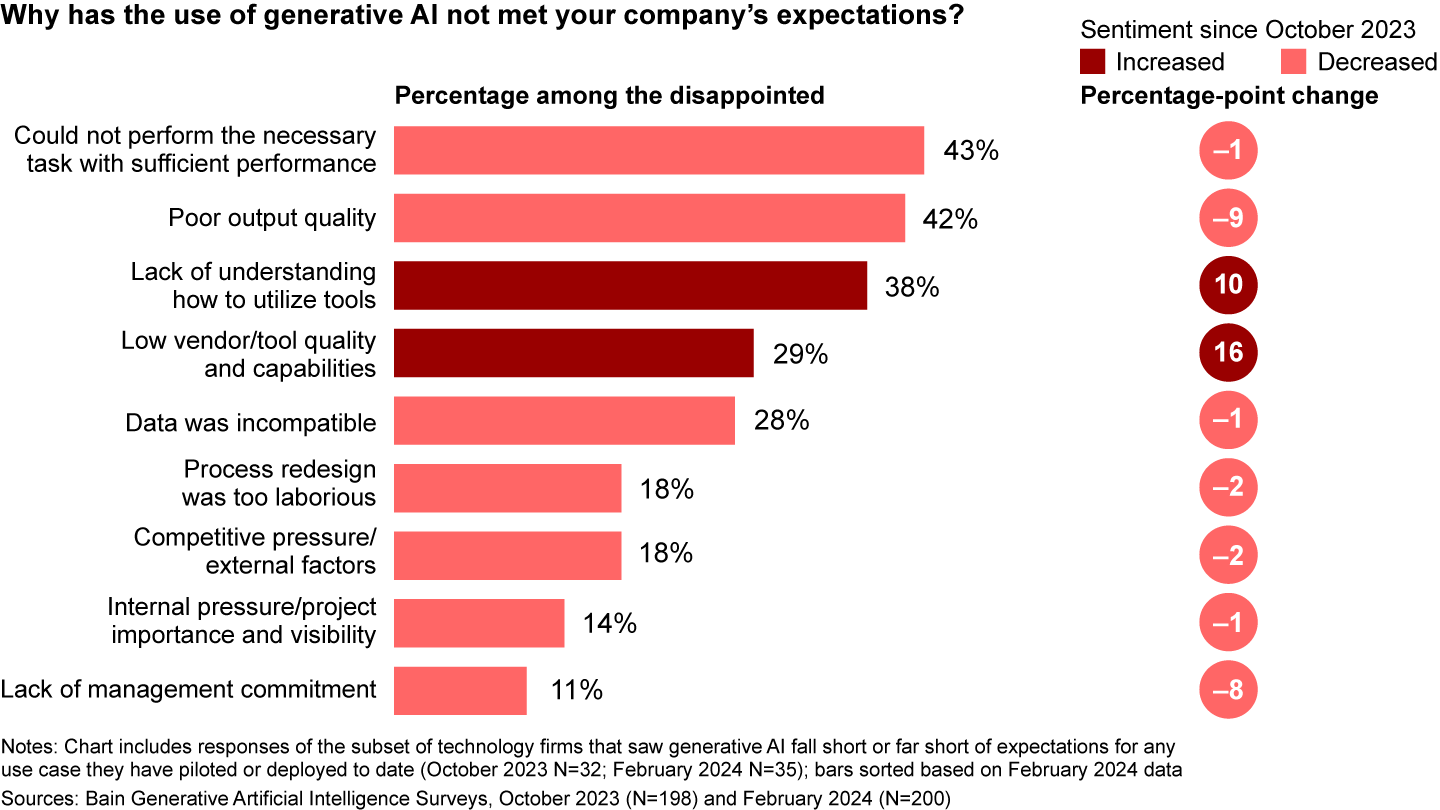

As these third-party solutions mature, we could see more decisions to buy. The percentage of companies buying off-the-shelf applications has already increased slightly as more tools become available, with mixed results. Compared with our October 2023 survey, respondents in February 2024 were more likely to select “low quality of vendors and tools” as the reason why generative AI has not met expectations. For the small subset of respondents who said use cases had not met expectations, the tools need to get better (see Figure 6).

Overall, the results of our quarterly survey show that across industries, companies have high expectations for the value that generative AI can add to their businesses, and they are investing appropriately in talent and other resources. Some use cases are already showing more promise than others, and we expect executive teams to adjust their expectations (and their funding) as they learn more. The race to gain a competitive edge has many companies developing their own solutions, but as third-party offers get better and become more sophisticated and specific, we expect to see more decisions to buy rather than build. As the technology matures, we expect that the difference in results will depend largely on data quality and the ability to operationalize use cases to meet users’ needs.

About IncQuery

IncQuery is a leading programming provider of quantitative surveys for primary research. Its collaborative co-authoring platform, combined with support from experienced survey directors, empowers professionals to quickly launch high-quality surveys. Visit incquery.com for more information.