Report

Executive Summary: Breaking the Gordian knot of commoditization

Insurers have long struggled to attract and retain customers. They do business in a highly competitive marketplace, and they sell a product that many consumers consider to be a commodity. Customers often cite price as their main reason for buying an insurance policy—particularly in property and casualty (P&C). Many consumers now buy insurance through aggregator sites, rarely connecting directly with the carrier or its agents.

Insurers find it challenging to differentiate themselves in the eyes of their customers, especially when they interact so irregularly with them. In an era when consumers across markets expect high-touch, personalized service, insurance, by its very nature, remains a low-touch industry. Worldwide in the product categories of home, auto, life and health insurance, most customers purchase an insurance product only every three to six years. In developed markets, just half of the customers have had any contact with their insurers for any reason in the past 12 months.

These are among the findings of Bain & Company’s third global survey of retail insurance customers. Working with Research Now, we canvassed more than 172,000 insurance policyholders in 20 countries to gauge how loyal they are to their carriers. This year’s survey shows strong momentum behind a significant trend: the growth of ecosystem services. Insurers are discovering new ways to build loyalty by offering their customers an interconnected array of services that extend beyond insurance.

Loyalty is good for business. Carriers that win the loyalty of their customers find that they stay longer, buy more products and recommend the company to their friends and colleagues. Higher loyalty means lower churn, and that can help companies reduce costs and expand margins.

Insurers have made concerted efforts in recent years to build customer loyalty. They’ve embraced digital platforms, retrained employees and started to redesign customer episodes. These initiatives can pay off. Our survey shows that insurers that concentrate on building loyalty can gain considerable ground—as much as 20 percentage points in Net Promoter Scores over a three-year period. Conversely, insurers that lose focus can find their loyalty scores slipping by similar margins.

On the whole, though, insurers are making only slow progress in differentiating their products and services, and delighting their customers. In many markets, the loyalty leaders have successfully defended their positions, particularly in P&C. Not only are the leaders in many countries the same as they were in prior years, but the gap between the laggards and the leaders remains wide.

How can insurers break the Gordian knot of commoditization and consumer indifference that is stymying their efforts to generate and sustain consumer loyalty?

To begin with, companies need to master the basics of customer relations. They must be accessible, accurate, fair, fast, empathetic and reliable—for every customer in every encounter. Successful companies think in terms of complete customer episodes. They take a holistic view of the customer, one that reaches across the company’s divisions, departments, disciplines and channels.

But getting the basics right, even with the help of the latest digital tools, isn’t sufficient to solve the fundamental problem at the heart of insurance: the lack of touch. Insurers that do nothing more than sell conventional insurance policies will continue to be hobbled by infrequent contact with their customers. It’s hard to build loyalty when you connect with your customers once a year—or less. The correlations are clear: More interactions, provided they are high-quality interactions, lead to more loyalty.

