Forbes.com

The downturn subjected limited partners (LPs) to a baptism of fire. Lackluster performance of private equity portfolios and tight funding for new commitments have made them more discerning about how they go about investing in PE, far more selective in their choice of general partners (GPs) with which they invest and increasingly assertive about the terms and conditions on which they are prepared to do business.

LPs’ emerging new perspective on PE was one of the highlights of Bain & Company’s Private Equity Report 2011, our comprehensive examination of the conditions that are shaping PE this year. Many of the LPs Bain spoke to said they continue to put all of their recently acquired disciplines to work with added resolve—and perhaps none with more energy than the expertise they have built subjecting GPs to more rigorous due diligence. LPs have doubled-down on their determination not to make mistakes. Taking no GP’s performance claims at face value, they are investing more time and resources in vetting current GPs and qualifying new ones.

As LPs continued to refine their approach, their experience last year brought four due diligence issues to the forefront: we examine the first of these—fund returns—here and will address three more in our next post.

Verifiable returns: LPs are deepening their analysis to ensure that they can verify true PE returns. Some LPs have learned from hard experience that most PE funds can lay claim to top-quartile performance by selecting the benchmark that makes them look best.

Not content to take GPs’ return claims at face value, many LPs now perform an independent review that involves a bottom-up quantitative analysis of how returns were generated, deal by deal. They know that the high returns generated during PE’s boom years rode a tailwind of expanding equity and debt markets. Going forward, only GPs that can add value with the market winds blowing against them will prove to be winners.

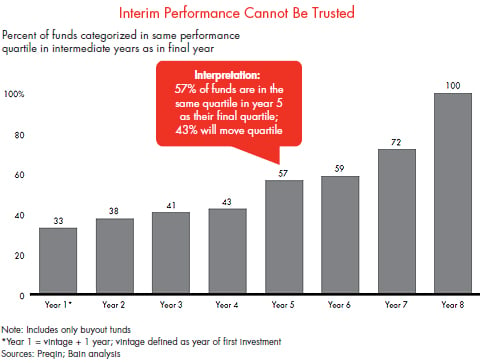

Many LPs are heightening their investigation of fund-raising GPs that pitch their new fund based on the unrealized performance of their previous one. Despite the implementation of mark-to-market accounting rules, LPs are understandably skeptical of interim valuations, which they believe leave GPs a fair amount of room for subjective judgment.

They also recognize—with good reason—that interim, largely unrealized performance is not a reliable indicator of the returns a fund will ultimately generate. Indeed, Bain analyzed the reported interim returns of scores of funds and found that particularly in a fund’s early and intermediate years, the reported returns are unreliable predictors of where the fund ends up once all investments have matured and been realized. Only 57 percent of funds in a given performance quartile in year five will end up in that same quartile when the holdings are liquidated at the end of the funds’ life.

Finally, many LPs are putting less credence in GPs’ performance track records as indicative of what to expect in their next fund. Although it is too early to tell how recent funds active during the peak of the PE boom will ultimately fare, anecdotal evidence suggests that the widely acknowledged persistence of GP performance across funds may have weakened in recent years. There is sufficient uncertainty surrounding this issue for LPs to know that they cannot rely solely on track record to guide their GP selection. They need to take a 360-degree look at every GP that comes back to the market to raise a new fund—even those whose past funds have been stellar performers.

In our next post, we will examine how LPs are sharpening three other due-diligence disciplines for evaluating which PE funds hold the best prospects for success.