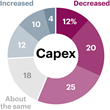

We work with clients at various balance sheet performance entry points. For those with strong balance sheets, our consulting services focus on optimizing cash availability, allocation, and efficiency, while improving capital allocation for stronger stakeholder returns. Organizations that still rely on traditional capital planning may limit their adaptability to changing investment priorities. We help clients reassess capital allocation with customized evaluation criteria, ensuring priority projects receive proper funding. For companies facing liquidity challenges, we provide rapid cash generation solutions, addressing urgent needs through our working capital management solution. Regardless of your starting point, we tailor our programs to enhance cash and capital capabilities, drawing on our experience from over 600 successful cash flow management cases. Our agile investment approach leverages the right tools and processes, including dynamic forecasting, streamlined governance, and approval structures as critical supports.