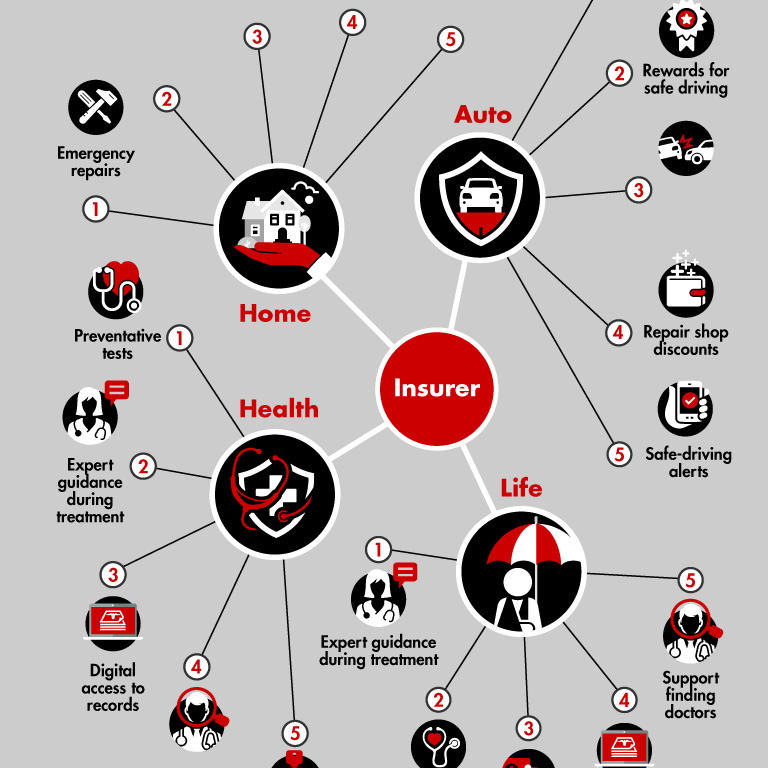

Insurers are discovering that the best way to get more quality time with their customers is to offer them non-insurance services—such as home security, car maintenance, health monitoring, financial planning and much more—that are natural extensions of their core products. No longer merely isolated providers of a low-touch product, insurers can become the key players in ecosystems of interconnected services for home, auto, health and life (see Figure 1).

Our survey shows that customers are ready and willing to hear from their insurers about services that reach beyond core insurance. In some major markets—Australia, China, France, Germany, Switzerland, the UK and the US—customer interest in ecosystem services has grown significantly in just the past year. Customers say they’re prepared to pay higher premiums to carriers that offer them desired services beyond insurance. And, if their own insurer doesn’t provide the services they’re looking for, they’ll consider switching to one that does.

Ecosystem services have the potential not only to build loyalty, but also to increase profits. Policyholders who use these services are likely to be safer and healthier, meaning they’re apt to file fewer claims—and that can be a boon to their carrier’s bottom line. Insurers that offer services beyond insurance gain access to a rich stream of customer data, which can help them hone their offerings further, as well as become more efficient delivering them. Given these benefits, it’s no wonder that many insurers are looking at expanding their role in the ecosystem.

The digital imperative

The digital revolution has lent new urgency to insurers’ need to reimagine what they do and how they do it.

Across industries, the bar has been raised on customer expectations. Digital pioneers such as Amazon and eBay have set new standards for convenience, speed, value and ease of use. Consumers, particularly younger ones, now want an Amazon-like experience whether they’re buying a car, opening a bank account or shopping for an insurance policy.

In some markets, insurers have made strides in delighting their customers through digital channels, particularly mobile. In China, Malaysia and South Korea, for example, P&C and life insurance customers who use mobile channels are more delighted than customers using other channels.

Overall, however, insurance customers who rely exclusively on digital channels tend to be less loyal than those who use multiple channels, including agents and call centers. Compared with multichannel customers, digital-only customers give their insurers lower marks in the areas of personalization, understanding their needs and trust in the company’s ability to resolve an issue.

Those relatively poor ratings may help explain why insurance customers are only slowly increasing their use of digital channels, and why the share of customers who use only digital channels remains quite small—ranging from just over 2% in Mexico to 23% in the UK. Throughout the world, the largest and fastest-growing segment of customers consists of so-called hybrids, those who use both online and offline channels. Generally speaking, customers use digital channels to supplement, not replace, other channels.

These trends present a twofold challenge to insurers: They must learn how to delight their digital customers, while continuing to please those who use conventional channels. With hybrid users, a customer episode can begin online and end offline, or vice versa, meaning insurers need to work on providing a seamless experience across channels.

Within digital, the biggest opportunity lies in personalization—an area where insurance lags behind other industries, such as online retail. By collecting data systematically, making it accessible across the organization and applying artificial intelligence, carriers can emulate retailers and create bespoke offerings. By knowing more about their customers, insurers can better target them at the moment when they are ready to buy. In the US, for example, Progressive’s Name Your Price program offers customers individualized proposals based on how much they are willing to pay.

Insurers face an imperative to get digital right. Established carriers must now contend with digital rivals from both inside and outside the industry. In recent years, insurtechs such as Lemonade and Oscar have risen up as insurgent challengers. While it’s unclear whether any of these upstarts will reach the critical mass necessary to dislodge incumbents, they have already had an impact on customer expectations.

The bigger digital threat to traditional insurers may come from tech giants such as Alibaba. In China, these companies have created vast digital financial platforms that include banking, payments and insurance—and they plan to take this approach to other markets. Alibaba, Tencent and Ping An are among the backers of Zhong An, China’s first all-digital insurer. Founded in 2013, Zhong An announced in June that it planned to go public. And it’s not just tech companies that are encroaching on insurers. Automaker Volkswagen, for example, has expanded into insurance, and Tesla is testing a package that offers customers an insurance contract with the purchase of a new car.

How Insurers Can Break the Gordian Knot of Commoditization

Insurers can build customer loyalty by focusing on ecosystem services.

Beyond insurance: Building loyalty with ecosystems

To thrive in this rapidly changing environment, forward-looking insurers are redefining the very nature of what it means to be an insurance company. Global insurer AXA, for example, has embarked on a multiyear effort to change the way it relates to its customers, transforming itself from a “payer” into a “partner.” Insurers that position themselves at the hub of an ecosystem can do much more than assess risk, sell policies and process claims. No longer simply allocators of capital, they can provide comprehensive and innovative solutions to their customers’ everyday needs, helping them protect their health, wealth and personal property.

As insurers expand into the ecosystem, they can enter a virtuous circle with their customers. The more insurers can leverage what they know about their policyholders—where they live, what kind of cars they drive, how many children they have, whether they smoke, how often they exercise—the better they can offer those customers insurance products and noninsurance services tailored to their specific needs. As customers use more services, insurers will be able to gather more information about their consumption habits and behavior, enabling carriers to further refine their offerings.

As industries become increasingly interconnected in ecosystems, the winners are likely to be companies that control customer interactions. Those that command the customer interface will have access to the data that comes with it. As the battle for the interface intensifies, insurers face an almost existential challenge. Insurers who can maintain—and expand—control of customer interactions can build a constellation of value-added services at the center of an ecosystem. Companies that cede power run the risk of becoming marginalized as narrowly defined utility players at the edge of the system.

As insurers develop ecosystems, it’s crucial that they think through which services are most relevant to each customer segment, develop a comprehensive strategy for managing data and come up with a clear plan for making money. The industry has just started on this journey, and not all players are equipped to win the competition.

Companies that succeed in ecosystem services will be those that redefine their missions. In an ecosystem, automotive insurers don’t just cover motorists when they have an accident, they help prevent crashes from occurring in the first place, with telematic sensors that monitor vehicles and motorists. Such telematic services are on the rise around the globe. Canadian cooperative Desjardins, for example, offers Ajusto, an app that tracks driving behavior and calculates discounts based on how safely motorists operate their vehicles. Some auto insurers are taking ecosystem services even further. In Brazil, P&C loyalty leader Porto Seguro helps customers finance cars, maintain them and enjoy them.

Residential insurers operating in an ecosystem don’t just come to the rescue of homeowners when the basement floods or the stove catches fire; they offer an array of digital monitors and sensors as part of what’s becoming known as the smart home. AXA’s smart-home applications in France, for example, connect homeowners remotely to sensors and cameras that can spot intruders, control lighting, detect smoke and monitor water leaks.

Health insurers that become lead actors in an ecosystem still cover people when they get sick, but also offer services that help them stay well, including remote medical diagnostics, fitness club discounts and expert nutrition advice. German health insurer AOK Nordost recently launched digital loyalty program FitMit AOK, which gives policyholders incentives to live a healthy lifestyle.

Interestingly, our survey shows that customers want their life insurers to provide similar health-related benefits. In an ecosystem, life insurers don’t just make payments when clients die; they provide advice on healthy living, along with financial planning and personal data protection. South African insurer Discovery is an early mover on health services for life insurance customers. The company’s health rewards program, Vitality, which Discovery offers globally in partnership with local insurers such as AIA in Asia and Generali in some European countries, is linked with life as well as health insurance policies.

With ecosystems, insurers can significantly increase the opportunities they have to connect with their customers. Our survey shows that engaging in more interactions with customers strongly correlates with higher loyalty scores. Not all encounters are created equal. Customers don’t want to be pestered; they don’t want to receive repeated, multichannel reminders to renew their policies, for example. But they do want to be contacted about services that help them live healthier, safer and more productive lives.

Because this trend is just beginning, insurers that move quickly and creatively to establish leadership in their ecosystem have a huge opportunity. Done right, ecosystem services can help insurers break the Gordian knot of commoditization. Ecosystem services can boost loyalty (see Figure 2). They can also attract new customers and reduce price sensitivity. Not every insurer will want to adopt an ecosystem strategy. Discount carriers that already compete effectively on cost and price may not want to move up the value chain. Many companies, though, will see ecosystem services as the best way to boost revenues, improve margins and, most important, sustain the loyalty of their very demanding customers.

1. The basics of loyalty: Connecting with the customer

-

Large gaps persist between loyalty leaders and loyalty laggards. In the US, perennial leader USAA is 55 percentage points ahead of the last-place company in P&C and 42 points better than the market average.

-

Since 2014, there has been little change at the very top of the rankings, but below that, some carriers have gained—or lost—considerable ground. In Germany, for example, one life insurer bettered its Net Promoter Score by 18 points, showing that companies that make concerted efforts to improve the quality of their customer interactions can see a measurable impact on loyalty. By the same token, carriers that become complacent and fail to innovate can see their scores plummet.

-

Customers who interact with their insurers are more likely to be loyal. That presents a challenge for companies because insurance, by its very nature, is a low-touch industry. There is a huge difference in Net Promoter Scores between customers who had at least one interaction with their carrier in the past year and those who did not; in China, the spread is 59 percentage points in P&C and 57 points in life insurance.

-

The quality of an interaction matters. Customers who are delighted by an interaction reward their carriers with positive Net Promoter Scores. But when customers are annoyed by an encounter, their displeasure shows up in negative scores.

2. Delighting through digital: Make it personal

-

In most countries, more than half of all insurance customers are digitally active, meaning they go online to research products and/or conduct important interactions with providers.

-

Customer usage of mobile channels, while growing, has remained at low levels, particularly in developed countries. In Germany, for example, only 3% of P&C and 6% of life insurance customers use a mobile channel (defined as a browser or app viewed on a phone or tablet) to conduct their most important transactions.

-

While usage numbers may be low, mobile channels show significant potential to delight, particularly in some Asian markets. In most other countries, though, in-person and phone interactions still generate higher loyalty scores, suggesting insurers have room for improvement in mobile.

-

Throughout the world, most customers continue to conduct at least some of their interactions through traditional channels. The largest and fastest-growing group of customers is made up of hybrid users, who do business both online and offline. Customers are using digital channels to complement, not replace, traditional channels.

-

In major markets, P&C and life insurance customers who use only digital channels give their carriers lower loyalty scores than do multichannel customers. The good news is that the gap in scores between digital-only and multichannel users has shrunk since 2014.

-

The biggest challenge insurers face with digital-only customers is finding a way to personalize their offerings. Digital-only customers give their carriers relatively low marks for personalization, understanding of needs and ability to resolve an issue.

3. Ecosystems: Customers want more than insurance from their carriers

-

In the countries surveyed, insurance customers are open to having their insurers provide services beyond insurance. In major markets, interest in ecosystem services has grown since 2016.

-

In automotive, the services that customers are most interested in include roadside assistance; rewards for safe driving; sensors that alert them when their unoccupied car is damaged and that help them locate it when it’s stolen; discounts at repair shops; and safe-driving alerts.

-

For their homes, customers want emergency repair services, remote monitoring, alerts about intrusion and damage, and automatic shutdowns of appliances during fires and floods.

-

In health, customers are looking for wellness exams, disease screening and online diagnostics; expert guidance during treatment and recovery; digital access to medical records and protection against their unauthorized use; and help finding doctors and scheduling appointments.

-

Life insurance customers would like the same sorts of services as health insurance customers: expert guidance during treatment; checkups, preventative tests and diagnostics; digital access to records; and help finding medical providers. In addition, they want support for senior citizens.

-

Ecosystem services are just starting, especially in developed markets. In most of the countries surveyed, only a small minority of insurance customers use three or more ecosystem services; in Japan, just 2% do. In many countries, usage rates are highest in auto and health.

4. Building loyalty with ecosystem services

-

Offering ecosystem services leads to higher loyalty. In the US, for example, the Net Promoter Scores for auto insurers that offer three or more ecosystems services is about 40 percentage points higher than the score for insurers that offer no ecosystem services. Customers who use ecosystem services and like them give their insurers the highest loyalty ratings.

-

Among customers interested in ecosystem services, many will consider switching to another insurer if their current carrier doesn’t offer the services they want. Customers interested in ecosystem services are likely to be lured away by companies that offer the right services. These findings signal that insurers that move early into ecosystem services have an opportunity to win new customers and gain market share.

-

Customers are willing to pay higher premiums to insurers that offer desired ecosystem services. Customers now are essentially getting these services for free because companies aren’t charging what customers are willing to pay.

Appendix: Methodology

Bain & Company partnered with Research Now, an online global market-research organization, to survey consumer panels in Australia, Brazil, Canada, China, France, Germany, Hong Kong, Indonesia, Italy, Japan, Malaysia, Mexico, the Netherlands, Poland, Singapore, South Korea, Spain, Switzerland, the UK and the US. The survey’s purpose was to gauge customers’ loyalty to their main insurance provider in life insurance and P&C insurance and the underlying reasons they hold the views they do. Conducted from April to July 2017, the survey polled 172,377 consumers of insurance providers.

In the Americas, Australia and Europe, for the individual insurance provider analysis, we included only companies for which we received at least 200 valid responses. In Asia, Mexico and Poland, we included providers with at least 100 responses. In many instances, sample sizes exceeded these thresholds.

Survey questions

This year’s research consisted of two surveys: a core survey and a follow-on survey. The core survey was launched in all 20 markets, and a follow-on survey was conducted in seven markets (Australia, China, France, Germany, Switzerland, the UK and the US).

Core survey

The core survey was split into three parts: loyalty and interaction channels, services ecosystems and demographics.

In the first part, respondents were asked to list the insurance products they purchased and name the corresponding insurance provider. They were asked to select their main insurance provider both in P&C and life insurance. They were then routed to either the P&C or life insurance questionnaire. They were asked the following two questions to assess their loyalty to their main insurance provider (either P&C or life insurance):

-

On a scale of zero to 10, where zero represents “not at all likely” and 10 represents “extremely likely,” how likely are you to recommend your main insurance provider to a friend or colleague?

-

Why did you give your main insurance provider the score you did?

Ratings of zero to 6 signified detractors, 7 and 8 signified passives, and 9 and 10 signified promoters. Net Promoter Scores were calculated by subtracting the percentage of detractors from the percentage of promoters. A positive score indicates advocacy and support, while a negative score shows the opposite.

We asked which channels respondents currently use to gather information about an insurance provider or insurance products, learn about products, seek advice, purchase a product, seek service, and submit and settle a claim.

We also asked about how respondents’ channel experience affected their likelihood to recommend their main insurance provider. Survey participants were asked, “To what extent did the interaction increase or decrease your likelihood to recommend your main P&C provider?” Responses were scored on a scale from negative 5 to 5; respondents who gave scores equal to or greater than 4 were considered delighted, and respondents giving scores equal to or less than negative 1 were considered likely annoyed. Channel experience scores were defined as the share of delighted customers minus the share of annoyed customers. Lastly, we asked respondents how “simple and digital” their most important interaction was along six dimensions, including level of personalization, timely resolution and understanding of needs.

In the second part of the survey, we asked respondents to provide details on services beyond insurance in one of four ecosystems—auto, home, health or life insurance. Detailed questions on auto, home and life insurance products were included in all 20 markets, and details on health only for selected markets (i.e., Australia, Brazil, China, Germany and the US). We asked each respondent about his or her likelihood to recommend the product provider on a scale of zero to 10, and the reason for the score. We asked about key purchasing criteria, switching behavior, premiums paid, ecosystem services offered and used, and the level of satisfaction with the use of these services.

Follow-on survey

The follow-on survey was an extension of the second part of the core survey (service ecosystems), with the aim of understanding customer preferences for these services in detail. We asked respondents to prioritize their interest in services beyond insurance in car, home, health or life, using a maximum difference approach. We also asked about their willingness to switch to another insurer and willingness to pay a higher premium if their preferred ecosystem services are included.

Statistical significance

On the question of statistical significance, the results of our data analysis are robust both for the measurement of insurance providers’ Net Promoter Scores in the different countries and for respondents’ Net Promoter Scores for each demographic category. The score measured for each insurance provider is statistically significant to an 80% confidence level, with a one-tailed test ranging from plus or minus 1.4% for a sample size of 4,495 to plus or minus 10% for a sample size of 101.

Henrik Naujoks is the head of Bain's Financial Services practice in Europe, the Middle East and Africa. Tanja Brettel is a practice area director. Camille Goossens, Gunther Schwarz, Harshveer Singh, Andrew Schwedel and Darci Darnell are partners in Bain's Financial Services practice.

Net Promoter®, Net Promoter System® , Net Promoter Score® and NPS® are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.